With a market cap of $214.7 billion, Linde plc (LIN) is a global industrial gases company operating across the United States, China, Germany, the United Kingdom, Australia, Mexico, Brazil, and other international markets. It supplies atmospheric and process gases and designs turnkey process plants serving industries such as healthcare, energy, manufacturing, and electronics.

Shares of the Woking, the United Kingdom-based company have underperformed the broader market over the past 52 weeks. LIN stock has risen 1.3% over this time frame, while the broader S&P 500 Index ($SPX) has increased 12.2%. However, shares of the company have gained 7.8% on a YTD basis, outpacing SPX's marginal decline.

Looking closer, LIN stock has lagged behind the State Street Materials Select Sector SPDR ETF's (XLB) 13.4% return over the past 52 weeks.

Shares of Linde fell 2.9% on Feb. 5 after the release of its Q4 2025 results, as reported net income down 11% year-over-year and EPS falling 9% to $3.26. Adjusted operating profit margin declined 40 basis points year-over-year to 29.5%, and EMEA underlying sales fell 2% due to a 3% volume decline, raising concerns about regional demand softness.

For the fiscal year ending in December 2026, analysts expect LIN's adjusted EPS to grow 8% year-over-year to $17.78. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

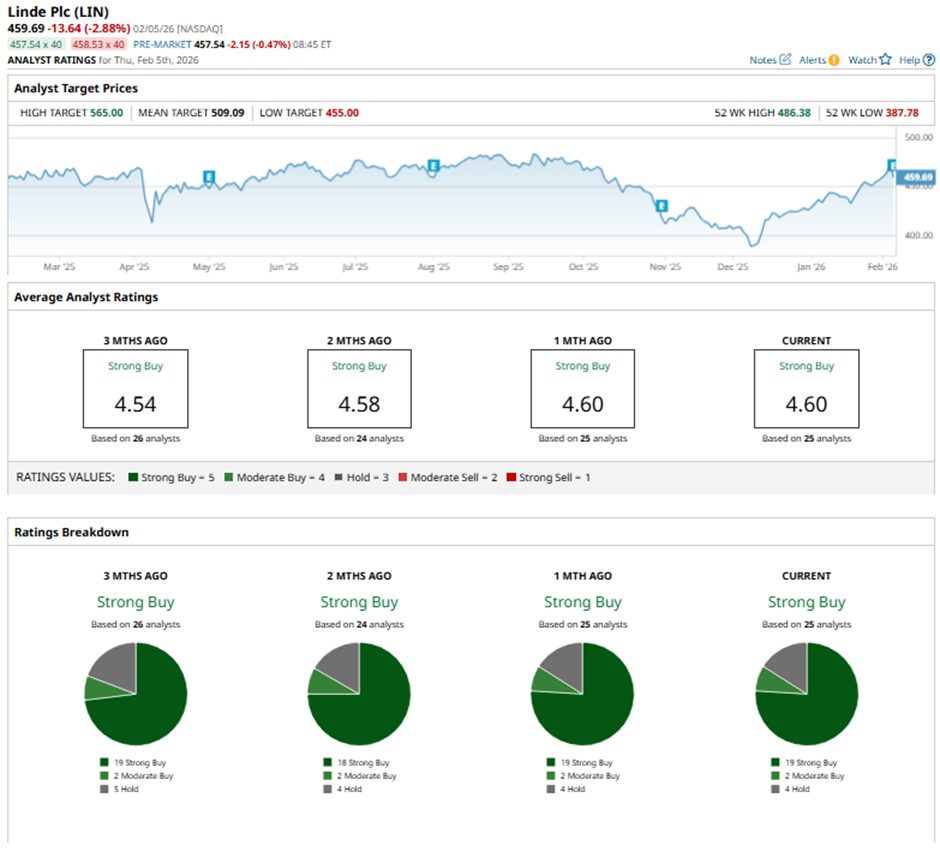

Among the 25 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 19 “Strong Buy” ratings, two “Moderate Buys,” and four “Holds.”

On Jan. 21, Citi raised its price target on Linde to $540 and maintained a “Buy” rating.

The mean price target of $509.09 represents a premium of 10.7% to LIN's current levels. The Street-high price target of $565 implies a potential upside of 22.9% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart