It’s another big week on the earning front with all eyes on some big tech names. This week we have Palantir Technologies (PLTR), Advanced Micro Devices (AMD), Robinhood Markets (HOOD), Uber Technologies (UBER), Qualcomm (QCOM), Applovin (APP), Shopify (SHOP), Arm Holdings (ARM), Arista Networks (ANET) and DataDog (DDOG) all reporting in what shapes as a busy and pivotal week for stocks.

Before a company reports earnings, implied volatility is usually high because the market is unsure about the outcome of the report. Speculators and hedgers create huge demand for the company’s options which increases the implied volatility, and therefore, the price of options.

After the earnings announcement, implied volatility usually drops back down to normal levels.

Let’s take a look at the expected range for these stocks. To calculate the expected range, look up the option chain and add together the price of the at-the-money put option and the at-the-money call option. Use the first expiry date after the earnings date. While this approach is not as accurate as a detailed calculation, it does serve as a reasonably accurate estimate.

Monday

PLTR – 10.4%

Tuesday

AMD – 9.0%

UBER – 7.4%

PFE – 5.1%

SHOP – 11.2%

ANET – 10.8%

BP – 4.4%

AMGN – 4.3%

Wednesday

HOOD – 10.2%

QCOM – 6.8%

NVO – 8.8%

APP – 14.0%

ARM – 10.7%

MCD – 3.5%

FTNT – 9.9%

Thursday

WBD – 4.5%

XYZ – 11.3%

DDOG – 9.6%

ABNB – 8.3%

VST – 8.9%

COP – 3.9%

PBR – 3.6%

Friday

Nothing of note

Option traders can use these expected moves to structure trades. Bearish traders can look at selling bear call spreads outside the expected range.

Bullish traders can sell bull put spreads outside the expected range, or look at naked puts for those with a higher risk tolerance.

Neutral traders can look at iron condors. When trading iron condors over earnings, it is best to keep the short strikes outside the expected range.

When trading options over earnings, it is best to stick to risk defined strategies and keep position size small. If the stock makes a larger than expected move and the trade suffers a full loss, it should not have more than a 1-3% effect on your portfolio.

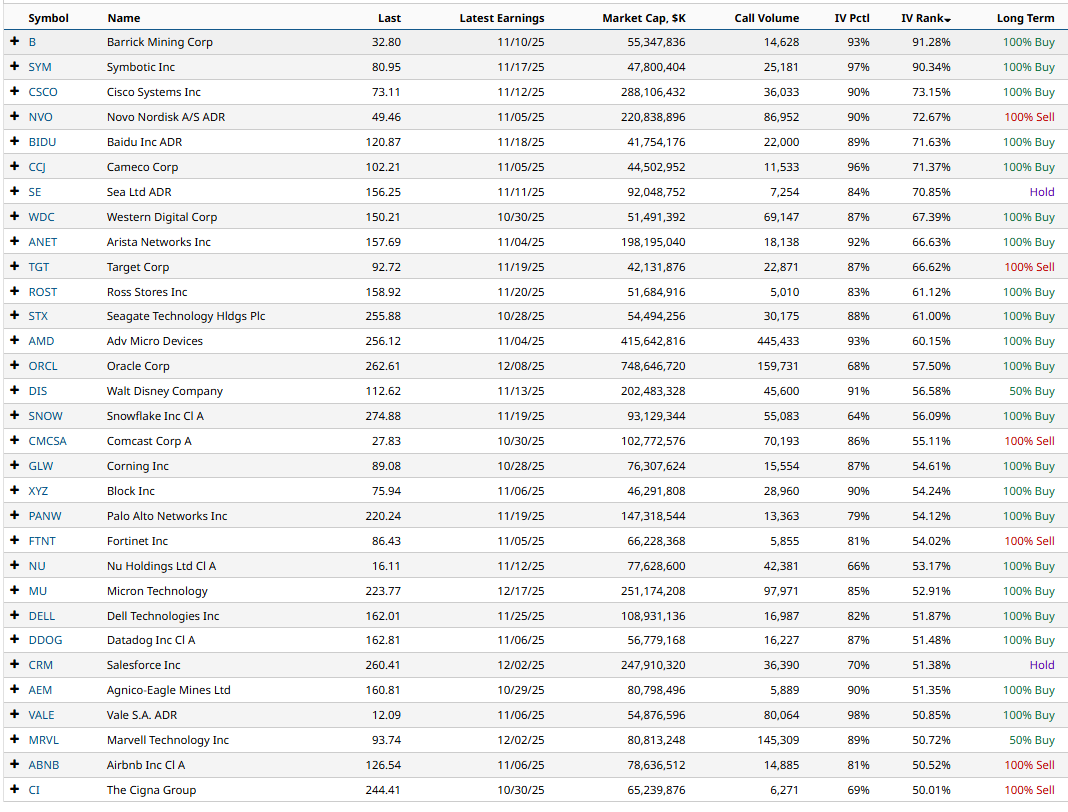

Stocks With High Implied Volatility

We can use Barchart’s Stock Screener to find other stocks with high implied volatility.

Let’s run the stock screener with the following filters:

- Total call volume: Greater than 5,000

- Market Cap: Greater than 40 billion

- IV Rank: Greater than 60%

This screener produces the following results sorted by IV Rank.

You can refer to this article for details of how to find option trades for this earnings season.

Last Week’s Earnings Moves

PYPL +3.9% vs 8.6% expected

UNH +0.5% vs 6.4% expected

UPS +8.0% vs 7.3% expected

V -1.6% vs 3.6% expected

STX +19.1% vs 10.9% expected

NEE -2.9% vs 3.7% expected

GOOGL +2.5% vs 6.7% expected

META -11.3% vs 7.1% expected

MSFT -2.9% vs 4.9% expected

BA -4.4% vs 5.6% expected

VZ +2.3% vs 3.7% expected

CMG -18.2% vs 8.8% expected

CVNA -13.8% vs 16.1% expected

SBUX -1.2% vs 7.8% expected

EBAY -15.9% vs 6.7% expected

AAPL -0.4% vs 4.1% expected

AMZN +9.6% vs 6.7% expected

COIN +4.7% vs 9.2% expected

MSTR +5.9% vs 6.8% expected

BMY +7.1% vs 5.5% expected

LLY +3.8% vs 6.0% expected

MRK -0.4% vs 4.5% expected

WDC +8.8% vs 10.3% expected

RBLX -15.5% vs 14.3% expected

MO -7.8% vs 3.6% expected

GILD +1.1% vs 5.2% expected

XOM -0.3% vs 2.9% expected

CVX +2.7% vs 3.1% expected

ABBV -4.5% vs 4.0% expected

Overall, there were 19 out of 29 that stayed within the expected range. 14 out of 29 moved higher following their announcement.

Unusual Options Activity

COIN, RGTI, MARA, AMZN, MSTR, MSFT and CRWV all experienced unusual options activity last week.

Other stocks with unusual options activity are shown below:

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart