With a market cap of $27.1 billion, Springfield, Massachusetts-based Eversource Energy (ES) is a public utility holding company that provides electricity, natural gas, and water services across Connecticut, Massachusetts, and New Hampshire. It operates through electric distribution, electric transmission, natural gas, and water distribution segments, including solar power facilities.

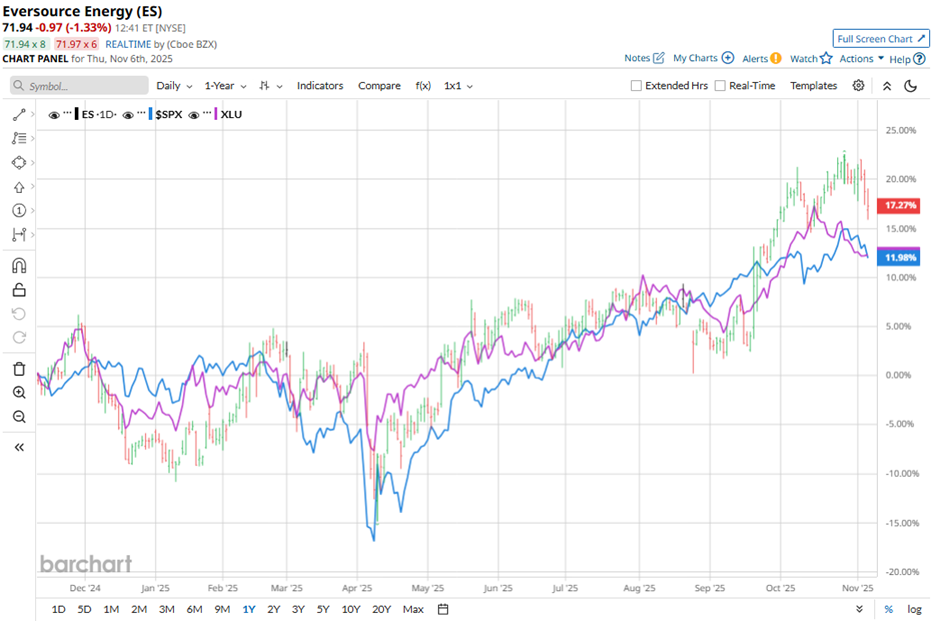

Shares of the power provider have outperformed the broader market over the past 52 weeks. ES stock has risen 17.9% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 13.4%. In addition, shares of the company are up 24.6% on a YTD basis, compared to SPX's 14.3% gain.

Looking closer, ES stock has also outpaced the Utilities Select Sector SPDR Fund's (XLU) 14.1% return over the past 52 weeks.

Despite reporting better-than-expected Q3 2025 adjusted EPS of $1.19 on Nov. 4, Eversource Energy’s shares fell 1.2% the next day. The company took a $75 million (or $0.20 per share) charge tied to increased liability from its previously sold offshore wind projects, signaling lingering risks in its clean-energy transition.

For the fiscal year ending in December 2025, analysts expect Eversource Energy's adjusted EPS to rise 3.9% year-over-year to $4.75. The company's earnings surprise history is strong. It beat or met the consensus estimates in the last four quarters.

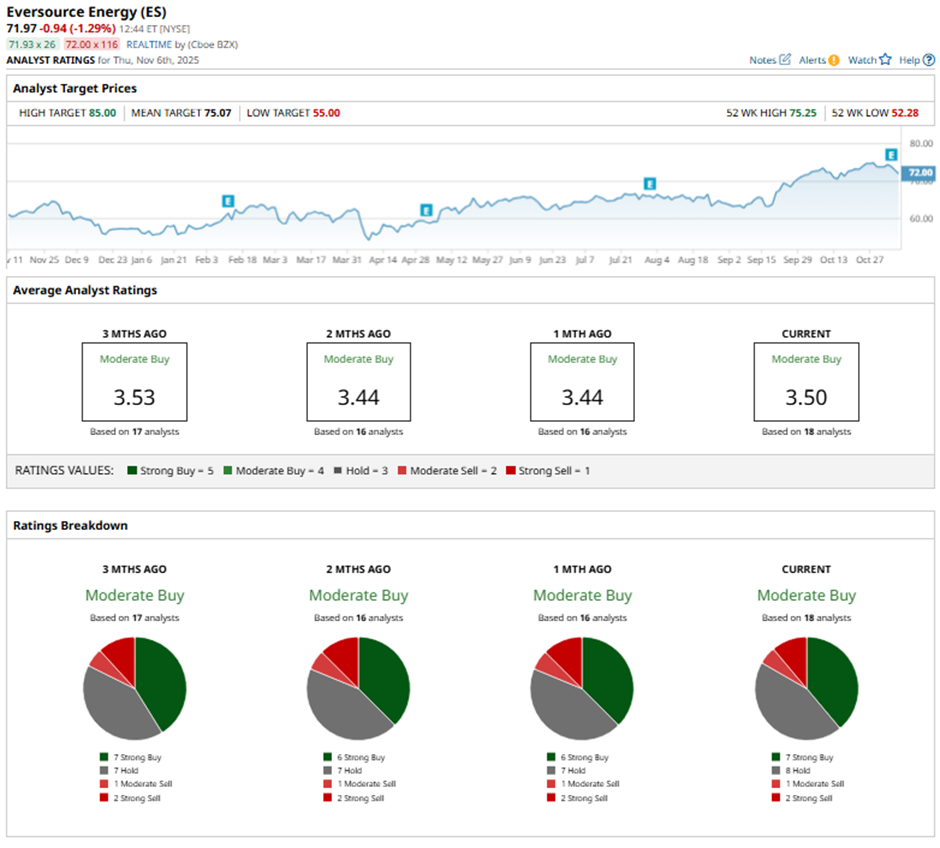

Among the 18 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on seven “Strong Buy” ratings, eight “Holds,” one “Moderate Sell,” and two “Strong Sells.”

On Nov. 6, Scotiabank’s Andrew Weisel raised Eversource’s price target to $64 but maintained an “Underperform” rating.

The mean price target of $75.07 represents a premium of 4.3% to ES' current levels. The Street-high price target of $85 implies a potential upside of 18.1% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Verizon Is Getting an Amazon Data Center Boost. Should You Buy the High-Yield Dividend Stock Here?

- ServiceNow Just Announced a 5-for-1 Stock Split. So, Is Now the Time to Buy NOW Stock?

- Palantir Is Getting a Bigger Seat at the Defense Table. Does That Make PLTR Stock a Buy Here?

- Analysts Say ‘We Would Be Aggressive Buyers on Any Pullbacks’ in Microsoft Stock. Should You Be Too?