The Kraft Heinz Company (KHC), headquartered in Pittsburgh, Pennsylvania and Chicago, Illinois, is a major global player in the food and beverage industry, offering a wide range of well-known brands. Its operations span several categories, including sauces, condiments, cheese, dairy products, and snacks.

The company is engaged in the production, promotion, and distribution of innovative food items worldwide. With a presence across North America, Europe, and emerging markets, the company has a market capitalization of $28.81 billion, making the stock a “large-cap.”

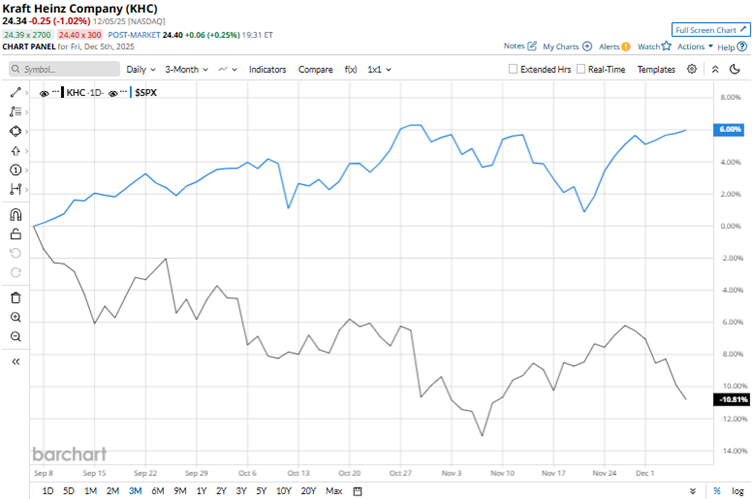

The stock has reached a 52-week low of $23.70 in November, but is up 2.7% from that level. Weak earnings, news of its corporate split, and external pressures have affected the stock’s trajectory. Kraft Heinz’s shares have dropped 10.8% over the past three months. On the other hand, the broader S&P 500 Index ($SPX) has gained 6% over the same period.

Over the longer term, this underperformance persists. Over the past 52 weeks, the stock has declined 21.3%, while it is down 8.6% over the past six months. Contrarily, the S&P 500 index has gained 13.1% and 15.7% over the same periods, respectively. The stock has traded consistently below its 200-day moving average over the past year, and it has recently dropped below its 50-day moving average in early December.

On Oct. 29, Kraft Heinz reported its third-quarter results for 2025. The company’s net sales decreased by 2.3% year-over-year (YOY) to $6.24 billion, which was slightly lower than the $6.25 billion that Wall Street analysts had expected. Organic net sales dropped 2.5% YOY. The company’s stock fell 4.5% intraday on Oct. 29.

Its adjusted EPS declined by 18.7% from the prior year’s period to $0.61. However, this exceeded the $0.57 EPS analysts expected. Kraft Heinz noted that the operating environment remains challenging. However, some improvements can be noted, in part due to its strategic investments.

Kraft Heinz is looking to reverse the blockbuster merger it underwent in 2015 when Warren Buffett’s Berkshire Hathaway and private equity firm 3G Capital teamed up to merge Kraft Foods with H.J. Heinz.

However, in September, the company announced that it would split into two businesses: one for its sauces, spreads, and shelf-stable meals, and another for its grocery and food-away-from-home businesses. The company believes its operating structure is complex, making capital allocation difficult. Therefore, splitting the firm into two might help in unlocking more potential.

We compare Kraft Heinz’s performance with that of another packaged foods stock, General Mills, Inc. (GIS), which has declined 29.9% over the past 52 weeks and 15.8% over the past six months. Therefore, Kraft Heinz has been the clear outperformer over the past 52 weeks.

Wall Street analysts are tepid on Kraft Heinz’s stock. The stock has a consensus rating of “Hold” from the 21 analysts covering it. The mean price target of $26.19 indicates a 7.6% upside compared to current levels. The Street-high price target of $30 indicates a 23.3% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart