Equifax Inc. (EFX) is a global leader in data, analytics, and technology, operating in consumer credit reporting and other information management solutions. Based in Atlanta, Georgia, the company serves clients in several countries.

Equifax delivers credit reporting, fraud detection, and risk management services to organizations worldwide. Their extensive operational reach supports financial institutions, employers, and regulatory agencies in making informed decisions. The company has a market capitalization of $25.03 billion.

The company’s stock has come under pressure after credit scoring company Fair Isaac Corporation (FICO) announced plans to sell its credit scores directly to mortgage lenders and resellers. Thereby, cutting out credit bureaus like Equifax.

Over the past 52 weeks, the stock has dropped 15.8%, while it has been down 26.5% over the past six months. The stock has reached a 52-week high of $281.07 in January, but is down 26.6% from that level.

On the other hand, the broader S&P 500 Index ($SPX) has gained 12.3% and 11.4% over the same periods, respectively, indicating that the stock has underperformed the broader market. The same trend can be observed when comparing the consulting services stock’s performance with that of the industrial sector. The Industrial Select Sector SPDR Fund (XLI) has gained 8.3% over the past 52 weeks and 4.2% over the past six months.

On Oct. 21, Equifax reported third-quarter results for fiscal 2025 that beat expectations. The company’s total operating revenue increased 7% year-over-year (YOY) to $1.54 billion, surpassing the $1.52 billion that Wall Street analysts had expected. This was primarily predicated upon revenues from U.S. information solutions growing by 11% from the prior year’s period. Equifax’s adjusted EPS was $2.04, up 10% YOY and higher than the $1.93 that Street analysts had expected.

Recently, the company completed the acquisition of human resources services provider Vault Verify. The purchase is projected to bolster the data that Equifax provides to verifiers.

For the fiscal year 2025, which ends in December 2025, Wall Street analysts expect Equifax’s EPS to grow 4.4% YOY to $7.61 on a diluted basis. Moreover, EPS is expected to increase 16.2% annually to $8.84 in fiscal 2026. The company has a solid history of surpassing consensus estimates, topping them in all four trailing quarters.

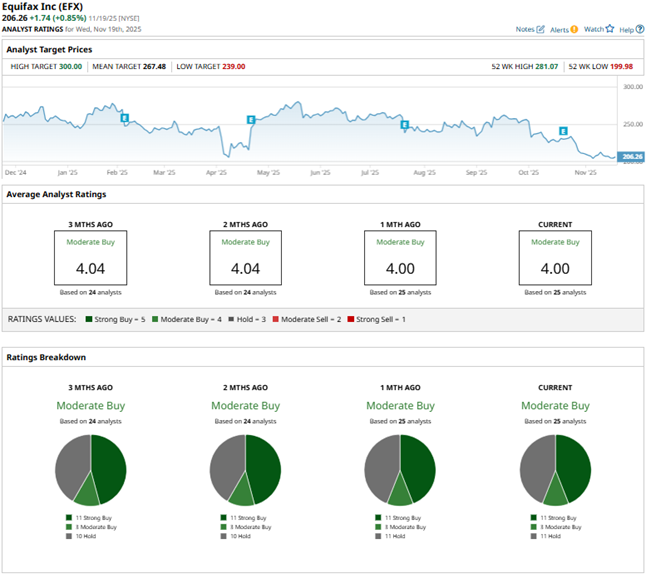

Among the 25 Wall Street analysts covering Equifax’s stock, the consensus is a “Moderate Buy.” That’s based on 11 “Strong Buy” ratings, three “Moderate Buys,” and 11 “Holds.” The ratings configuration has remained relatively similar over the past three months.

Last month, analysts at Stifel maintained a “Buy” rating on Equifax’s stock. However, Stifel analysts also reduced the price target from $295 to $253, citing slower-than-expected margin expansion in the third quarter.

Equifax’s mean price target of $267.48 indicates a 29.7% upside over current market prices. The Street-high price target of $300 implies a potential upside of 45.4%.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Burry Calls ‘Fraud’ on Hyperscalers: 4 Pins Set to Pop the AI Bubble and the ‘Big Short’ Math on Big Tech

- The Dow Jones Looks Ready for Death, But These 3 Blue-Chip Stocks Have More Life (and Gains) Ahead

- Jensen Huang Says ‘Blackwell Sales Are Off the Charts, and Cloud GPUs Are Sold Out’ as Nvidia Crushes Q3 Earnings and Beats Analyst Expectations

- Stocks Rally Before the Open on Upbeat Nvidia Earnings, U.S. Jobs Report in Focus