Valued at a market cap of $37.2 billion, eBay Inc. (EBAY) is an e-commerce company that operates one of the world’s largest marketplaces connecting millions of buyers and sellers across more than 190 markets. The San Jose, California-based company enables its users to list, buy, and sell a wide variety of products, including new, used, unique, and collectible items.

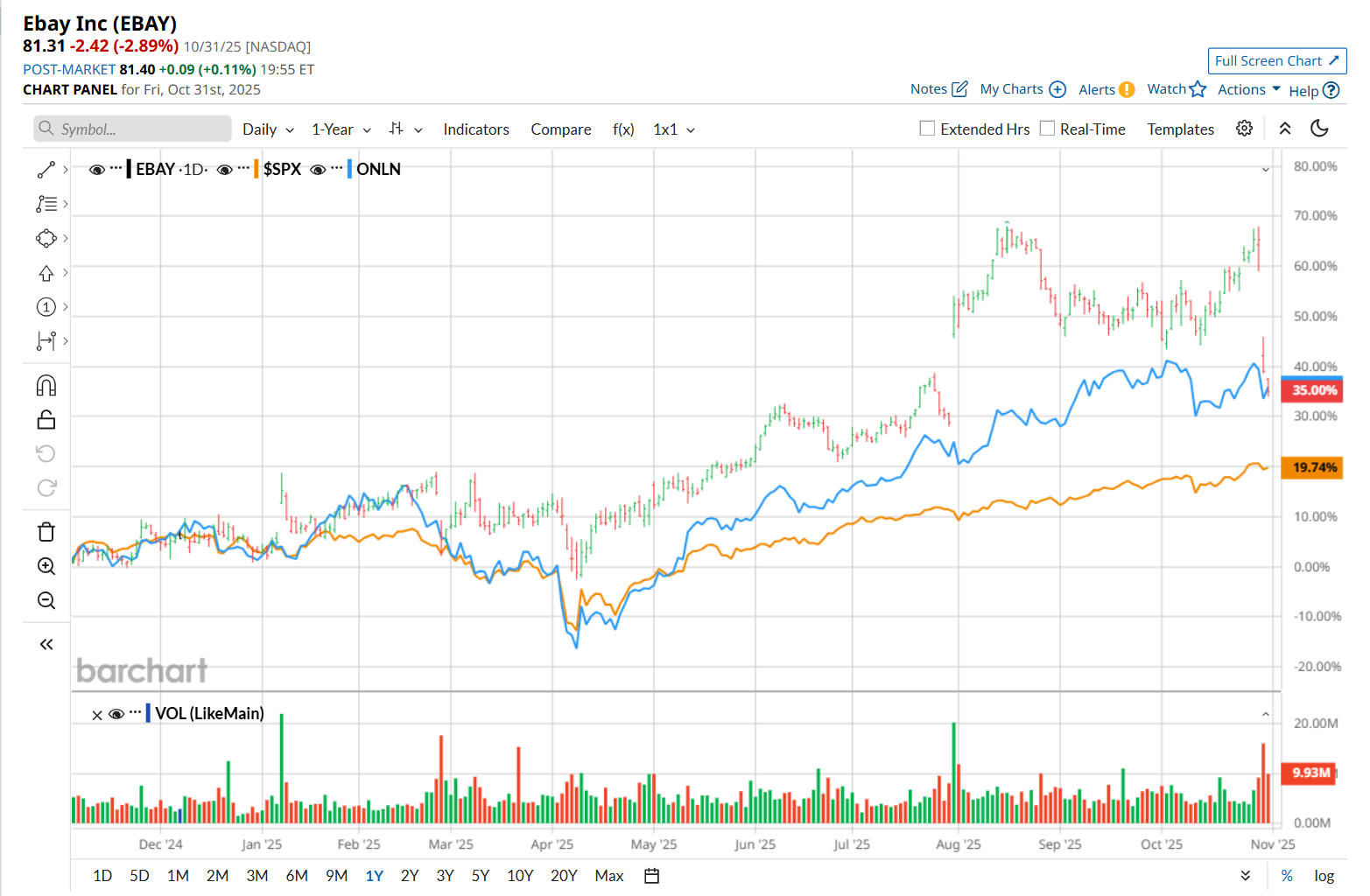

This e-commerce company has outperformed the broader market over the past 52 weeks. Shares of EBAY have surged 29.8% over this time frame, while the broader S&P 500 Index ($SPX) has gained 17.7%. Moreover, on a YTD basis, the stock is up 31.3%, compared to SPX’s 16.3% rise.

However, narrowing the focus, EBAY has lagged behind the ProShares Online Retail ETF’s (ONLN) 36.7% return over the past 52 weeks and 34.1% surge on a YTD basis.

EBAY delivered better-than-expected Q3 earnings results on Oct. 29. Overall, the company’s revenue improved 9.5% year-over-year to $2.8 billion, surpassing consensus estimates by 2.9%. Moreover, its adjusted EPS of $1.36 increased 14.3% from the year-ago quarter, topping analyst expectations by 2.3%. However, despite these positives, its shares crashed 15.9% in the following trading session as investors focused on its weaker-than-expected Q4 profit outlook, fueling concerns amid persistent macroeconomic uncertainty. Additionally, EBAY’s total number of active buyers remained flat year over year, underscoring its continued struggle to attract new users.

