Valued at a market cap of $67.7 billion, Monster Beverage Corporation (MNST) is a leading U.S. beverage company best known for its Monster Energy brand, which is one of the top global energy drink franchises. The company develops, markets, and distributes energy drinks and alternative beverages, including Monster Energy, Reign, NOS, Full Throttle, and several lifestyle and performance-focused drink lines.

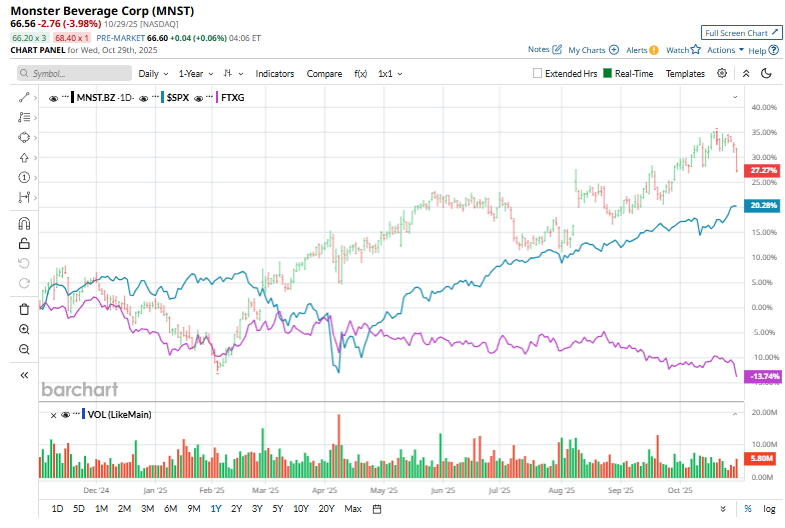

Shares of the energy-drink leader have surged past the broader market over the past 52 weeks. MNST stock has rallied 26.8% over this time frame, while the broader S&P 500 Index ($SPX) has gained 18.1%. Year-to-date, the stock is up 26.6%, again topping the S&P 500’s 17.2% return.

The strength becomes even more evident when compared to the First Trust Nasdaq Food & Beverage ETF’s (FTXG) 14.9% downtick over the past 52 weeks and 9.5% loss on a YTD basis.

On Aug. 7, Monster released its Q2 2025 earnings, and its shares climbed 6.4% in the next trading session. Net sales rose 11.1% year over year to $2.11 billion, while adjusted EPS improved 23% to $0.52, topping estimates. Additionally, gross margin improved to 55.7% from 53.6%, underscoring operational strength and pricing power.

For the current fiscal year, ending in December, analysts expect MNST’s EPS to grow 17.9% year over year to $1.91. The company’s earnings surprise history is mixed. It missed the consensus estimates in two of the last four quarters, while surpassing on two other occasions.

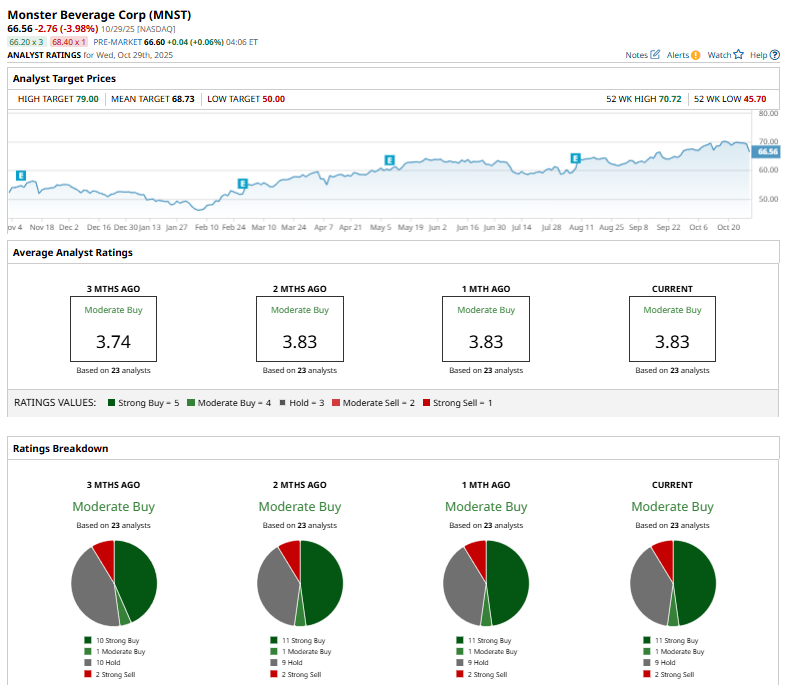

Among the 23 analysts covering the stock, the consensus rating is a “Moderate Buy” which is based on 11 “Strong Buy,” one "Moderate Buy,” nine “Hold,” and two "Strong Sell” ratings.

This configuration is slightly more bullish than three months ago, with 10 analysts suggesting a “Strong Buy” rating.

On Oct. 9, Bank of America Corporation’s (BAC) Peter Galbo reiterated a “Buy” rating on Monster Beverage and kept a $75 price target.

The mean price target of $68.73 represents a 3.3% premium from MNST’s current price levels, while the Street-high price target of $79 suggests an upside potential of 18.7%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- It's 'Going to Be Like a Shockwave' When Tesla's AI Innovations Hit. Should You Buy TSLA Stock First?

- Adobe Systems Bear Put Spread Could Return 233% in this Down Move

- Stocks Muted Before the Open After Mixed Big Tech Earnings, Trump-Xi Summit

- Dear Apple Stock Fans, Mark Your Calendars for October 30