VANCOUVER, BC / ACCESSWIRE / September 6, 2023 / Noram Lithium Corp. ("Noram" or the "Company") (TSXV:NRM)(OTCQB:NRVTF)(Frankfurt:N7R) is providing an update on its 100% owned Zeus Lithium Project ("Zeus" or the "Project"), located in Clayton Valley, Nevada.

In mid-March, the Company produced an updated Mineral Resource Estimate (MRE) for Zeus which outlined a Measured and Indicated resource estimate of 5.2 Mt Lithium Carbonate Equivalent ("LCE", 1034 Mt at 941 ppm lithium), and an additional Inferred resource estimate of 1.1 Mt LCE (235 Mt at 871 ppm lithium) utilizing a 400 ppm Li cut-off1. Following the updated MRE, the Company initiated several Project de-risking initiatives, including engaging an independent consultant to optimize the Zeus mine plan, focusing on the high-grade core of the deposit.

Highlights of the mine plan optimization analysis work completed to-date:

This analysis was derived from the existing MRE using a variable cut-off grade stockpiling strategy. Preliminary results of the work are as follows:

- Higher-grade material ("HGO") for direct feed to processing: 39 Mt at 1,450 ppm Li

- Higher-grade material stockpiled for processing after HGO: 22 Mt at 1,360 ppm Li

- Medium-grade material stockpiled for processing after HGO: 7 Mt at 1,120 ppm Li

- Lower-grade material stockpiled for potential processing: 37 Mt at 850 ppm Li

- Waste material: 38 Mt

- Implied strip ratio of 0.36 (waste:material for processing)

- Contained LCE of 668,000t, approximately 11% of the overall mineral resources

- 19-years of operations processing high/medium-grade material plus a potential additional mine life of 11 years processing low-grade stockpile, at a nominal processing rate of 3.5 Mt/year

"The mine optimization work based on our updated Mineral Resource Estimate has been successful at delineating a significant amount of material at grades over 50% higher than our resource grade" stated Greg McCunn, CEO of Noram. "The high-grade feed to the processing plant allows a reduction in throughput and lower upfront capital, while maintaining meaningful levels of lithium carbonate production for the electric vehicle battery market.

Drill core samples at the HGO grade of 1,450 ppm Li have been used for our current metallurgical test work and process design work. We expect to receive key results from this ongoing testing in the coming weeks."

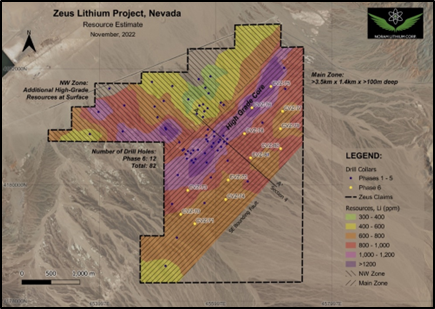

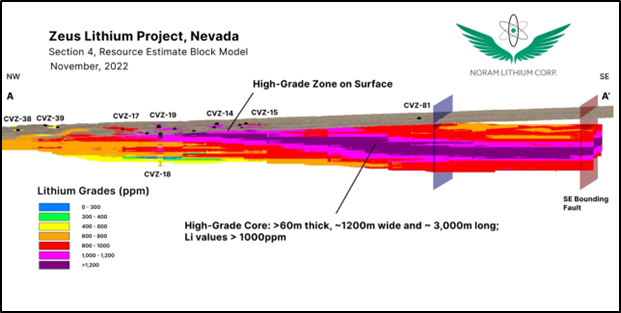

The high-grade core of the Zeus deposit outcrops at surface and consists of a layer of high-grade material approximately 60 metres thick, 1200 metres wide and 3000 metres long (Figures 1 and 2).

Further mine planning work is currently being undertaken to schedule the preliminary pit constrained resource. The scheduled mine plan will be used as the basis for the upcoming economic study on the Zeus Project. Results of the optimization study are subject to change in upcoming economic study on the Zeus Project.

The results of the optimization analysis are shown in Table 1 below.

Table 1 - Optimization analysis for the Zeus high-grade core.

Product from Pit |

Million Tonnes (Mt) |

Lithium Grade (ppm) |

Lithium Contained (kt) |

LCE Contained (kt) |

High Grade Material - HGO |

39 |

1,450 |

56.2 |

299 |

High Grade Material Stockpiled |

22 |

1,360 |

29.4 |

157 |

Medium Grade Material Stockpiled |

7 |

1,120 |

8.3 |

44 |

Low Grade Material Stockpiled |

37 |

850 |

31.6 |

168 |

Waste |

38 |

-- |

-- |

-- |

The analysis was derived from the existing MRE using a variable cut-off grade and stockpiling strategy from Measured, Indicated and Inferred mineral resources. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that any mineral resource will be converted into mineral reserves.

For additional information:

Contacts:

In Europe: VP Corporate Development simon.studer@noramlithium.com

Elsewhere: Investor Relations at ir@noramlithiumcorp.com

Website: www.noramlithiumcorp.com

ON BEHALF OF THE BOARD OF DIRECTORS

Sandy MacDougall

Founder and Executive Chairman

(778) 999-2159

About Noram Lithium Corp.

Noram Lithium Corp. (TSXV:NRM)(OTCQB:NRVTF)(Frankfurt:N7R) is focusing on advancing its 100%-owned Zeus Lithium Project located in Clayton Valley, Nevada an emerging lithium hub within the United States. With the upsurge in the electric vehicle and energy storage markets the Company aims to become a key participant in the domestic supply of lithium in the United States. The Company is committed to creating shareholder value through the strategic allocation of capital.

Footnote

1 Refer to the report entitled "Updated Resource Estimate Zeus Lithium Project, Esmeralda County Nevada" with an effective date of March 17, 2023 and filed under the Company's filings on www.sedar.com

Figure 1 - Resource Block Model Plan View; colours represent Li grades as indicated on the right.

Figure 2 - Section A-A' Highlighting extensive continuity of high grade lithium sedimentary layers.

Qualified Person

The technical information contained in this news release has been reviewed and approved by Brad Peek, M.Sc., CPG, who is a Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, and also Vice President of Exploration for Noram.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward Looking Information

This news release may contain forward-looking information which is not comprised of historical facts. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes statements regarding, among other things, plans for ongoing development of the Zeus Lithium Project. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, regulatory approval processes, results of further exploration work, and availability of capital on terms acceptable to the Company. Although Noram believes that the assumptions used in preparing the forward-looking information in this news release are reasonable, including that all necessary regulatory approvals will be obtained in a timely manner, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Noram disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by applicable securities laws.

SOURCE: Noram Lithium Corp.

View source version on accesswire.com:

https://www.accesswire.com/780875/noram-lithium-provides-update-on-zeus-lithium-project-mine-plan-optimization-work