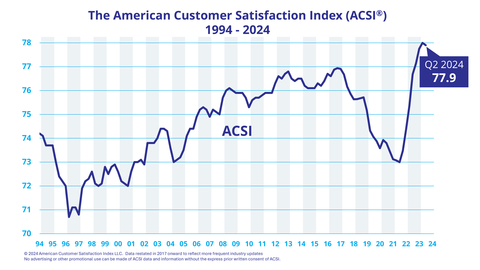

The sharp recovery in the quality of U.S. economic output over the past two years as measured by the American Customer Satisfaction Index (ACSI®) is now stagnating. At the national level, customer satisfaction is down 0.1% in the second quarter of 2024 to a score of 77.9 (on a 0-100 scale). Even though there has been a large increase in customer satisfaction over the past two years, it is not much higher now than it was in 2013.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240813432464/en/

ACSI 1994-2024 (Graphic: Business Wire)

While some companies have managed to significantly improve the satisfaction of their customers over the past decade — and benefited from it financially — many have not. Despite large corporate investments in customer experience management, there has only been a marginal increase in the national ACSI score.

There are several reasons for this, but rising customer expectations, an often-suggested culprit, is not one of them. ACSI data show that customer expectations are almost always higher than their subsequent satisfaction, but the gap has remained unchanged over the years. Businesses’ lack of data about consumers is not a problem either. Companies have more data on their customers today than ever before. But data need processing and powerful analytics. Consumer data are noisy, highly collinear, and do not follow standard probability distributions. There are methods for handling this, but they remain mostly absent in company customer data analytics.

“Strong and increasing levels of customer satisfaction improve customer loyalty, which has an exponentially cumulative effect on profit,” said Claes Fornell, founder of the ACSI and the Distinguished Donald C. Cook Professor (emeritus) of Business Administration at the University of Michigan. “Loyal customers also lower business risk, and low risk/high return leads to long-term profitability. In the aggregate, it also has a positive effect on the economy. Although the national ACSI score is only up marginally from a decade ago, it is nevertheless near record levels. The economy has been strong with solid GDP growth, inflation decline, robust consumer spending, and exceptional employment growth.”

Consistent with the present lack of growth in customer satisfaction, however, there are now signs that household spending is slowing and consumers are becoming more budget conscious. This may well lead to a reduction in consumer spending growth, the largest component of GDP. If so, some industries are now more vulnerable than others.

Just as price elasticity varies across industries, so does quality (satisfaction) elasticity. Companies in industries with high elasticity have the most to gain from positive changes in customer satisfaction but also have the most to lose from negative changes. According to ACSI data, high-elasticity industries include credit unions, banks, subscription TV providers, internet service providers (ISPs), and financial advisors. Gas stations and supermarkets are on the opposite side of the spectrum. It is not that companies in these industries are immune to declining customer satisfaction, but the effect of it would be less dramatic.

As the quality of economic output, as judged by those who consume it, stagnates or deteriorates, consumer spending may follow suit with negative consequences for further economic growth, as well as for labor and equity markets. The U.S. economy is not there yet, but there are warning signals.

The national ACSI score (or ACSI composite) is updated each quarter based on annualized customer satisfaction scores for all sectors and industries. For more, follow the American Customer Satisfaction Index on LinkedIn and X at @theACSI or visit www.theacsi.org.

No advertising or other promotional use can be made of the data and information in this release without the express prior written consent of ACSI LLC.

About the ACSI

The American Customer Satisfaction Index (ACSI®) has been a national economic indicator for over 25 years. It measures and analyzes customer satisfaction with approximately 400 companies in about 40 industries and 10 economic sectors, including various services of federal and local government agencies. Reported on a scale of 0 to 100, scores are based on data from interviews with roughly 200,000 responses annually. For more information, visit www.theacsi.org.

ACSI and its logo are Registered Marks of American Customer Satisfaction Index LLC.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240813432464/en/

Contacts

FOR MORE INFORMATION

Denise DiMeglio 610-228-2102

denise@gregoryfca.com