Yesterday, Plug Power (PLUG) inked its first contract with NASA, which is a key milestone for the hydrogen solutions company. The deal will see Plug Power supply up to 480,000 pounds of liquid hydrogen to NASA's Glenn Research Center in Cleveland and the Neil Armstrong Test Facility in Sandusky, Ohio.

The contract deal is worth up to $2.8 million, enabling Plug Power to enter the aerospace sector. The agreement validates the company’s ability to meet NASA's strict standards for purity and reliability in mission-critical operations.

NASA consumes over 37 million pounds of liquid hydrogen annually, so this initial award could be just the beginning of a longer partnership. Plug Power will handle deliveries using its own cryogenic transport fleet, drawing from a growing network of hydrogen production facilities across the United States. This built-in supply chain gives Plug an edge in reliability and consistency.

The NASA contract signals that Plug Power can compete in high-specification markets beyond its traditional material handling business. Plug aims to position itself as a key player in the rapidly expanding hydrogen economy, with applications spanning aerospace, industrial operations, and next-generation energy systems.

Is Plug Power Stock a Good Buy Right Now?

Valued at a market cap of $2.64 billion, and even with today's 5% bump in price, Plug Power stock is still down over 50% from its 52-week high. Plug Power develops hydrogen fuel cell systems and infrastructure for material handling, backup power, and transportation.

The company produces fuel cells (GenDrive, GenSure), hydrogen production equipment (electrolyzers), liquefaction systems, and distribution solutions. It also supplies liquid hydrogen and provides integrated, turnkey services, enabling businesses to transition from fossil fuels to clean hydrogen across multiple industries.

Plug Power delivered a solid third quarter, reporting $177 million in revenue and balanced growth across its hydrogen business segments. The electrolyzer vertical reported revenue of $65 million, an increase of 13% year-over-year (YoY). Notably, Plug Power’s operational cash burn improved by more than 50% driven by pricing discipline and a focus on working capital management.

Plug Power has made notable progress with over 230 megawatts of electrolyzer programs underway across Europe, Australia, and North America. A major milestone was the delivery of the first 10-megawatt electrolyzer to the Galp project in Portugal, which is the initial phase of a planned 100-megawatt installation. The company's Georgia Green Hydrogen Plant also demonstrated strong performance in August, producing 324 tons with 97% uptime and 92.8% efficiency.

Plug announced a strategic move to monetize electricity rights in New York and another location through a partnership with a major data center developer. This transaction is expected to generate over $275 million in liquidity through asset monetization and the release of restricted cash. The deal also positions Plug Power to enter the rapidly growing data center market, where its fuel cell systems can provide zero-emission backup power.

Moreover, Plug Power secured a global hydrogen supply agreement with a leading industrial gas company, thereby reducing the need for near-term plant development. As a result, Plug suspended activities under its Department of Energy loan program, which allows it to redirect capital toward higher-return opportunities. Management confirmed it remains on track to hit $700 million in revenue for 2025 and achieve gross margin neutrality by year's end.

What Is the PLUG Stock Price Target?

Analysts tracking PLUG stock forecast revenue to increase from $629 million in 2024 to $1.7 billion in 2029. Plug Power is forecast to remain unprofitable in the near term, and its free cash outflow could surpass $1.2 billion through 2027.

