Boasting a market cap of $408.9 billion, Costco Wholesale Corporation (COST) is a leading global membership-based warehouse retail chain known for its bulk-buying model, competitive pricing, and limited-selection high-value merchandise. Founded in 1983 and headquartered in Issaquah, Washington, Costco operates large warehouse clubs offering everything from groceries, household essentials, apparel, and electronics to travel services, optical care, and fuel stations.

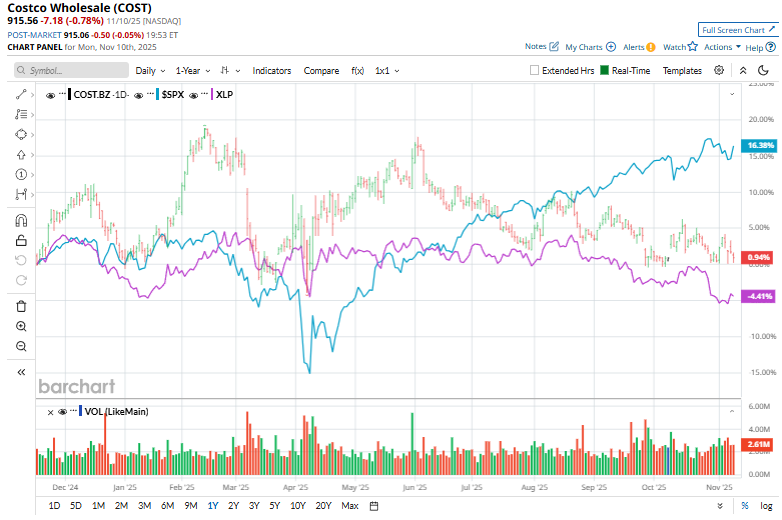

The discount retailer has lagged behind the broader market over the past year. COST stock has slumped 3% over the past 52 weeks and marginally on a YTD basis, compared to the S&P 500 Index’s ($SPX) 14% surge over the past year and 16.2% returns in 2025.

Additionally, Costco has trailed the sector-focused Consumer Staples Select Sector SPDR Fund’s (XLP) 5.4% uptick over the past 52 weeks and 2.8% gains on a YTD basis.

On Sept. 25, Costco delivered its Q4 2025 earnings, and its shares dipped 2.9% in the next trading session. Its revenue surged 8% year over year to $86.2 billion, and EPS stood at $5.87, both slightly above expectations. Comparable sales grew around 5.7%, coming in just shy of forecasts, while e-commerce remained a standout with double-digit gains and membership fee income jumped more than 14% thanks to growth in executive memberships and new perks. Despite solid execution and continued consumer demand for value, shares traded lower as investors reacted to the modest comp-sales miss and Costco’s rich valuation.

For the current fiscal year 2026, ending in August, analysts expect Costco to deliver an EPS of $19.97, up 11% year over year. The company has a mixed earnings surprise history. While it surpassed the Street’s bottom-line estimates thrice over the past four quarters, it missed the estimates on one other occasion.

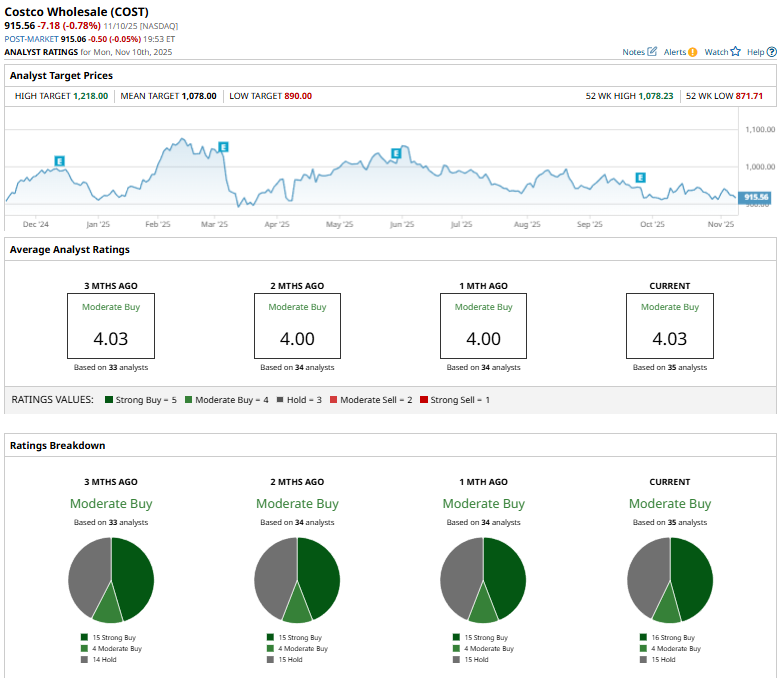

Costco has a consensus “Moderate Buy” rating overall. Of the 35 analysts covering the stock, opinions include 16 “Strong Buys,” four “Moderate Buys,” and 15 “Holds.”

This configuration is more bullish than it was a month ago, when 15 analysts issued “Strong Buy” recommendations.

On October 11, Bank of America Securities analyst Robert Ohmes reiterated a “Buy” rating on Costco.

Costco’s mean price target of $1,078 represents a 17.7% upside potential. Meanwhile, the street-high target of $1,218 suggests a notable 33% premium to current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart