Valued at a market cap of $4 trillion, Microsoft Corporation (MSFT) is a global technology leader that develops, licenses, and supports a wide range of software products, cloud services, and hardware devices. The Redmond, Washington-based company is best known for its products like Windows, Microsoft 365, Azure, LinkedIn, and Xbox.

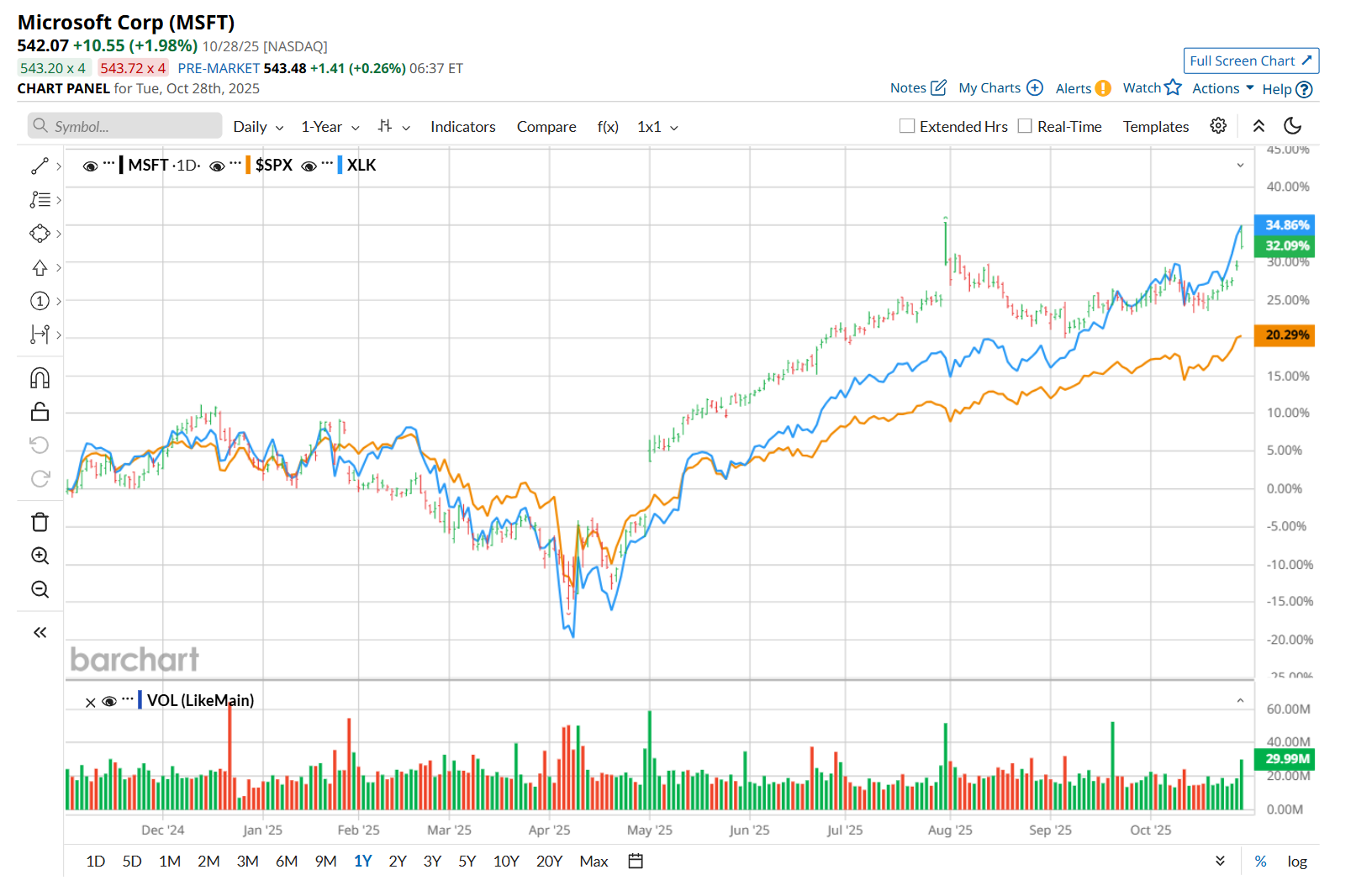

Shares of this software giant have outpaced the broader market over the past 52 weeks. Microsoft has rallied 25.4% over this time frame, while the broader S&P 500 Index ($SPX) has gained 18.1%. Moreover, on a YTD basis, the stock is up 28.5%, compared to SPX’s 17.2% uptick.

However, narrowing the focus, Microsoft has underperformed the Technology Select Sector SPDR Fund’s (XLK) 30.4% return over the past 52 weeks and 30.8% rise on a YTD basis.

On Oct. 29, Microsoft delivered better-than-expected Q1 results. The company’s overall revenue improved 18.4% year-over-year to $77.7 billion, beating consensus estimates by 3.6%. Moreover, its adjusted EPS of $4.13 advanced 22.6% from the year-ago quarter and came in 13.2% ahead of analyst expectations. Strong growth in revenue and operating income across all three of its reportable segments supported its strong performance.

For fiscal 2026, ending in June, analysts expect Microsoft’s EPS to grow 12.9% year over year to $15.40. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

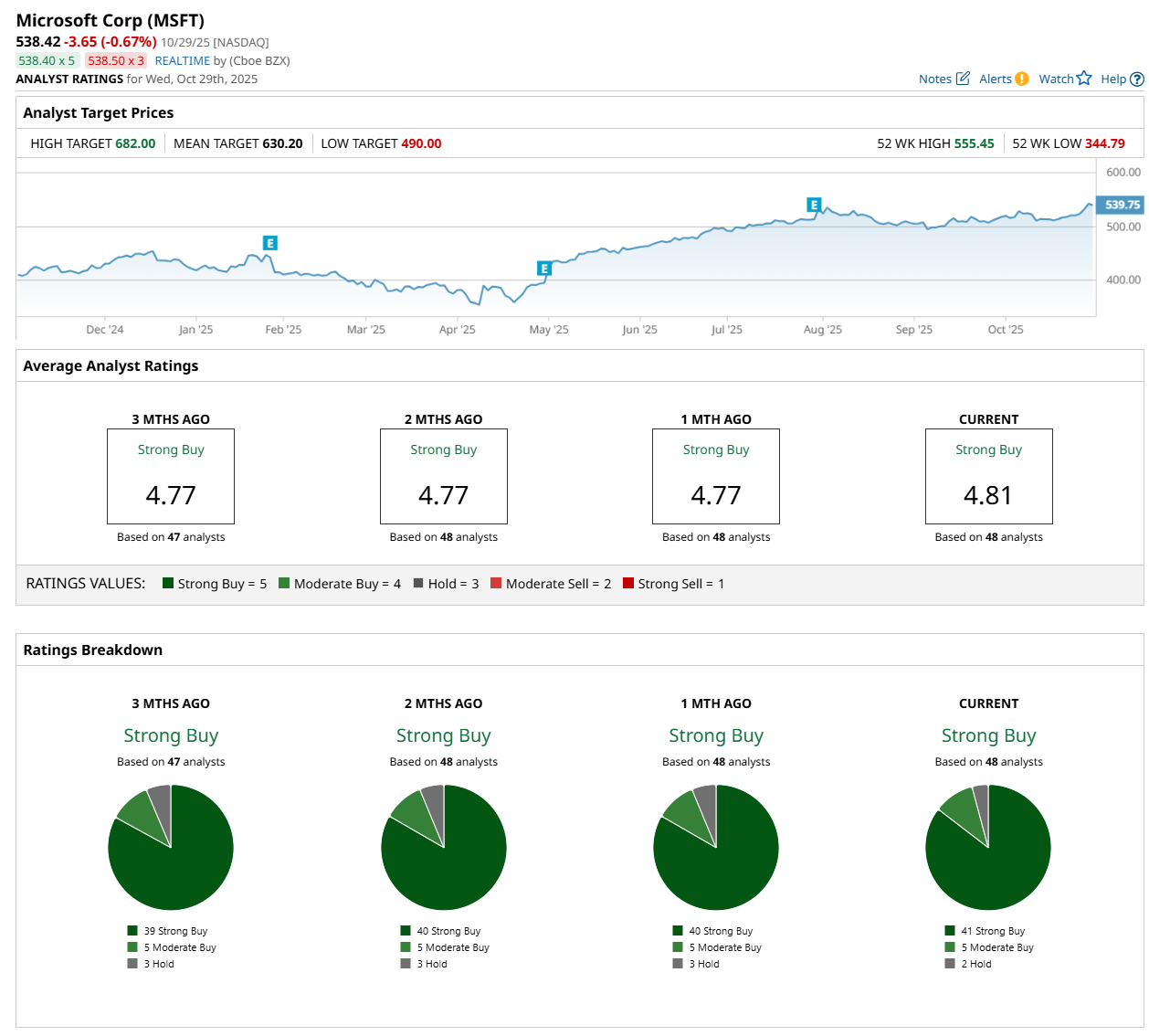

Among the 48 analysts covering the stock, the consensus rating is a "Strong Buy”, which is based on 41 “Strong Buy,” five "Moderate Buy," and two “Hold” ratings.

This configuration is more bullish than a month ago, with 40 analysts suggesting a “Strong Buy” rating.

On Oct. 28, Mizuho Financial Group, Inc. (MFG) analyst Gregg Moskowitz maintained a "Buy" rating on Microsoft and set a price target of $640, implying an 18.9% potential upside from the current levels.

The mean price target of $630.20 represents a 17% premium from MSFT’s current price levels, while the Street-high price target of $682 suggests an upside potential of 26.7%.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart