JPMorgan Chase & Co. (JPM) provides financial and retail banking services. Valued at $850.9 billion by market cap, the company provides services such as investment banking, treasury and securities, asset management, private banking, card member, commercial banking, and home finance.

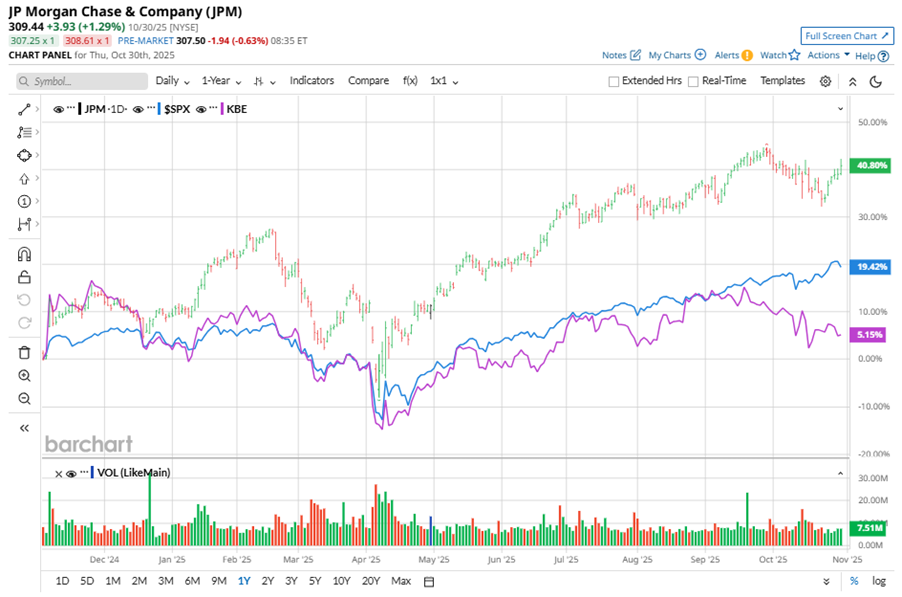

Shares of this investment banking leader have outperformed the broader market over the past year. JPM has gained 37.9% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 17.4%. In 2025, JPM’s stock rose 29.1%, surpassing the SPX’s 16% rise on a YTD basis.

Zooming in further, JPM’s outperformance looks more pronounced compared to the SPDR S&P Bank ETF (KBE). The exchange-traded fund has gained about 2% over the past year. Moreover, JPM’s double-digit gains on a YTD basis outshine the ETF’s 2% returns over the same time frame.

JPMorgan's stellar performance was driven by robust growth across its business segments. Net interest income rose 2% to $24.1 billion, while investment banking fees jumped 16%. The Markets segment notched its best Q3 ever with $8.9 billion in revenue, and Asset & Wealth Management reached a record $6.1 billion, up 11.5%.

On Oct. 14, JPM shares closed down by 1.9% after reporting its Q3 results. Its net revenue stood at $46.4 billion, up 8.8% year over year. The company’s EPS increased 16% from the prior-year quarter to $5.07.

For the current fiscal year, ending in December, analysts expect JPM’s EPS to grow 9.4% to $19.92 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

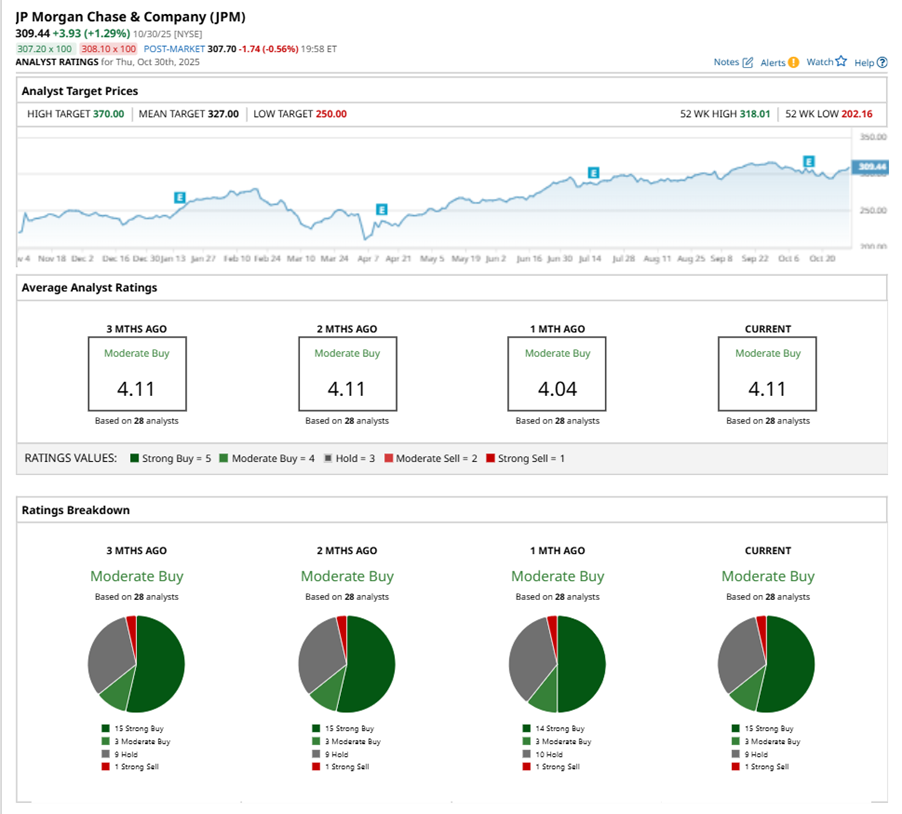

Among the 28 analysts covering JPM stock, the consensus is a “Moderate Buy.” That’s based on 15 “Strong Buy” ratings, three “Moderate Buys,” nine “Holds,” and one “Strong Sell.”

This configuration is more bullish than a month ago, with 14 analysts suggesting a “Strong Buy.”

On Oct. 15, Morgan Stanley (MS) kept an “Equal Weight” rating on JPM and raised the price target to $338, implying a potential upside of 9.2% from current levels.

The mean price target of $327 represents a 5.7% premium to JPM’s current price levels. The Street-high price target of $370 suggests an upside potential of 19.6%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart