The New York–based News Corporation (NWSA) is a global, diversified media and information services company, creating and distributing authoritative, engaging content alongside complementary products and services.

At a market capitalization of about $14.6 billion, well above the $10 billion “large-cap” threshold, the scale empowers a balanced portfolio spanning Digital Real Estate Services (REA Group and Move), Dow Jones, HarperCollins, and News Media assets, enabling diversified cash flows and geographic reach.

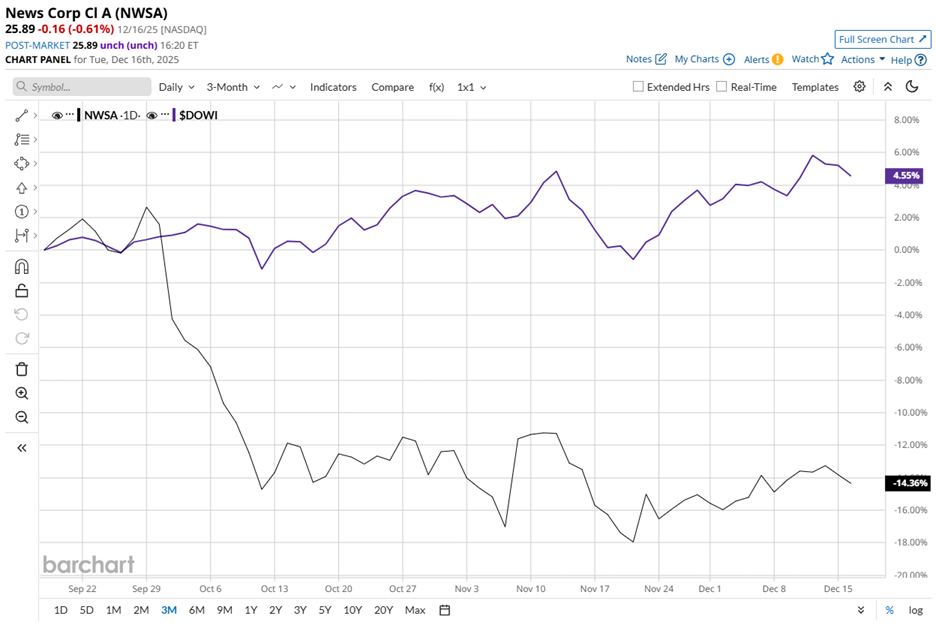

The stock market, however, has been less forgiving. NWSA stock trades about 18.1% below its September high of $31.61 and has fallen 12.9% over the past three months. During the same period, the Dow Jones Industrial Average ($DOWI) gained 5.2%, implying investor hesitation toward News Corporation.

The pattern extends beyond the short term. Over the past 52 weeks, NWSA stock slipped 9.6% and fell nearly 6% year-to-date (YTD), while the Dow advanced 10.1% and 13.1%, respectively.

In fact, NWSA stock has been trading below its 50-day moving average of $26.05 and its 200-day moving average of $27.81 since October. Although the stock briefly moved above the 50-day average in December, the subsequent pullback suggests the trend remains in transition as the market searches for clearer directional confirmation.

Then the business spoke for itself. On Nov. 7, News Corporation’s shares jumped 6.5%, a day after the company reported its Q3 fiscal 2025 results, which topped expectations. Revenue reached $2.14 billion, marking a 2.3% year-over-year increase and surpassing the $2.10 billion analyst estimate. EPS came in at $0.20, ahead of the Street's forecasts of $0.18.

The uptick was primarily driven by Dow Jones and Digital Real Estate Services. Management linked the performance to increased demand for digital subscriptions and data analytics alongside early stages of the U.S. real estate market recovery.

Looking ahead, News Corporation’s management believes that sustained strength in its digital businesses and continued stabilization in real estate markets would be critical to future growth. The company anticipates profiting from new artificial intelligence (AI)-related partnerships and sustained investment in high-margin content licensing.

For context, NWSA’s rival, the New York Times Company (NYT), has gained 21.1% over the past 52 weeks and 29.3% YTD, highlighting the potential for News Corporation to enhance relative performance.

Analysts maintain an optimistic outlook despite recent stock softness. NWSA stock carries a “Moderate Buy” consensus from 10 analysts, with an average price target of $37.97, indicating potential upside of 46.7% from current levels and reflecting confidence in the company’s diversified portfolio and ongoing growth initiatives.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This High-Yield Dividend Stock Trades at a Third of Its Record Highs: Is It a Buy for 2026?

- Elon Musk Warns He Wants to ‘Slow Down AI and Robotics’ But Says It’s Impossible and ‘Advancing at a Very Rapid Pace’

- Buy the Dip, or Panic Sell? What This Powerful Chart Indicator is Telling Us About the Stock Market Now.

- Should You Buy the Dip in Alibaba Stock?