Cummins Inc. (CMI) is a global power technology leader that designs, manufactures, and services a broad portfolio of power solutions, including diesel, natural-gas, hybrid, and electric powertrains, along with components like turbochargers, filtration, controls, and power generation systems. Headquartered in Columbus, Indiana, the company operates in approximately 190 countries through a vast network of distributors and dealers. Cummins has a market capitalization of around $62.9 billion.

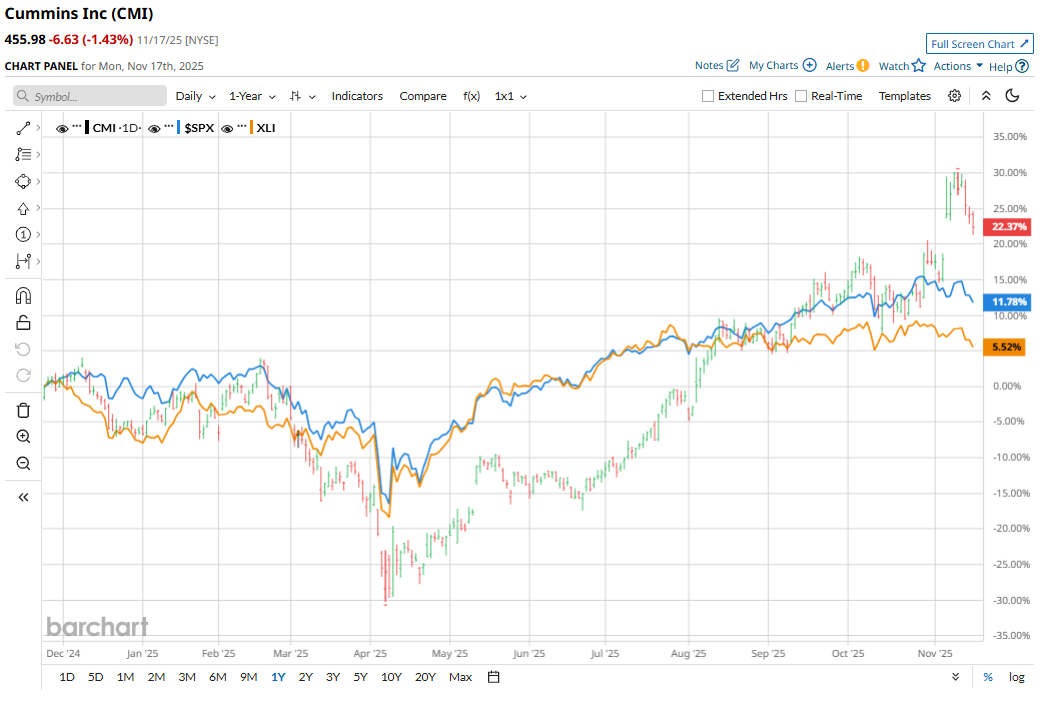

CMI stock has outpaced the broader market and its industrial peers. The stock has surged 26% over the past 52 weeks, easily outpacing the S&P 500 Index’s ($SPX) 13.7% climb. The rally continues in 2025, with CMI up 30.8% on a year-to-date (YTD) basis, outshining the SPX’s 13.4% gain.

Even against its own sector, CMI has been surging past the Industrial Select Sector SPDR Fund (XLI), which has risen 8.2% over the past year and 14.2% on a YTD basis.

Cummins' shares have been rising this year largely because of very strong demand in its Power Systems business, especially for data center and mission-critical generators. Investors are also excited about its long-term “Destination Zero” push, including green hydrogen and hybrid powertrain investments through its Accelera business, which gives it exposure to the energy transition.

For the current fiscal year, ending in December 2025, analysts expect CMI’s EPS to grow 5% YoY to $22.44 on a diluted basis. It beat the consensus estimate in each of the last four quarters.

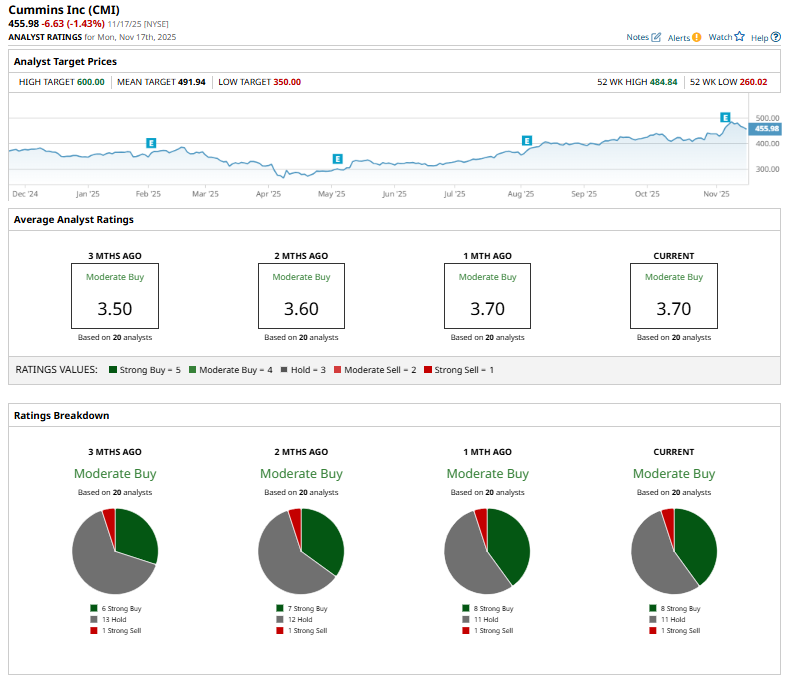

Among the 20 analysts covering CMI stock, the consensus is a “Moderate Buy.” That’s based on eight “Strong Buy” ratings, 11 “Holds,” and one “Strong Sell.”

This configuration is slightly more bullish than three months ago, when there were six “Strong Buy” ratings.

Recently, Bernstein’s Chad Dillard lifted his price target on Cummins to $475 from $385 and maintained a “Market Perform” rating, noting that strength in the power generation business is offsetting softness in engines.

The mean price target of $491.94 represents a 7.9% premium to CMI’s current price levels. The Street-high price target of $600 suggests an upside potential of 31.6%.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Dear Coinbase Stock Fans, Mark Your Calendars for December 17

- Warren Buffett Says to Embrace Stock Volatility Because ‘A Tolerance for Short-Term Swings Improves Our Long-Term Prospects’

- Bridgewater Is Betting Big on This 1 Chip Stock (Not Nvidia). Should You Buy Shares Here?

- S&P Futures Slip on Souring Risk Sentiment