Nvidia (NVDA) shares are trading in green this morning after the company said its GPUs are “a generation ahead” of Google’s (GOOGL) tensor processing units (TPUs).

The remarks arrive on the heels of media reports that Meta Platforms (META) is considering switching to Alphabet’s custom AI chips to power its data centers by 2027.

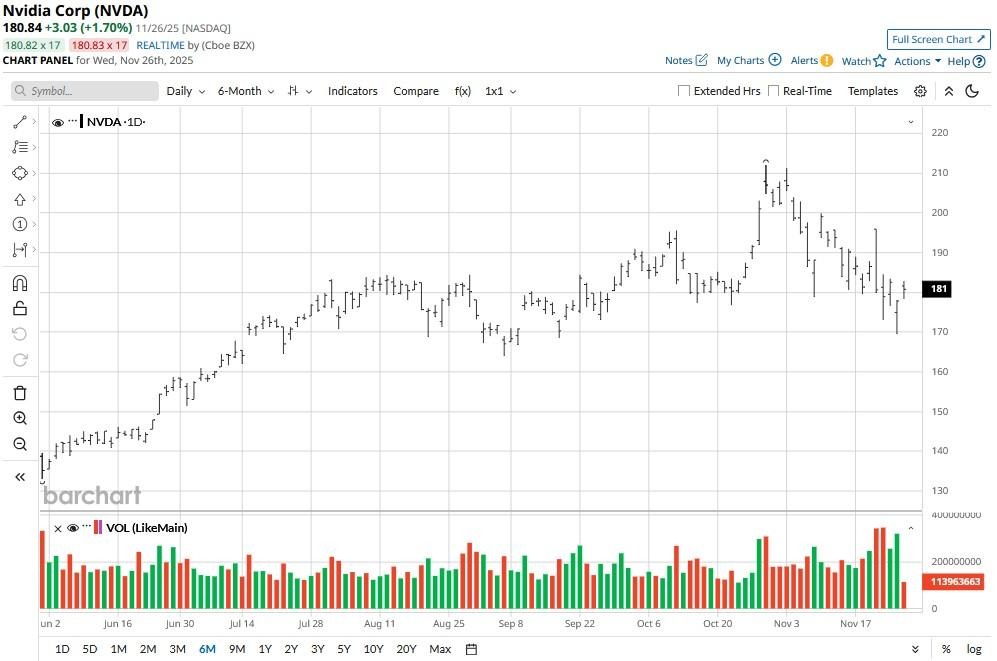

Despite today’s gain, Nvidia stock is down some 15% versus its year-to-date high set in late October.

Does Nvidia’s Reassurance Warrant Buying Nvidia Stock?

NVDA shares are inching higher today because the company’s comment reinforces the titan’s dominance in the AI chips market.

It feeds right into industry expert Gene Musnter’s view that a rival designing a better chip than Nvidia “is not even in the equation” for another year or two.

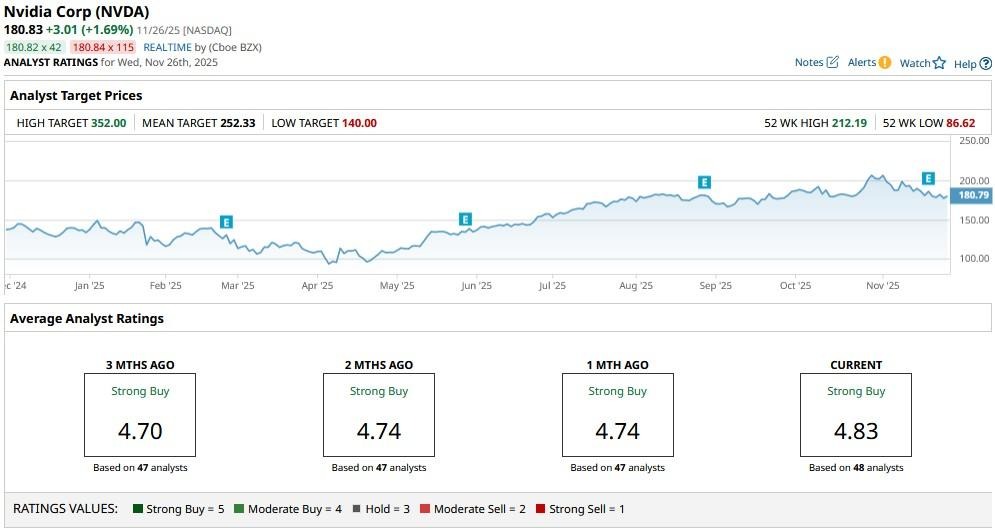

The remarks also made Bernstein reiterate its “Outperform” rating on the AI stock on Nov. 26, saying “data center opportunity is enormous, and still early, with material upside still possible.”

Stacy Rasgon – the firm’s senior analyst – has a $275 price target on Nvidia stock, which indicates potential upside of a whopping 50% from current levels.

Backlog Strength Warrants Owning NVDA Shares

Nvidia shares are worth owning also because Jensen Huang downplayed AI bubble concern on the earnings call last week, saying “we see something very different.”

The artificial intelligence stock looks headed to challenge its 50-day moving average (MA) at the $186 level on Wednesday.

A break above this price could further accelerate upward momentum in the near-term, which looks likely given options data is currently pointing to a rally past $200 by late February.

Investors should also note that NVDA has already booked about half a trillion dollars’ worth of AI chip orders. In terms of revenue visibility, it’s really as good as it gets.

Nvidia Remains a Wall Street Favorite Heading into 2026

Wall Street more broadly continues to see NVDA stock as a core long-term holding as well.

The consensus rating on Nvidia shares remains at “Strong Buy” with the mean target of about $252 indicating potential upside of another 40% through the end of 2026.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Marvell Stock Is Down 25% in 2025, and This Analyst Says Investors Should Stay Away from the MRVL Dip

- These Stock Charts Filter Out the Noise So You Can Focus on Price. Here’s What Trend Traders Need to Know.

- Cathie Wood Is Buying the Dip in BitMine Immersion Stock. Should You?

- Google Is Getting the AI Spotlight, But Nvidia Says Its GPUs Are a ‘Generation Ahead.’ How Should You Play NVDA Stock Here?