With a market cap of $9.4 billion, Paycom Software, Inc. (PAYC) is a U.S.-based provider of cloud-based human capital management (HCM) solutions delivered through a software-as-a-service model for small to mid-sized businesses. The company offers an integrated platform that manages the entire employee life cycle, from recruitment and onboarding to payroll, benefits, and retirement.

Companies valued less than $10 billion are generally described as “mid-cap” stocks, and Paycom Software fits right into that category. Its comprehensive suite of applications includes talent acquisition, time and labor management, payroll, talent management, compliance, analytics, and employee self-service tools.

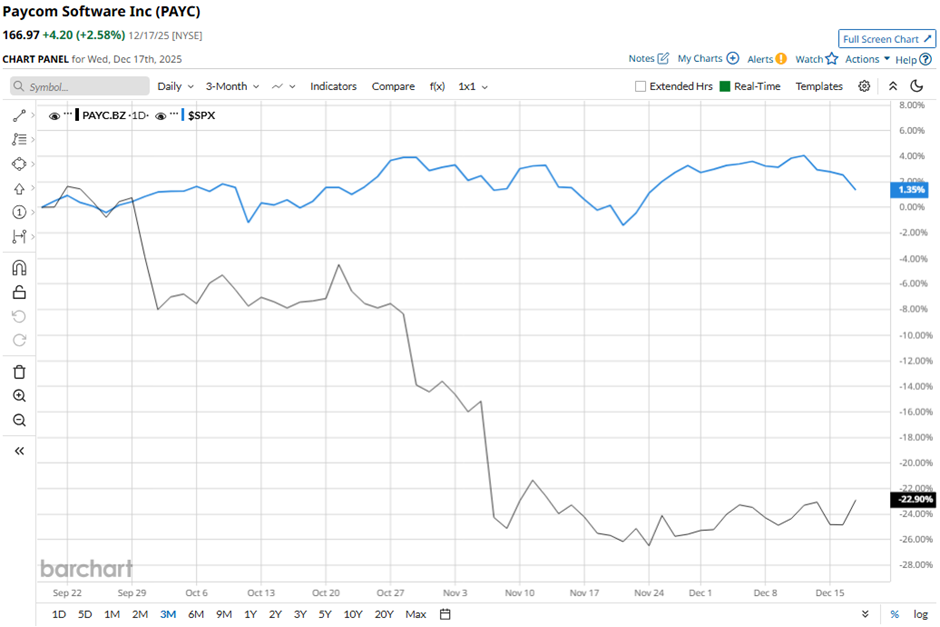

Shares of the Oklahoma City, Oklahoma-based company have fallen 37.6% from its 52-week high of $267.76. Paycom Software’s shares have decreased 22.2% over the past three months, lagging behind the broader S&P 500 Index’s ($SPX) 1.8% gain over the same time frame.

In the longer term, PAYC stock is down 18.5% on a YTD basis, underperforming SPX’s 14.3% rise. Moreover, shares of the human-resources and payroll software maker have dropped 28.3% over the past 52 weeks, compared to the 11.1% return of the SPX over the same time frame.

The stock has been trading below its 50-day moving average since late June.

Despite reporting better-than-expected Q3 2025 revenue of $493.3 million on Nov. 5, Paycom’s shares tumbled 10.7% the next day as adjusted EPS of $1.94 missed the estimate. Investors were also unsettled by a sharp decline in cash and cash equivalents to $375 million from $532.2 million in the prior quarter.

In comparison, rival Shopify Inc. (SHOP) has outperformed PAYC stock. SHOP stock has surged 52.1% on a YTD basis and 35.4% over the past 52 weeks.

Despite the stock’s weak performance over the past year, analysts remain moderately optimistic on PAYC. It has a consensus rating of “Moderate Buy” from the 21 analysts in coverage, and the mean price target of $209.12 is a premium of 25.2% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart