EOG Resources, Inc. (EOG) is a leading independent energy company engaged in the exploration, development, production and marketing of crude oil, natural gas, and natural gas liquids. Headquartered in Houston, Texas, the firm is a major player across U.S. basins, including the Permian Basin, Eagle Ford, and more, as well as in international operations. The company’s market cap stands around $58.9 billion.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and EOG fits well into that category, with its market cap exceeding this mark, underscoring its size, influence, and dominance in its industry. EOG boasts a robust portfolio and has optimized its production mix to favor high-value oil and natural gas liquids, enabling the company to capitalize on favorable market prices and maximize revenue and profit margins.

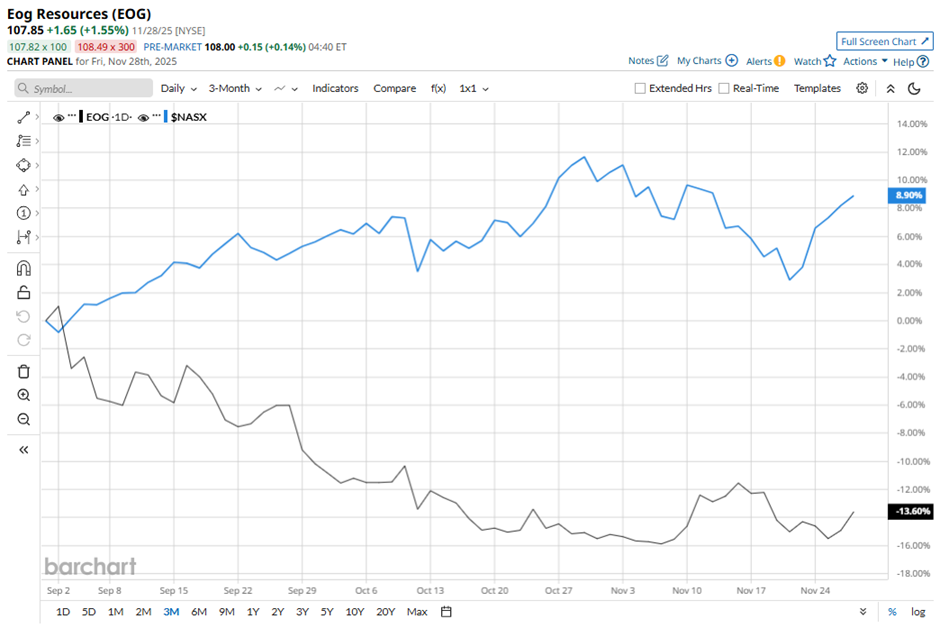

Despite its notable strength, EOG slipped 22% from its 52-week high of $138.18, achieved on Jan. 16. Over the past three months, EOG stock has declined 13.3%, underperforming the Nasdaq Composite’s ($NASX) 7.7% rise during the same time frame.

In the longer term, shares of EOG dipped 12% on a YTD basis and plummeted 19% over the past 52 weeks, underperforming NASX’s YTD gains of 21% and 22.6% returns over the past year.

To confirm the bearish trend, EOG has been trading below the 200-day moving average since early July, but with some fluctuations. The stock is also trading below the 50-day moving average since mid-Sept.

EOG’s stock drop in 2025 reflects a combination of macro and company-specific headwinds, notably, weakening global oil and gas prices. In addition, some analysts have also cited concerns about oversupply and softening demand in the oil market, which casts doubt on near-term upside. Investors seem cautious as future cash flow forecasts and commodity price volatility introduces uncertainty.

EOG’s rival, ConocoPhillips (COP) shares have plummeted 10.4% in 2025 alone and 18% over the past 52 weeks.

Wall Street analysts are moderately bullish on EOG’s prospects. The stock has a consensus “Moderate Buy” rating from the 32 analysts covering it, and the mean price target of $137.73 suggests a potential upside of 27.7% from current price levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The AI Race Is a Marathon, Not a Sprint. Here Is How AMD Stock Could Still Finish First.

- This Under-$10 Stock Just Reported a 700% Surge in Robotaxi Revenue. Should You Buy Shares Here?

- As Google Locks Down a Multimillion-Dollar NATO Deal, Should You Buy, Sell, or Hold GOOGL Stock?

- Should You Grab This ‘Strong Buy’ Growth Stock With 56% Upside?