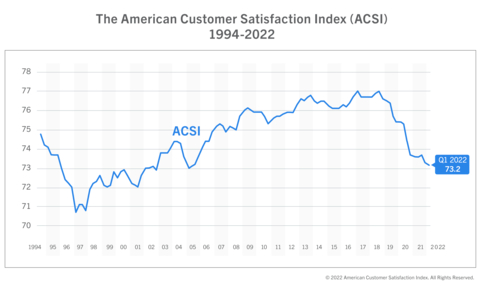

Customer satisfaction in the U.S. is now at its lowest level in 17 years, sliding 0.1% to a score of 73.2 (out of 100) in the first quarter of 2022, according to the national American Customer Satisfaction Index (ACSI®).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220510005294/en/

(Graphic: Business Wire)

Rarely has the U.S. economy faced as many challenges as it does today. While it would not be surprising that GDP growth might slow due to falling customer satisfaction, this is actually not what’s happening now.

It’s true that customer dissatisfaction has a dampening effect on discretionary household spending. It’s also true that household spending is the largest component of GDP. However, GDP, which contracted by 1.4% in the first quarter, didn’t fall due to weak consumer spending. On the contrary, annual consumer spending has been strong because of pent-up demand due to COVID-19 and because it was financed by robust household savings. GDP shrank because of weak exports. Long term, however, household savings cannot be a major source of consumption funding.

If adjusted for inflation, and once inflation itself is adjusted for the service and product quality deterioration reflected in ACSI, consumer spending will no longer prop up GDP. Supply chain problems will continue. Labor shortages will also be a factor in the foreseeable future. Both contribute to more inflation.

“Global trade, and especially international supply chains, will continue to be disrupted. Combined with the prolonged customer satisfaction decline, it’s evident the U.S. faces complicated economic challenges,” said Claes Fornell, founder of the ACSI and the Distinguished Donald C. Cook Professor (emeritus) of Business Administration at the University of Michigan. “If households continue to use savings to finance consumption, it might neutralize some of the economic pressures in the short term, but it will also create a very different economy – one where demand continues to exceed supply. And that’s not sustainable because it fosters monopoly tendencies in the sense that it will matter less if customers are satisfied or not: Sellers will continue to gain pricing power, which further fuels inflation, and buyers compete with one another while sellers don’t compete much at all.”

The national ACSI score (or ACSI composite) is updated each quarter based on annualized customer satisfaction scores for all sectors and industries. For more, follow the American Customer Satisfaction Index on LinkedIn and Twitter at @theACSI or visit www.theacsi.org.

No advertising or other promotional use can be made of the data and information in this release without the express prior written consent of ACSI LLC.

About the ACSI

The American Customer Satisfaction Index (ACSI®) has been a national economic indicator for 25 years. It measures and analyzes customer satisfaction with more than 400 companies in 47 industries and 10 economic sectors, including various services of federal and local government agencies. Reported on a scale of 0 to 100, scores are based on data from interviews with roughly 500,000 customers annually. For more information, visit www.theacsi.org.

ACSI and its logo are Registered Marks of American Customer Satisfaction Index LLC.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220510005294/en/

Contacts

FOR MORE INFORMATION

Denise DiMeglio 610-228-2102

denise@gregoryfca.com