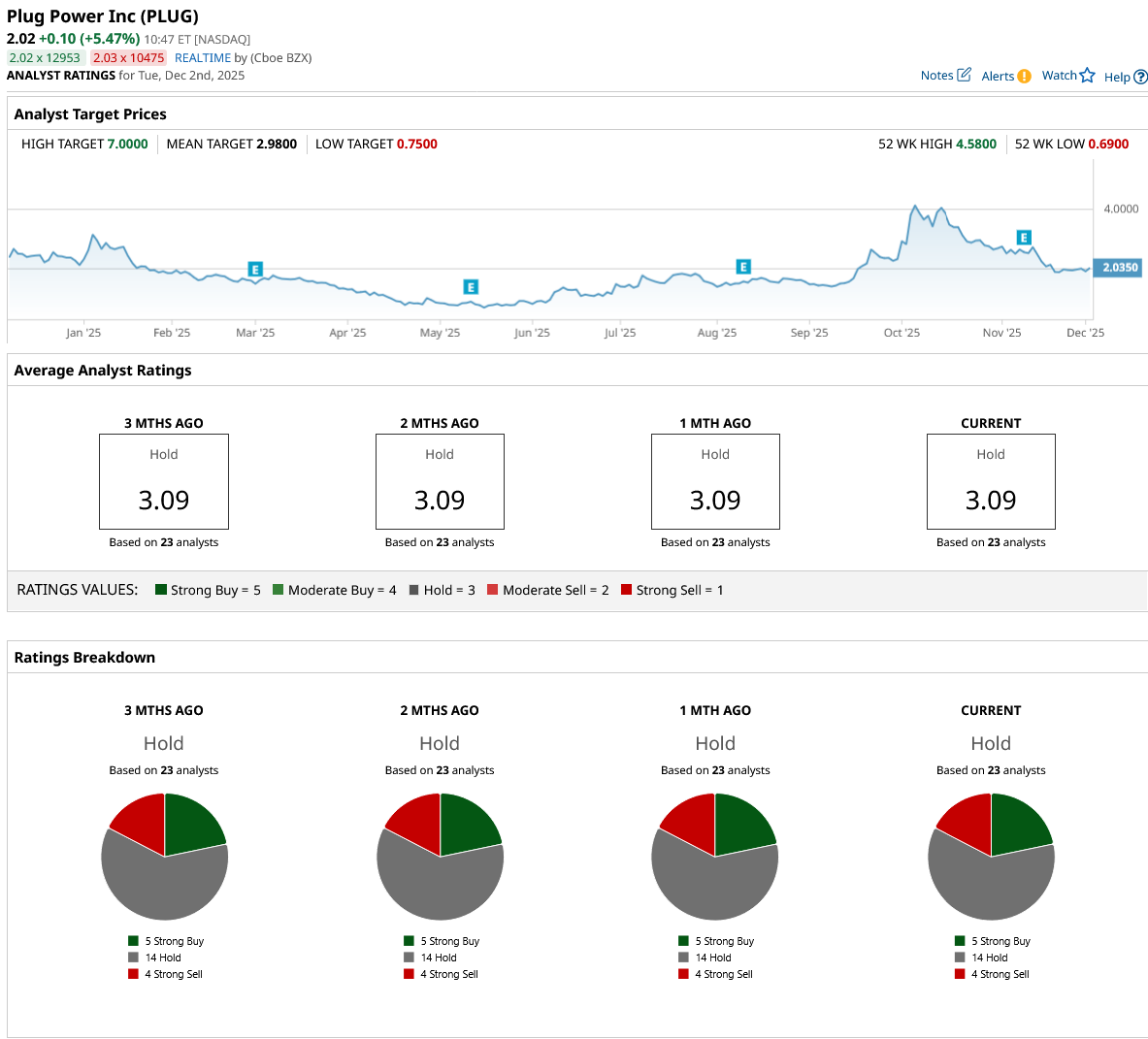

Wall Street projects Plug Power to end 2029 with a free cash outflow of $257 million. If the stock is priced at 20x forward FCF, it could double over the next three years. Out of the 23 analysts covering Plug Power stock, five recommend “Strong Buy,” 14 recommend “Hold,” and four recommend “Strong Sell.” The average PLUG stock price target is $2.98, indicating an upside potential of about 50% from current levels.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Dan Ives Is Betting Big on CoreWeave Stock as an AI Winner. Should You Buy CRWV Too?

- Analysts Say AWS Will Drive ‘Significant Upside’ for Amazon. Should You Buy AMZN Stock Now?

- This Analyst Predicts Tesla Stock Will Crush Traditional Automakers, ‘They Had Plenty of Warning Time’

- Top 100 Stocks to Buy: Par Pacific Holdings Looks Tempting, But Should You Bite?