With a market cap of $201.1 billion, The Walt Disney Company (DIS) is a global entertainment leader with diversified operations across film, television, streaming, publishing, and theme parks. Disney continues to evolve its business structure to align with the rapidly changing media landscape.

Shares of the Burbank, California-based company have slightly lagged behind the broader market over the past 52 weeks. DIS stock has returned 17.7% over this time frame, while the broader S&P 500 Index ($SPX) has increased 17.9%. In addition, shares of the company are up marginally on a YTD basis, compared to SPX’s 16.6% rise.

Moreover, shares of the entertainment company have underperformed the Communication Services Select Sector SPDR ETF Fund’s (XLC) 23.4% surge over the past 52 weeks.

Despite Disney’s better-than-expected Q3 2025 adjusted EPS of $1.61, shares fell 2.7% on Aug. 6 because revenue missed forecasts at $23.65 billion. Investors were disappointed by a $179 million decline in Entertainment segment operating income and a $269 million drop in Linear Networks, signaling ongoing pressure in traditional media.

For the fiscal year that ended in September 2025, analysts expect DIS' adjusted EPS to grow 18.1% year-over-year to $5.87. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

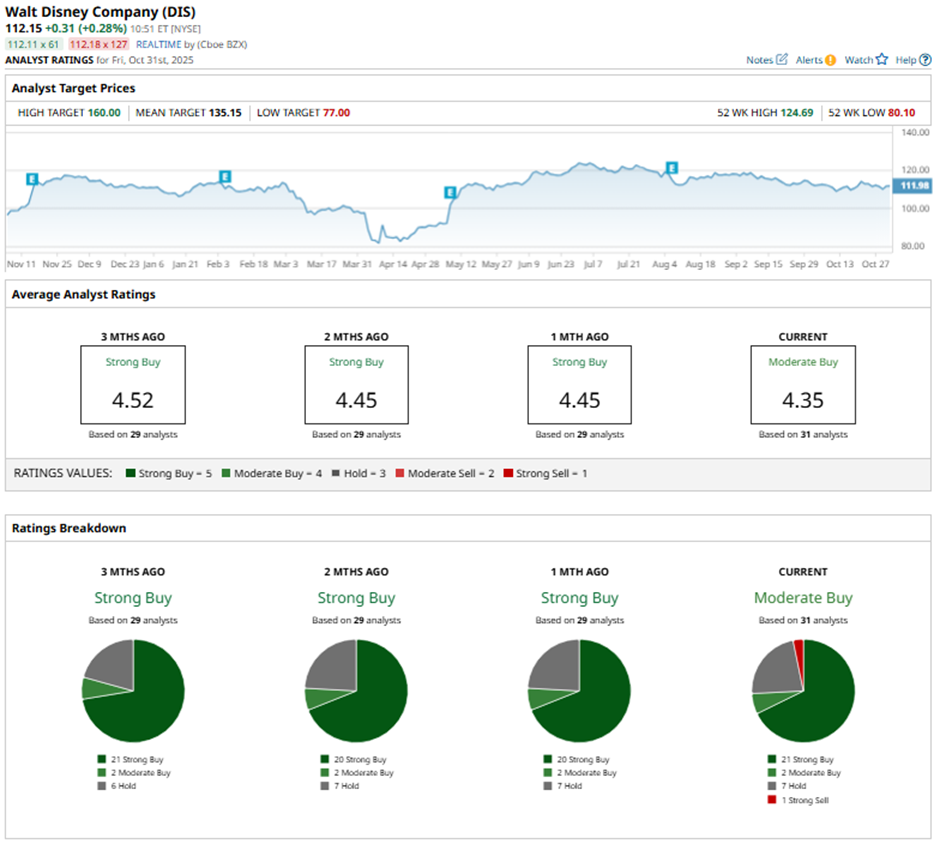

Among the 31 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 21 “Strong Buy” ratings, two “Moderate Buys,” seven “Holds,” and one “Strong Sell.”

On Jul. 29, JPMorgan analyst David Karnovsky raised Disney’s price target to $138 and maintained an “Overweight” rating.

The mean price target of $135.15, representing a premium of 20.5% to DIS' current price. The Street-high price target of $160 suggests a 42.7% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Tesla’s New Focus Isn’t on Cars, But on ‘Sustainable Abundance.’ What Does That Mean for TSLA Stock and Buy-and-Hold Investors?

- Amazon's Revenue Beat Surprises Analysts and Its Cash Flow Surges (Not FCF) - AMZN Stock Could Still Be Undervalued

- As Apple Turns the Corner With the iPhone 17, Should You Buy AAPL Stock for 2026?

- This Stock Lets You Profit from Building the Power Grid