As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q4. Today, we are looking at advertising software stocks, starting with Integral Ad Science (NASDAQ: IAS).

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

The 7 advertising software stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 22% since the latest earnings results.

Integral Ad Science (NASDAQ: IAS)

Founded in 2009, Integral Ad Science (NASDAQ: IAS) provides digital advertising verification and optimization solutions, ensuring that ads are viewable by real people in brand-safe environments across various platforms and devices.

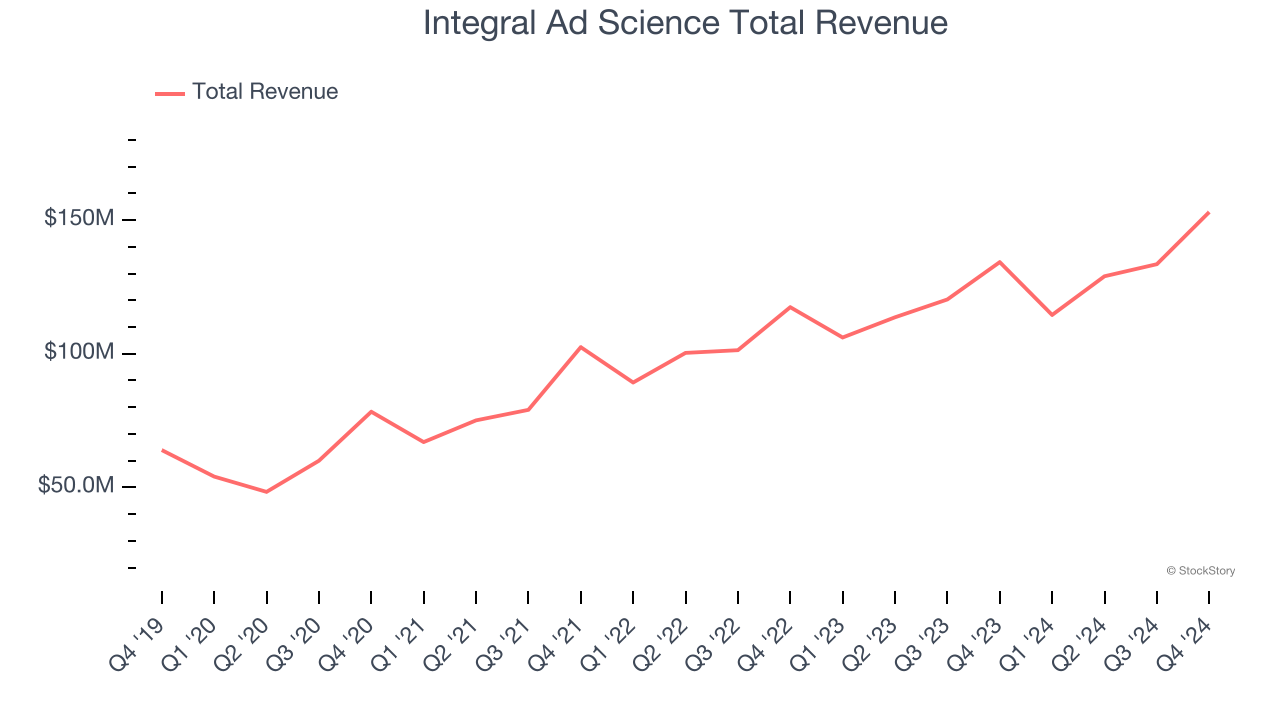

Integral Ad Science reported revenues of $153 million, up 14% year on year. This print exceeded analysts’ expectations by 2.7%. Overall, it was a strong quarter for the company with a solid beat of analysts’ EBITDA estimates.

"We achieved 14% revenue growth in the fourth quarter with double-digit gains across our optimization, measurement, and publisher businesses," said Lisa Utzschneider, CEO of IAS.

The stock is up 8.8% since reporting and currently trades at $10.50.

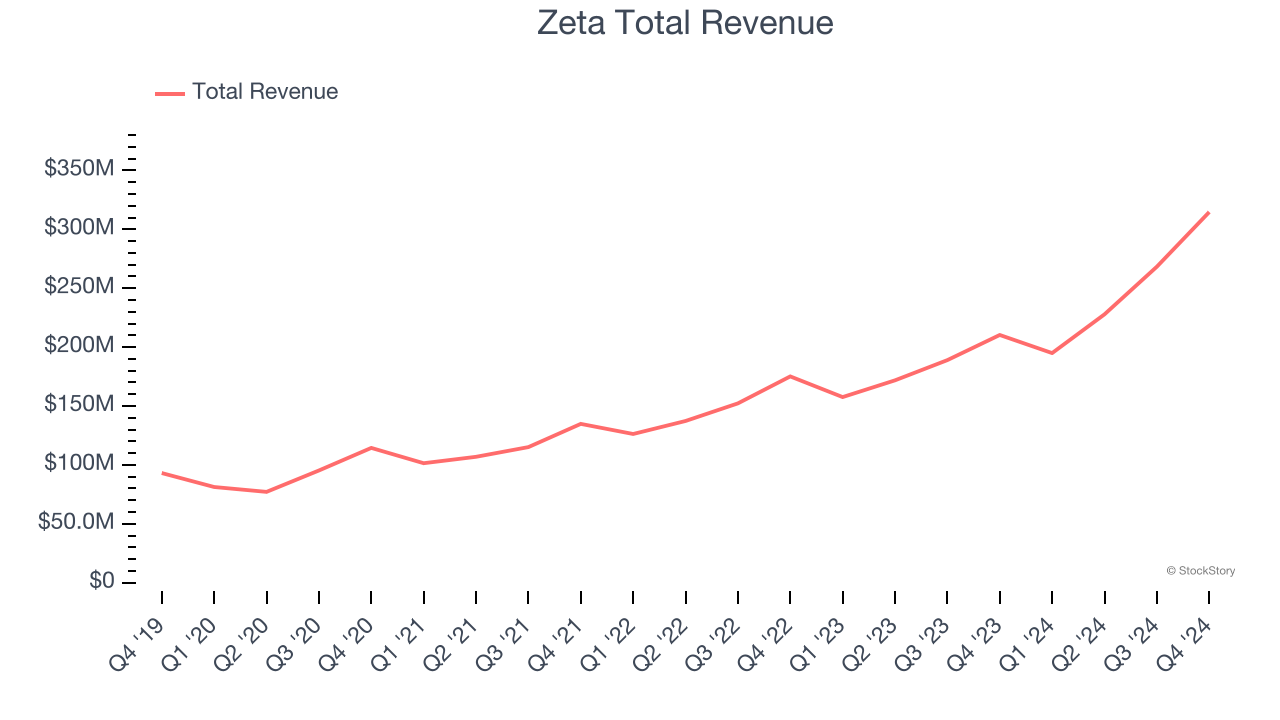

Best Q4: Zeta (NYSE: ZETA)

Co-founded by former Apple CEO John Sculley, Zeta Global (NYSE: ZETA) provides software and data analytics tools that help companies market their products to billions of customers.

Zeta reported revenues of $314.7 million, up 49.6% year on year, outperforming analysts’ expectations by 6.7%. The business had an exceptional quarter with an impressive beat of analysts’ billings estimates and EBITDA guidance for next quarter exceeding analysts’ expectations.

Zeta achieved the fastest revenue growth and highest full-year guidance raise among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 16.4% since reporting. It currently trades at $17.22.

Is now the time to buy Zeta? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: The Trade Desk (NASDAQ: TTD)

Founded by former Microsoft engineers Jeff Green and Dave Pickles, The Trade Desk (NASDAQ: TTD) offers cloud-based software that uses data to help advertisers better plan, place, and target their online ads.

The Trade Desk reported revenues of $741 million, up 22.3% year on year, falling short of analysts’ expectations by 2.3%. It was a disappointing quarter as it posted EBITDA guidance for next quarter missing analysts’ expectations and a significant miss of analysts’ billings estimates.

As expected, the stock is down 44% since the results and currently trades at $68.54.

Read our full analysis of The Trade Desk’s results here.

DoubleVerify (NYSE: DV)

When Oren Netzer saw a digital ad for US-based Target while sitting in his Tel Aviv apartment, he knew there was an unsolved problem, so he started DoubleVerify (NYSE: DV), a provider of advertising solutions to businesses that helps with ad verification, fraud prevention, and brand safety.

DoubleVerify reported revenues of $190.6 million, up 10.7% year on year. This number came in 3% below analysts' expectations. Overall, it was a softer quarter as it also recorded EBITDA guidance for next quarter missing analysts’ expectations.

The stock is down 33.8% since reporting and currently trades at $14.38.

Read our full, actionable report on DoubleVerify here, it’s free.

AppLovin (NASDAQ: APP)

Co-founded by Adam Foroughi, who was frustrated with not being able to find a good solution to market his own dating app, AppLovin (NASDAQ: APP) is both a mobile game studio and provider of marketing and monetization tools for mobile app developers.

AppLovin reported revenues of $1.37 billion, up 44% year on year. This result topped analysts’ expectations by 8.6%. Overall, it was a very strong quarter as it also produced EBITDA guidance for next quarter exceeding analysts’ expectations.

AppLovin scored the biggest analyst estimates beat among its peers. The stock is down 11.7% since reporting and currently trades at $335.92.

Read our full, actionable report on AppLovin here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.