- IQST Delivers Diversified Business with Divisions Focused on Telecommunications, Fintech, Electric Vehicles, Artificial Intelligence and More.

- 2025 Plan Toward $15 Million EBITDA Run Rate in 2026 and $1 Billion Revenue Goal in 2027.

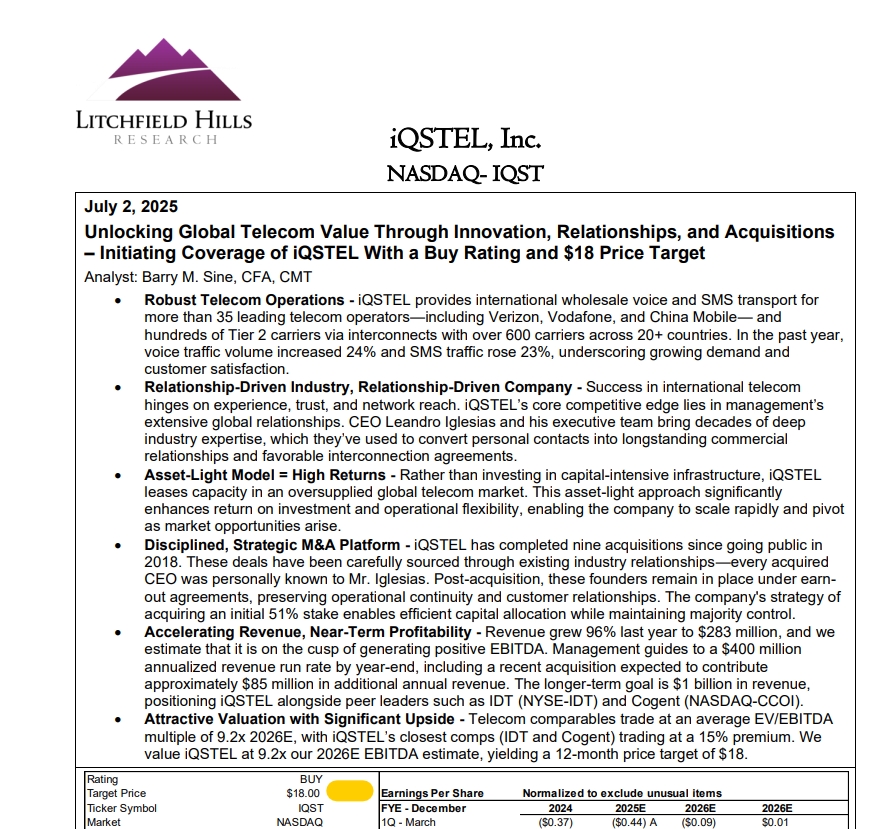

- Litchfield Hills Research Issues Recommendation and Detailed Report on IQSTEL (IQST) with $18 Price Target.

- $35 Million Revenue in July, Surpassing $400 Million Annual Run Rate Five Months Ahead of Schedule.

- New IQST Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

- Q2 Results: $17.41 Assets Per Share, Beating Metrics Including Net Shareholders' Equity, Gross Revenue, Gross Margin, Net Income, and Adjusted EBITDA

- IQST and CYCU Sign MOU for Equity Exchange and Alliance with Half of the Stock to be Distributed as a Dividend to Shareholders.

- Launch of IQ2Call, Delivering Vertical AI-Telecom Integration to Target the $750B Global Market.

- Equity Position Strengthened with $6.9 Million Debt Cut -- Almost $2 Per Share.

- Closing of GlobeTopper Acquisition on July 1st, Forecasting $34M Revenue and Positive EBITDA for H2 2025.

- IQST Shareholders to Receive ASII Common Shares as a Dividend as Part of Nasdaq Uplisting Plan.

IQSTEL, Inc. (Nasdaq: IQST) offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQST delivers high-value, high-margin services to its extensive global customer base. IQST projects $340 million in revenue for FY-2025, building on its strong business platform.

IQST has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQST is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

Executing 2025 Plan Toward $15 Million EBITDA Run Rate in 2026 and $1 Billion Revenue Goal in 2027

On August 25th IQST announced the next stage of its growth strategy, setting an intermediate goal of reaching a $15 million EBITDA run rate in 2026 as part of its long-term plan to become a $1 billion revenue company by 2027.

Achieving this milestone matters because public companies in the IQST sector are typically valued at 10x to 20x EBITDA. If the market applies these valuation guidelines to IQST, then at a $15 million EBITDA run rate the company could reach an implied market capitalization of $150 million to $300 million, representing a significant potential upside for shareholders as the company advances toward its $1 billion revenue target.

This goal is part of the IQST road map to growth:

- $400 million revenue run rate – achieved, giving the company the critical mass needed to scale and improve the bottom line.

- $15 million EBITDA run rate – in process, designed to significantly increase market capitalization.

- $1 billion revenue in 2027 – the long-term target, positioning IQSTEL in the select group of billion-dollar companies and advancing into the big leagues of the tech space.

To achieve these goals, IQST will execute a two-pronged "pincer strategy":

Strategic Acquisitions – IQST is pursuing 2–3 key acquisitions, with each target expected to add approximately $5 million in EBITDA run rate to the company's bottom line. IQST has already identified potential targets and plans to begin discussions later this year about joining its high-margin, high-technology global business platform. To finance these IQST acquisitions, the primary plan is to use a combination of traditional commercial bank debt and preferred shares as a first option, a structure designed to increase value for common shareholders while preserving financial strength and flexibility

Operational Streamlining – In parallel, IQST is focusing on efficiencies across its existing operations. These initiatives, already underway, are designed to further strengthen margins and contribute directly to the company's EBITDA run rate growth.

Around 12 institutional investors now hold approximately 4% of IQST shares — just 120 days after uplisting to Nasdaq. Visit: https://www.nasdaq.com/market-activity/stocks/iqst/institutional-holdings

Supporting this trajectory, Litchfield Hills Research recently reaffirmed its $18 price target for IQST following its review of the company's Q2 2025 Form 10-Q filing. Read the full report here: https://shre.ink/te9s

Q2 Results: $17.41 Assets Per Share, Beating Metrics Including Net Shareholders' Equity, Gross Revenue, Gross Margin, Net Income and Adjusted EBITDA

On August 14th IQST announced financial results for the second quarter ended June 30, 2025, reporting substantial growth in shareholder equity, improved gross margins and increased profitability.

Q2 2025 Highlights:

Net Shareholder Equity increased from $11.9 million in December 2024 to $14.29 million as of June 30, 2025 — not yet including the benefit of a $3.5 million debt reduction announced in July, expected to be reflected in Q3.

Gross Revenues up 17% year-over-year for the first six months of 2025, increasing from $132.58 million in H1 2024 to $155.15 million in H1 2025, with 100% of this growth being organic.

Gross Margin improved by 7.45% compared to the same period in 2024.

Telecom Division Net Income rose 29.94% quarter-over-quarter to $321,321, with EBITDA of $1.1 million for the first half of 2025.

Assets per Share: $17.41 | Equity per Share: $4.84 (pre-debt reduction impact).

Additionally, between May and June 2025, approximately $3.6 million was converted into IQST common shares, and these issuances were fully absorbed by the market before July — during which the stock price remained stable above $10/share. Importantly, these new share issuances did not negatively impact our Net Shareholder's Equity ratio. In fact, Net Shareholder's Equity per issued share improved from $3.37 as of June 30, 2024, to $4.08 as of June 30, 2025.

IQST and CYCU Sign MOU for Equity Exchange and Alliance with Half of the Stock to be Distributed as a Dividend to Shareholders

On August 7th IQST and CYCU announced the signing of a Memorandum of Understanding (MOU) to become mutual equity partners following a planned $1 million stock exchange, with half of each company's exchanged shares to be distributed as a dividend to enhance shareholder value.

IQST has been developing proprietary AI services through its in‑house IQSTEL Intelligence division (www.realityborder.com), launching two proprietary products: www.Airweb.ai — a multilingual AI web/phone/messaging agent — and www.IQ2Call.ai — an AI‑powered call center agent. Most recently, IQSTEL Intelligence was engaged by ONAR to develop a full suite of AI‑driven sales support tools.

Expanding Tech Portfolio with Launch of IQ2Call, Delivering Vertical AI-Telecom Integration to Target the $750B Global Market

On July 15th IQST announced the launch of IQ2Call, a next-generation, AI-powered call center service developed by its artificial intelligence subsidiary, Reality Border. Designed to eliminate wait times and provide intelligent, adaptive scalability, IQ2Call merges the IQST telecom infrastructure with advanced AI to create a revolutionary customer engagement platform.

IQST IQ2Call is currently being deployed with its first batch of customers in Spain and the United States, marking the start of its global rollout. The solution offers enterprise-grade performance with real-time analytics, zero wait times, and the ability to instantly scale operations from 1 to 100+ agents — all while maintaining full compliance and multilingual support.

IQST Confirms Closing of GlobeTopper Acquisition, Forecasting $34M Revenue and Positive EBITDA for H2 2025

IQST has announced that the previously disclosed acquisition of 51% of GlobeTopper (GlobeTopper.com) is now officially closed and effective as of July 1, 2025.

This milestone marks a major acceleration of the IQST global fintech expansion strategy and positions the company to further solidify its path toward $1 billion in annual revenue by 2027.

With the transaction now finalized, GlobeTopper is a consolidated subsidiary of IQST and will begin contributing to IQST financial results starting in July 2025.

GlobeTopper is forecasting:

$34 million in revenue and $0.26 million in EBITDA for the second half of 2025

Starting with $5 million in revenue for July

Scaling up to over $6 million in December 2025

This forecast reflects only GlobeTopper's standalone performance. It does not yet include any additional upside from cross-selling or synergies with the IQST extensive commercial platform, which serves over 600 telecom operators globally.

As disclosed in IQSTEL's 8-K filed on May 30, the Unit Purchase Agreement outlines GlobeTopper's forecast standalone of $85 million in revenue and $0.62 million in EBITDA for FY-2026, reinforcing the strength of the underlying business model.

Craig Span, CEO of GlobeTopper, will continue to lead the company, ensuring seamless integration into IQST fintech operations. GlobeTopper is working in close collaboration with GlobalMoneyOne.com to implement a strategic 3-year business roadmap.

Together, they will focus on expanding cross-border payments, digital wallets, mobile remittances, and prepaid services, particularly across high-value markets in Africa, Europe, and the Americas.

For more information on $IQST visit: www.IQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Media Contact

Company Name: IQSTEL Inc.

Contact Person: Leandro Jose Iglesias, President and CEO

Email: Send Email

Phone: +1 954-951-8191

Address:300 Aragon Avenue Suite 375

City: Coral Gables

State: Florida 33134

Country: United States

Website: www.iQSTEL.com