All News about 20+ Year Treas Bond Ishares ETF

Traders Bet Aggressively On Rate Cuts Ahead Of Jobs Data: 5 ETFs To Watch This Week

September 03, 2024

Via Benzinga

Topics

ETFs

Wall Street Tumbles, Yen Surges, Oil Sinks Below $70, VIX Spikes As Traders Brace For Volatile Month: What's Driving Markets Tuesday?

September 03, 2024

Via Benzinga

Topics

Stocks

Exposures

US Equities

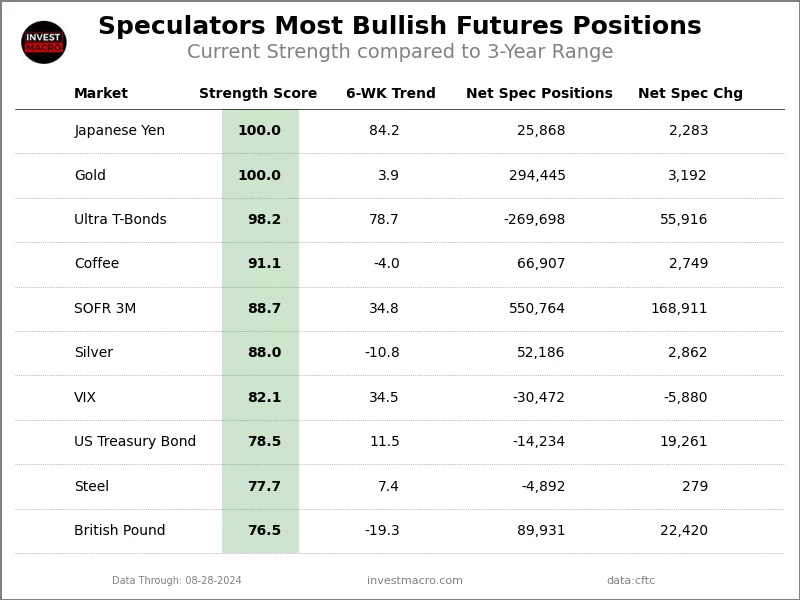

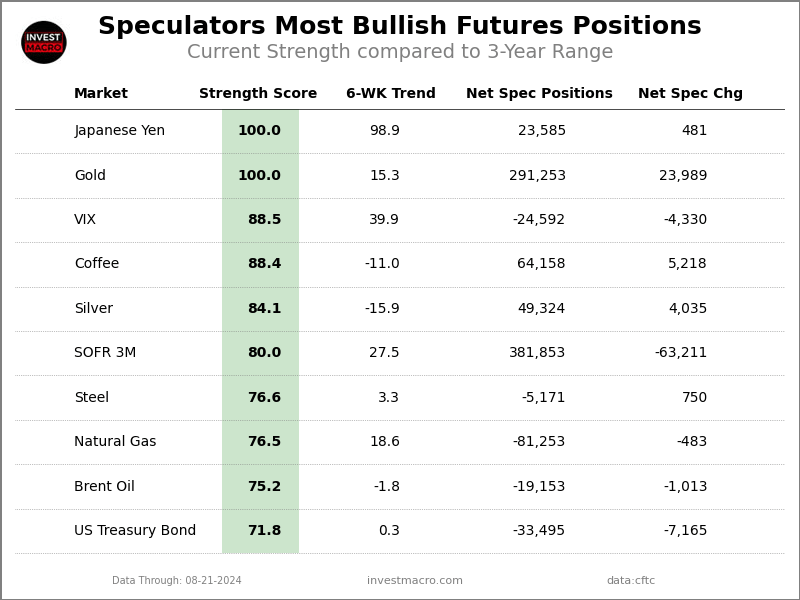

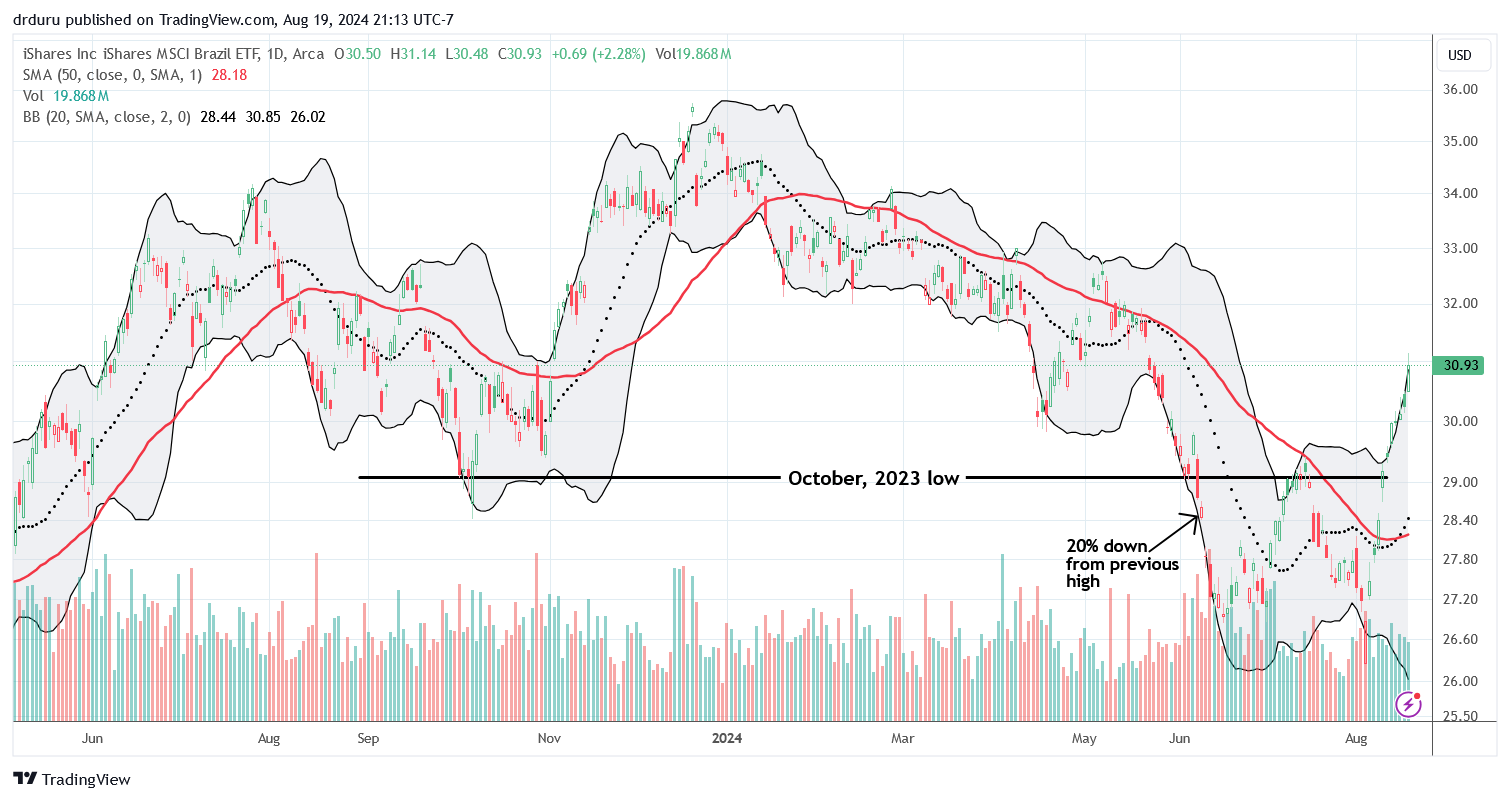

COT Speculator Extremes: Yen, Gold & Brazil Real Lead Bullish & Bearish Positions

September 01, 2024

Via Talk Markets

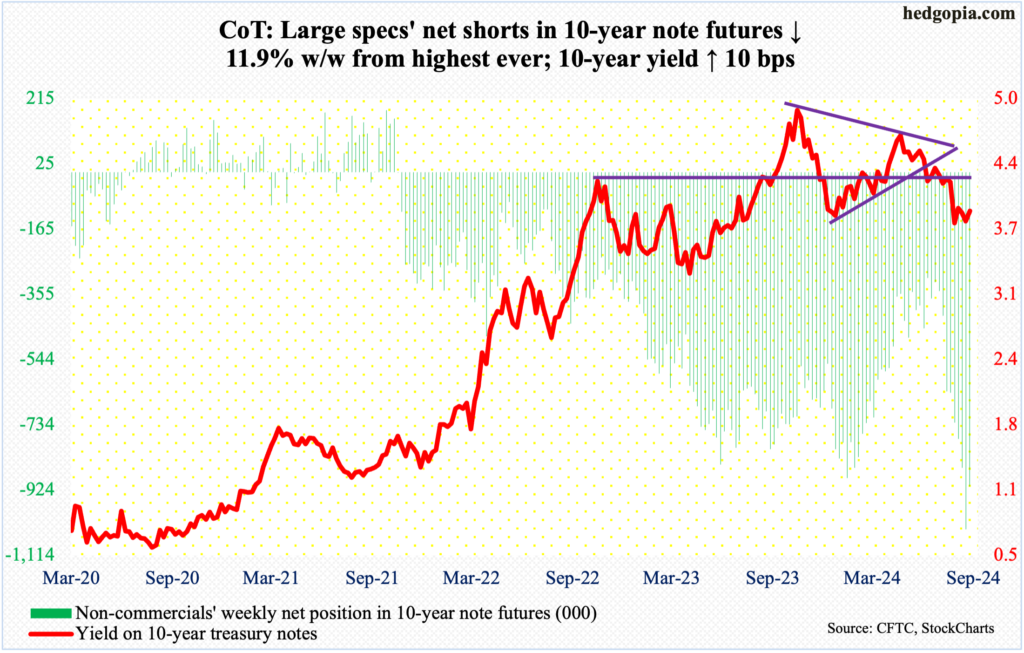

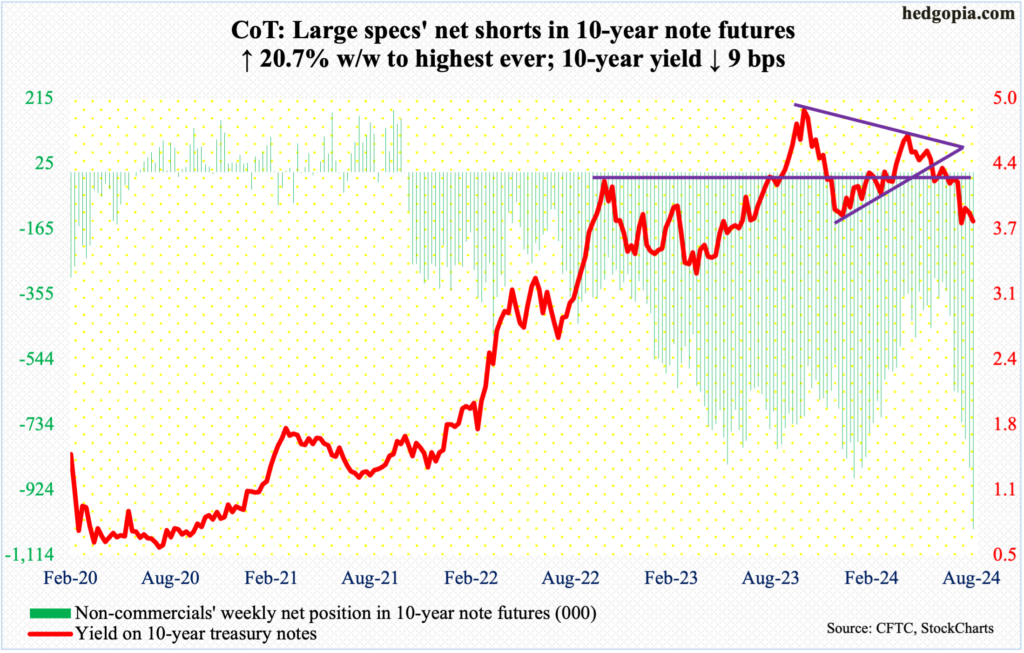

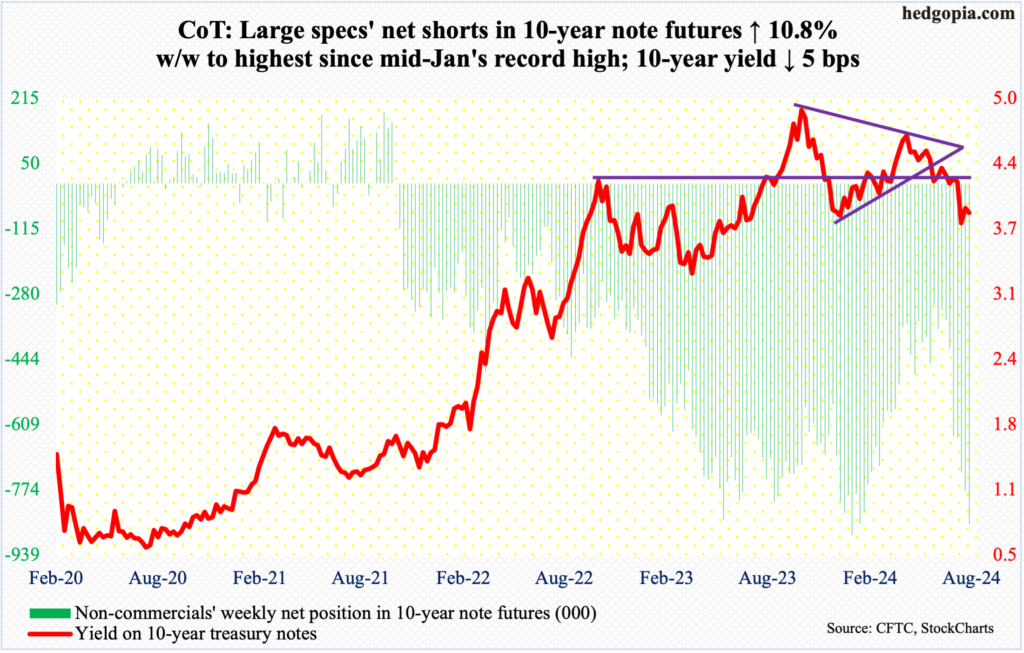

Hedge Funds Positions, Noncommercial Buying - How CoT Peeks Into The Future

September 01, 2024

Via Talk Markets

Topics

Bonds

Exposures

Debt Markets

Traders Scale Back Bets On 50-Basis-Point September Rate Cut Ahead of Friday's Key Fed Inflation Gauge Data

August 29, 2024

Via Benzinga

Topics

Economy

Exposures

Interest Rates

Fitch Reaffirms US 'AA+' Credit Rating, Warns Of Growing Debt Burden: 'Tax Cuts Will Be Extended Under Either Trump Or Harris'

August 29, 2024

Via Benzinga

Topics

Government

Exposures

Political

US Dollar, Oil Prices, Tech Stocks Rise As GDP Roars By 3% In Q2; Bonds, Yen Slip As Bets For Large Rate Cuts Ease

August 29, 2024

Via Benzinga

Topics

Economy

Exposures

Economy

Traders Brace For Fed's Favorite Inflation Report Friday: July Price Pressures Expected To Edge Higher

August 29, 2024

Via Benzinga

Topics

Economy

Exposures

Interest Rates

Speculator Extremes: Yen, Gold, 5-Year, 10-Year & Cotton Lead Bullish & Bearish Positions

August 25, 2024

Via Talk Markets

Exposures

Textiles

Jerome Powell: 'Time Has Come' For Interest Rate Cuts, Cooling In Labor Market 'Unmistakable'

August 23, 2024

Via Benzinga

Topics

Economy

Exposures

Interest Rates

US Stocks Fall As Dollar, Treasury Yields Rise Ahead Of Fed's Jackson Hole; Oil Rebounds: What's Driving Markets Thursday?

August 22, 2024

Via Benzinga

Topics

Economy

Exposures

Interest Rates

Interest Rate Markets Rethink Fed Strategy As Economic Data Signals No Rush For Major Rate Cuts

August 15, 2024

Via Benzinga

Topics

Economy

Exposures

Interest Rates

Wall Street Eyes Sixth Positive Session On Upbeat Economic Data, Bonds Fall As Traders Lose Conviction In Large Rate Cuts

August 15, 2024

Via Benzinga

Topics

Economy

Exposures

Economy

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

|

|

|