As the Q4 earnings season wraps, let’s dig into this quarter’s best and worst performers in the internet of things industry, including PowerFleet (NASDAQ: PWFL) and its peers.

Industrial Internet of Things (IoT) companies are buoyed by the secular trend of a more connected world. They often specialize in nascent areas such as hardware and services for factory automation, fleet tracking, or smart home technologies. Those who play their cards right can generate recurring subscription revenues by providing cloud-based software services, boosting their margins. On the other hand, if the technologies these companies have invested in don’t pan out, they may have to make costly pivots.

The 8 internet of things stocks we track reported a slower Q4. As a group, revenues missed analysts’ consensus estimates by 1.4% while next quarter’s revenue guidance was 3.4% below.

Thankfully, share prices of the companies have been resilient as they are up 7.5% on average since the latest earnings results.

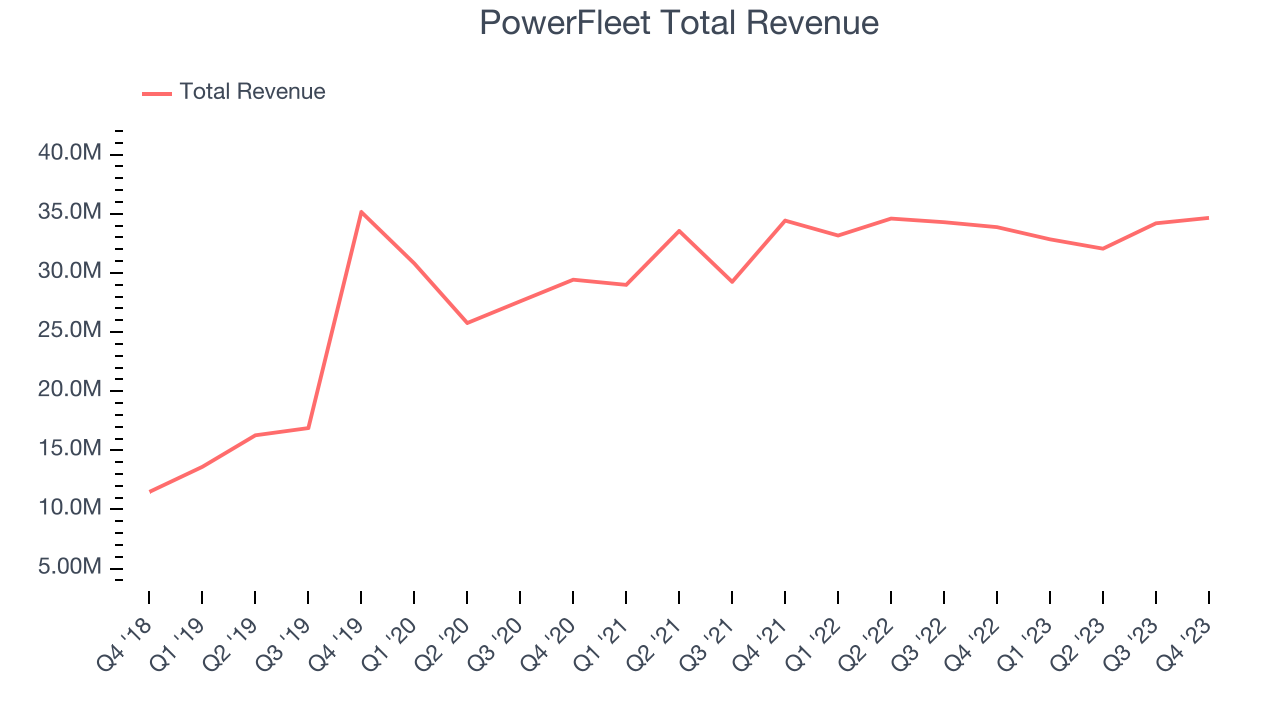

PowerFleet (NASDAQ: PWFL)

Having worked with some of the most notable companies in USPS and General Electric, PowerFleet (NASDAQ: PWFL) provides fleet and asset management systems and software for various industries.

PowerFleet reported revenues of $34.65 million, up 2.3% year on year. This print exceeded analysts’ expectations by 2.1%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EBITDA estimates.

PowerFleet scored the biggest analyst estimates beat of the whole group. Unsurprisingly, the stock is up 59.5% since reporting and currently trades at $4.61.

Is now the time to buy PowerFleet? Access our full analysis of the earnings results here, it’s free.

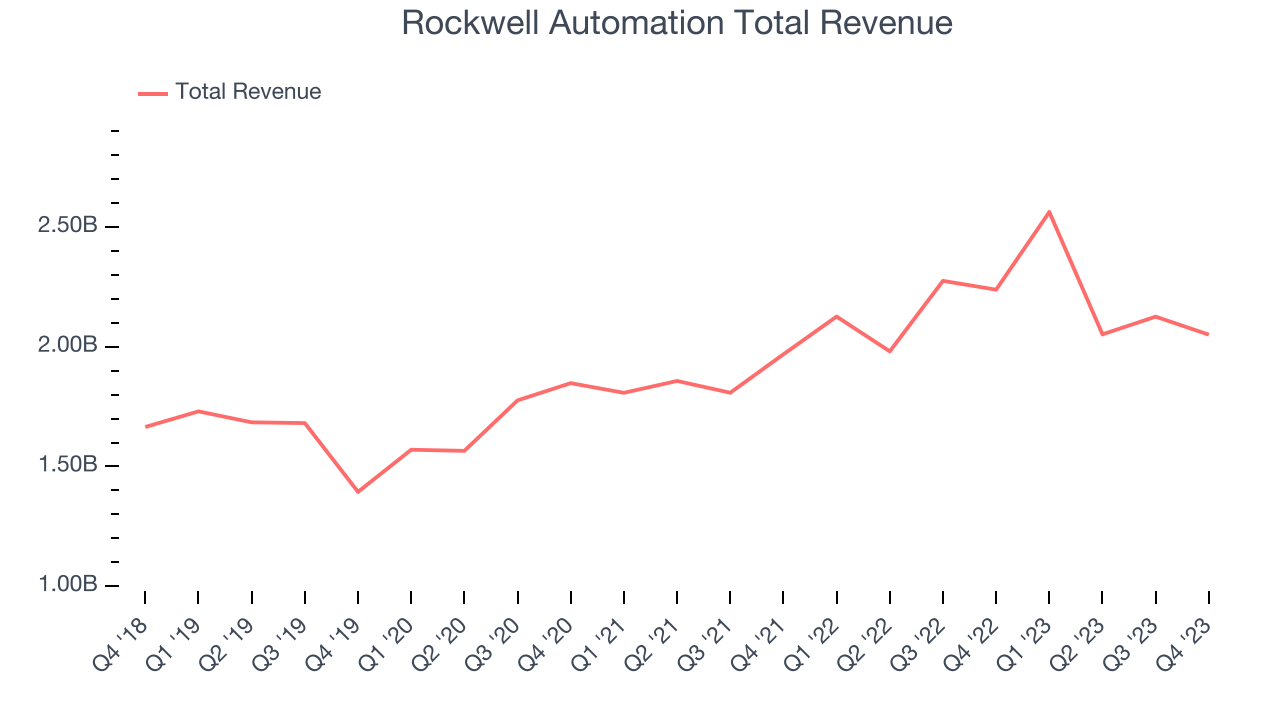

Best Q4: Rockwell Automation (NYSE: ROK)

One of the first companies to address industrial automation, Rockwell Automation (NYSE: ROK) sells products that help customers extract more efficiency from their machinery.

Rockwell Automation reported revenues of $2.05 billion, down 8.4% year on year, in line with analysts’ expectations. The business had a very strong quarter with an impressive beat of analysts’ earnings and EBITDA estimates.

The market seems happy with the results as the stock is up 7.6% since reporting. It currently trades at $269.78.

Is now the time to buy Rockwell Automation? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Vontier (NYSE: VNT)

A spin-off of a spin-off, Vontier (NYSE: VNT) provides electronic products and systems to the transportation, automotive, and manufacturing sectors.

Vontier reported revenues of $696.4 million, down 8.9% year on year, falling short of analysts’ expectations by 6.7%. It was a disappointing quarter as it posted underwhelming earnings guidance for the full year.

Vontier delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 13.2% since the results and currently trades at $34.05.

Read our full analysis of Vontier’s results here.

SmartRent (NYSE: SMRT)

Founded by an employee at a real estate rental company, SmartRent (NYSE: SMRT) provides smart home devices and software for multifamily residential properties, single-family rental homes, and student housing communities.

SmartRent reported revenues of $48.52 million, down 9.1% year on year. This result lagged analysts' expectations by 6%. It was a softer quarter as it also logged a miss of analysts’ operating margin estimates.

The stock is up 6.6% since reporting and currently trades at $1.77.

Read our full, actionable report on SmartRent here, it’s free.

Arlo (NYSE: ARLO)

With its name deriving from the Old English word meaning “to see,” Arlo (NYSE: ARLO) provides home security products and other accessories to protect homes and businesses.

Arlo reported revenues of $127.4 million, up 10.8% year on year. This print surpassed analysts’ expectations by 1.9%. More broadly, it was a softer quarter as it produced full-year revenue guidance missing analysts’ expectations.

Arlo had the weakest full-year guidance update among its peers. The stock is down 20.1% since reporting and currently trades at $10.80.

Read our full, actionable report on Arlo here, it’s free.

Market Update

Inflation progressed towards the Fed's 2% goal recently, leading the Fed to reduce its policy rate by 50bps (half a percent or 0.5%) in September 2024. This is the first cut in four years. While CPI (inflation) readings have been supportive lately, employment measures have bordered on worrisome. The markets will be debating whether this rate cut's timing (and more potential ones in 2024 and 2025) is ideal for supporting the economy or a bit too late for a macro that has already cooled too much.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and them to your watchlist. These companies are posied for grow regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.