For the current fiscal year, ending in December, analysts expect EBAY’s EPS to grow 12.5% year over year to $4.42. The company’s earnings surprise history is promising. It exceeded or met the consensus estimates in each of the last four quarters.

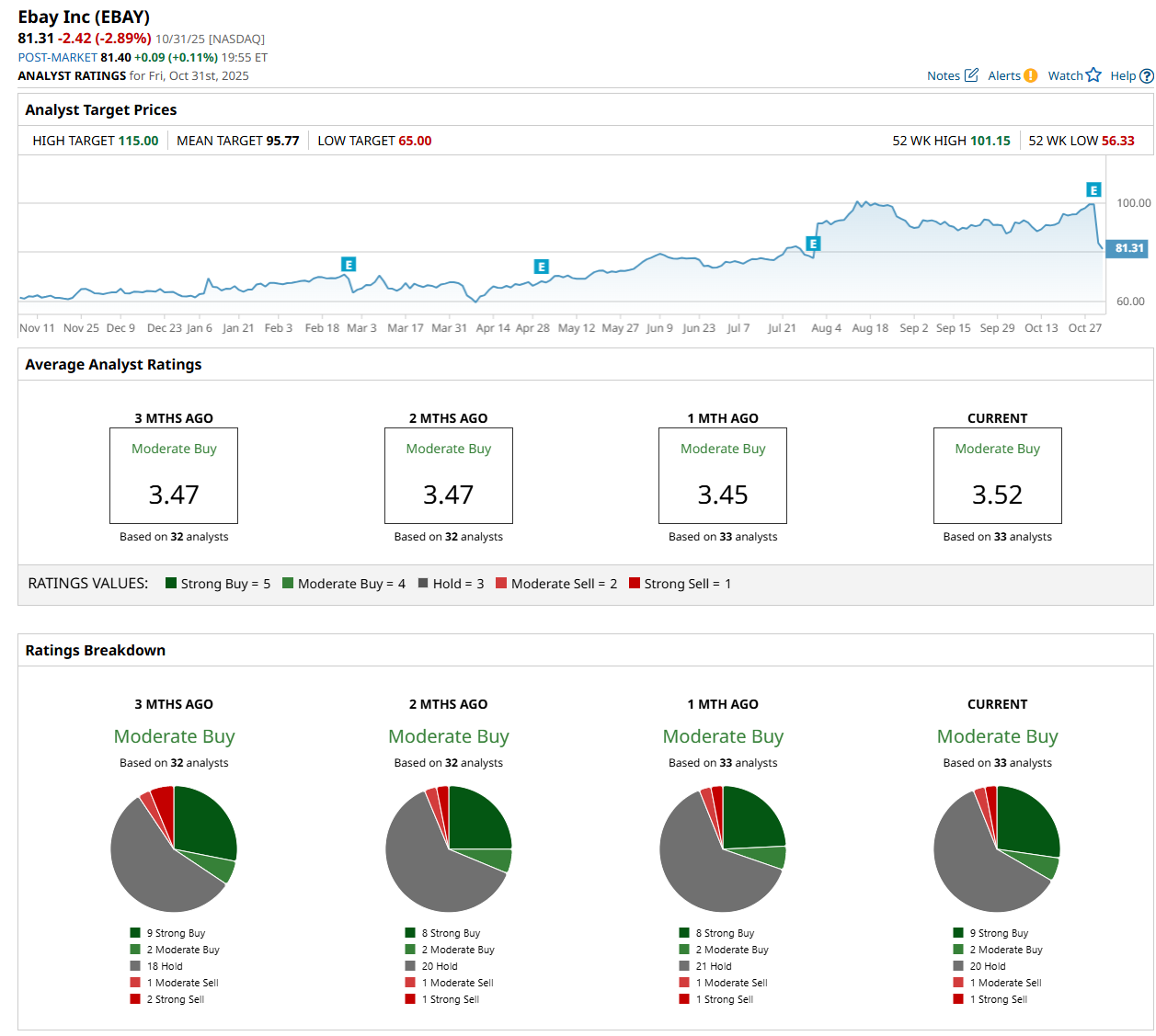

Among the 33 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on nine “Strong Buy,” two “Moderate Buy,” 20 "Hold,” one “Moderate Sell,” and one "Strong Sell” rating.

This configuration is slightly more bullish than a month ago, with eight analysts suggesting a “Strong Buy” rating.

On Oct. 30, Wedbush maintained a "Hold” rating on EBAY, with a price target of $90, implying a 10.7% potential upside from the current levels.

The mean price target of $95.77 represents a 17.8% premium from EBAY’s current price levels, while the Street-high price target of $115 suggests an ambitious upside potential of 41.4%.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- ‘Painful But Necessary’ Job Cuts at Target Support Buying the High-Yield Dividend Stock Here

- The Saturday Spread: Exploiting the Information Arbitrage That No One is Talking About

- The Only 3 Dividend Kings You’ll Ever Need for a Lifetime of Income

- This Pair of New 2X ETFs Goes Double or Nothing on Big Tech. Should You Chase the Volatility in Apple, Nvidia, and Microsoft Now?