Semiconductor testing company FormFactor (NASDAQ: FORM) will be reporting results this Wednesday afternoon. Here’s what investors should know.

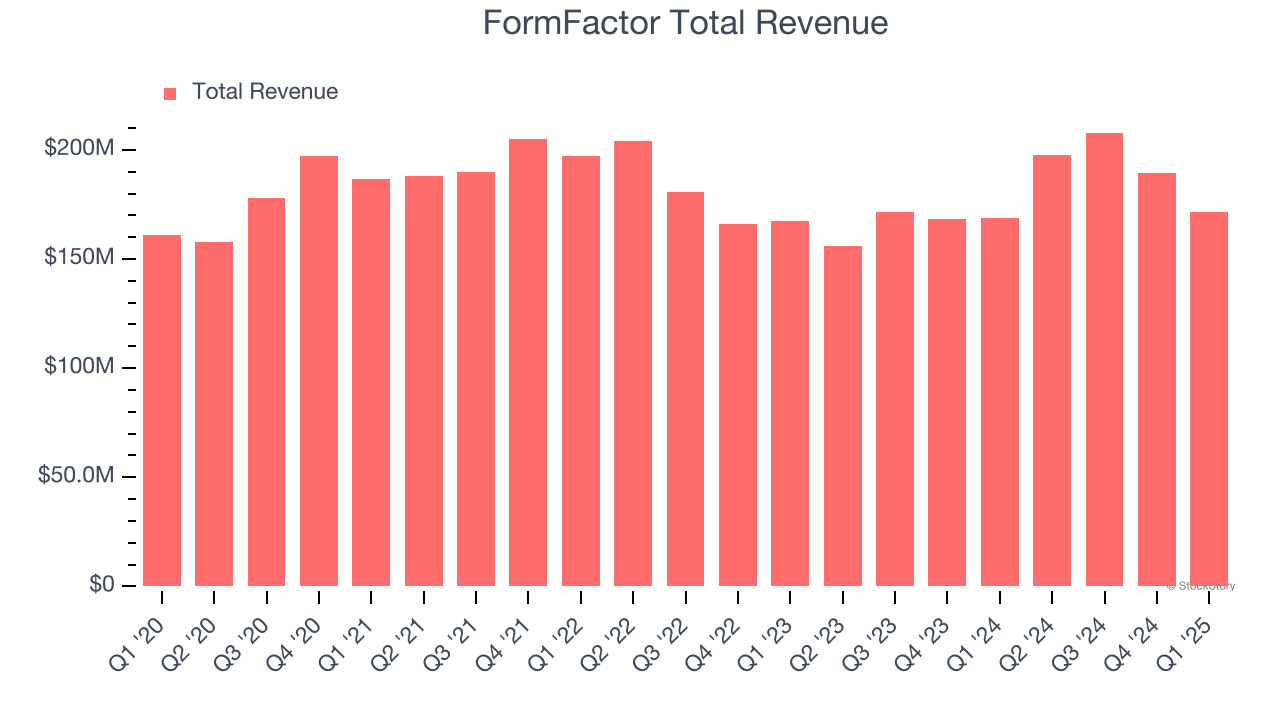

FormFactor beat analysts’ revenue expectations by 0.9% last quarter, reporting revenues of $171.4 million, up 1.6% year on year. It was a strong quarter for the company, with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

Is FormFactor a buy or sell going into earnings? Read our full analysis here, it’s free.

This quarter, analysts are expecting FormFactor’s revenue to decline 4.1% year on year to $189.4 million, a reversal from the 26.7% increase it recorded in the same quarter last year. Adjusted earnings are expected to come in at $0.30 per share.

The majority of analysts covering the company have reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. FormFactor has only missed Wall Street’s revenue estimates once over the last two years, exceeding top-line expectations by 1.5% on average.

Looking at FormFactor’s peers in the semiconductors segment, some have already reported their Q2 results, giving us a hint as to what we can expect. Amkor delivered year-on-year revenue growth of 3.4%, beating analysts’ expectations by 6.3%, and Micron reported revenues up 36.6%, topping estimates by 4.9%. Micron traded down 1.2% following the results.

Read our full analysis of Amkor’s results here and Micron’s results here.

There has been positive sentiment among investors in the semiconductors segment, with share prices up 4.9% on average over the last month. FormFactor is up 2.3% during the same time and is heading into earnings with an average analyst price target of $38.38 (compared to the current share price of $35.20).

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.