iShares MSCI USA Value Factor ETF (NY:VLUE)

Price and Volume

Detailed Quote| Volume | 484,657 |

| Open | 138.05 |

| Bid (Size) | 136.25 (1,800) |

| Ask (Size) | 137.37 (3,600) |

| Prev. Close | 137.97 |

| Today's Range | 136.66 - 138.05 |

| 52wk Range | 91.80 - 138.74 |

| Shares Outstanding | 591,000 |

| Dividend Yield | 1.93% |

Top News

More NewsPerformance

More News

Read More

Intel Tanks On Big Q2 Earnings Miss: ETFs In Focus ↗

August 02, 2024

What's Happening With Ford's Shares On Thursday? ↗

June 13, 2024

What's Happening With Ford's Shares Today? ↗

June 03, 2024

A Spread Of Top-Ranked Value ETFs To Bet In 2023 ↗

January 14, 2023

A New Value ETF Hits The Market ↗

June 18, 2022

5 Value ETFs to Buy Now for Outperformance ↗

May 20, 2022

Intel Q4 Earnings Put These ETFs in Focus ↗

January 27, 2022

7 Hot Stocks to Buy That Definitely Are Worth the Love ↗

January 24, 2022

Intel Q2 Earnings Put These ETFs in Focus ↗

July 23, 2021

Intel ETFs Heat Up On GlobalFoundries Deal Buzz ↗

July 17, 2021

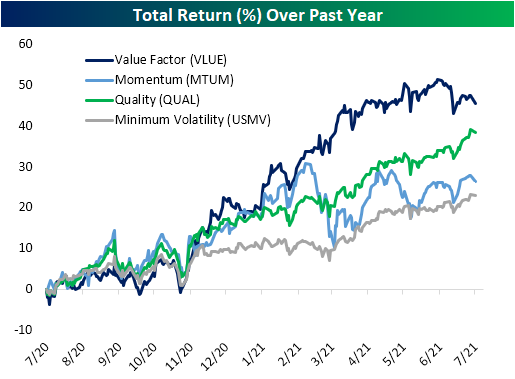

Value (VLUE) Giving Way To Quality (QUAL) ↗

July 07, 2021

Intel Stock Investors Pull Back: Technical Levels To Watch ↗

April 23, 2021

4 Value ETFs to Buy for Q2 2021 ↗

April 23, 2021

Frequently Asked Questions

Is iShares MSCI USA Value Factor ETF publicly traded?

Yes, iShares MSCI USA Value Factor ETF is publicly traded.

What exchange does iShares MSCI USA Value Factor ETF trade on?

iShares MSCI USA Value Factor ETF trades on the New York Stock Exchange

What is the ticker symbol for iShares MSCI USA Value Factor ETF?

The ticker symbol for iShares MSCI USA Value Factor ETF is VLUE on the New York Stock Exchange

What is the current price of iShares MSCI USA Value Factor ETF?

The current price of iShares MSCI USA Value Factor ETF is 136.73

When was iShares MSCI USA Value Factor ETF last traded?

The last trade of iShares MSCI USA Value Factor ETF was at 12/31/25 08:00 PM ET

What is the market capitalization of iShares MSCI USA Value Factor ETF?

The market capitalization of iShares MSCI USA Value Factor ETF is 80.81M

How many shares of iShares MSCI USA Value Factor ETF are outstanding?

iShares MSCI USA Value Factor ETF has 81M shares outstanding.

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.