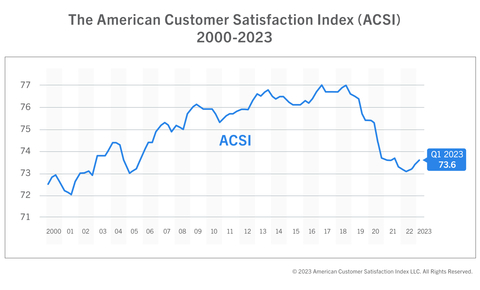

Customer satisfaction in the United States improves for a third consecutive quarter, edging up 0.3% to 73.6 (on a 100-point scale) in the first quarter of 2023. The gain extends a positive streak in the American Customer Satisfaction Index (ACSI®) that reverses the trend of several years of declining customer satisfaction.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230509005295/en/

ACSI 2000 - 2023 (Graphic: Business Wire)

From late 2018 to mid-2022, U.S. customer satisfaction declined almost every quarter as the ACSI fell to its lowest level — 73.1 — in nearly two decades. While perpetuated by COVID-19 and supply chain problems, the weakening of customer satisfaction began about a year prior to the pandemic, following a long period of no improvement. Worldwide inflation and service industry labor shortages added to the problem. Under ordinary economic circumstances, companies compete for the satisfaction of their customers. Those that succeed are rewarded with increased revenue and higher profits. In other words, that’s how a market economy is supposed to work.

But the economy has been far from normal for several years now. “Strange as it may seem, high inflation and shortages of supply have been coupled with strong labor markets,” said Claes Fornell, founder of the ACSI and the Distinguished Donald C. Cook Professor (emeritus) of Business Administration at the University of Michigan. “Customer satisfaction has declined, but contrary to what’s typical, firms with higher customer satisfaction have not reaped the usual financial rewards from customer loyalty. While some industries, energy companies in particular, have been exceedingly profitable, it was not because of strong customer satisfaction, but rather the opposite.”

Nevertheless, things may return to normal as the upticks in customer satisfaction over the past nine months reverse the downward trend. Consumer spending has increased as well. While higher interest rates and stubborn inflation have created headwinds for economic growth, improved customer satisfaction contributes to consumer spending, which is the largest contributor by far to gross domestic product.

If customer satisfaction and consumer spending continue to increase while inflation abates and interest rates stabilize, the financial returns on customer satisfaction should also return to normalcy. Specifically, companies with strong customer satisfaction would do well financially.

During the first quarter of 2023, most industries show a year-over-year increase in customer satisfaction. For example, hotels and internet services are up by 4 points; streaming services and subscription TV rise by 3 points; and airlines, rental cars, online travel agencies, and restaurants improve a bit more modestly.

Since the decline in customer satisfaction began before the pandemic, following a long stretch of little or no improvement, there is something else in need of attention: While companies today have more data on customers than ever before, the analytics technology for turning data into useful information needs upgrading. The ACSI system of cause-and-effect equations, with solutions based on a form of machine learning, generates information about where to allocate resources for maximal impact – not only on customer satisfaction, but on financial results. Similar analytics are needed for managing resource allocation. Too many companies use measures of questionable relevance with very large margins of error.

The national ACSI score (or ACSI composite) is updated each quarter based on annualized customer satisfaction scores for all sectors and industries. For more, follow the American Customer Satisfaction Index on LinkedIn and Twitter at @theACSI or visit www.theacsi.org.

No advertising or other promotional use can be made of the data and information in this release without the express prior written consent of ACSI LLC.

About the ACSI

The American Customer Satisfaction Index (ACSI®) has been a national economic indicator for over 25 years. It measures and analyzes customer satisfaction with more than 400 companies in 45 industries and 10 economic sectors, including various services of federal and local government agencies. Reported on a scale of 0 to 100, scores are based on data from interviews with roughly 500,000 customers annually. For more information, visit www.theacsi.org.

ACSI and its logo are Registered Marks of American Customer Satisfaction Index LLC.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230509005295/en/

Contacts

Denise DiMeglio

908-295-3843

denise@gregoryfca.com