SOURCE: Enbridge

DESCRIPTION:

Operational emissions from midstream companies like Enbridge account for a small portion of total GHG emissions across the energy value chain. Our immediate focus is on executing on our plan to reduce Scope 1 and 2 emissions. Yet, we are doing our part to reduce Scope 3 emissions as well.

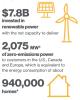

Investment in renewables and lower-carbon infrastructure

Enbridge has been investing in solutions to reduce third-party (Scope 3) emissions for years. Since our initial investment in a single wind farm in 2002, we’ve committed more than $7.8 billion in renewable energy and power transmission projects. Today we have net renewable energy capacity—either operating or under construction—of 2,075 MW of zero-emission energy.

We continue to pursue further investment in renewable projects to expand our portfolio of projects in North America and Europe. As we evaluate these investment opportunities, we continue to work with partners, including the Canada Pension Plan Investment Board and large European energy companies.

We have three utility-scale offshore wind projects under construction off the coast of France, and we are in late- stage development of additional offshore wind projects in Europe. Currently we have three in operation—one in the UK and two located in Germany.

We believe that RNG—which is produced by turning decomposing organic waste into pipeline-quality methane—provides a cost-effective way to decarbonize sectors like heavy transport. We have six projects either operating or under construction today, including a project supplying the City of Toronto with carbon negative RNG to fuel garbage trucks and several more in the works with municipalities interested in using RNG for buses.

In 2020, Enbridge Gas celebrated the groundbreaking of Ontario’s largest RNG plant in Niagara Falls, and just weeks later announced an investment in a first-of-its-kind RNG project in Alberta that uses a unique technology called thermal hydrolysis to process agricultural and livestock farming waste. We have also recently announced RNG projects across Canada with Walker Industries and Comcor Environmental.

We are an early investor and a big believer in hydrogen. Our natural gas infrastructure will be critical to the development of a hydrogen economy in North America. We’ve built expertise by building and operating Canada’s first utility-scale power-to-gas plant. This 2.5-MW green hydrogen energy storage project (expandable to 5 MW) helps balance the provincial electricity grid. We recently received regulatory approval to undertake a pilot project in Markham, ON, to blend hydrogen into select portions of the local natural gas distribution network. This is the first project of its kind in North America and it starts to illustrate how existing assets are critical components of future energy systems.

In Quebec, we’re developing a renewable energy ecosystem based on green hydrogen.1 And, since we move about 20% of the natural gas consumed in the U.S., we’re actively exploring how much hydrogen can be blended into our natural gas transmission and distribution system.

In total, and inclusive of projects under construction, Enbridge currently has 23 wind assets, seven solar energy sites, five waste heat recovery facilities, one hydro facility, one geothermal facility, six renewable natural gas (RNG) facilities, three compressed natural gas (CNG) fueling stations2 and one green power-to-gas hydrogen facility.

Scope 3 metrics

Enbridge currently tracks and reports on the following Scope 3 data: utility customer natural gas use, employee air travel and electricity grid loss. Despite limited guidance defining Scope 3 parameters for the midstream sector, Enbridge is committed to tracking and reporting Scope 3 emissions. To that end, we’ve developed a new metric designed to measure the emissions intensity of the energy we deliver.

- Emissions intensity of the energy we deliver—

This metric—a response to a growing desire to differentiate energy products on the basis of their lifecycle emissions—measures the upstream emissions intensity of the energy that Enbridge delivers on behalf of its customers.The graph at right shows a slight decrease in the emissions intensity of the energy we delivered between 2018 and 2020. Over time, this metric will reflect both emissions reductions achieved by our customers and how further diversification of our business impacts our emissions profile. Our supplemental measurement methodology can be found in the Appendix, page 62.

We have also developed a metric to illustrate how Enbridge’s low-carbon investments help to reduce third-party emissions.

- Enbridge’s contribution to avoidance of third-party emissions—

This metric recognizes how Enbridge’s investments in RNG, Demand Side Management (DSM) and renewable energy help to advance the energy transition.The chart to the right illustrates that our investments have avoided more than 2 million tCO2e per year since 2018. Our supplemental measurement methodology can be found in the Appendix, page 62.

1 Green hydrogen is generated by renewable energy sources without producing carbon emissions.

2 Enbridge also has CNG fueling stations at many of its offices/depots and a CNG rental program for customers.

Read Enbridge's full 2020 Sustainability Report

KEYWORDS: NYSE: ENB, Enbridge, Scope 3 emissions

![]()