AI-related hardware stocks have been among 2025’s hottest stories, but not every supplier is positioned to ride the wave. While GPUs and memory names hog headlines, optical and laser companies quietly power the data center plumbing that lets massive AI models talk to each other, and that infrastructure is starting to attract Wall Street attention.

Lumentum (LITE) has suddenly landed in the spotlight after Mizuho just raised its one-year price target to $325, a Street high, citing Google’s (GOOG) (GOOGL) ramp-up of Tensor Processing Units (TPUs) as a big catalyst. Analysts see Lumentum as a key beneficiary of expanding AI infrastructure at Meta Platforms (META) and Amazon (AMZN), with its optical networking gear positioned to support faster, more efficient data movement.

For investors tracking the AI hardware wave, LITE stock is drawing growing attention, but should you buy its stock now? Let's dive deep and find out the answer.

About Lumentum Stock

Founded in 2015, Lumentum Holdings is a photonics company specializing in lasers and optical components. It makes indium phosphide laser diodes, high-speed transceivers, optical circuit switches, and similar products used in cloud data centers, telecom networks, and industrial applications. Essentially, Lumentum’s gear powers data links in AI data center racks and precision manufacturing. The company runs two main segments, Cloud & Networking and Industrial Tech, and has a market value of around $20 billion.

LITE shares have soared this year. As of the start of December, LITE stock is up roughly 279% year to date (YTD). This meteoric rise is driven by booming demand. Big cloud companies are buying lasers and optical switches as fast as they can. Strong earnings and a stream of higher price targets have fueled the rally.

But this rally comes with lofty pricing. By any metric, Lumentum is far from cheap. It trades at roughly 53x forward earnings and about 11.3x sales ratios, which are well above historical norms and typical communications equipment peers, which trade at 23x and 4x, respectively, suggesting the stock is priced for perfection.

The AI Boom and Google Connection

So the thing is that Lumentum isn’t making AI chips; it’s selling the critical gear that connects them. Its lasers and optical switches help data centers move massive amounts of data faster and with less power. Google is building massive AI data centers using its own AI chips (TPUs). Those chips need ultra-fast optical networks to move data between servers and clusters. Lumentum supplies the lasers and optical components that make those networks work.

As Google expands its TPU data centers and sells AI compute power to customers, it needs more high-speed optical gear. That directly boosts demand for Lumentum’s products, which is why analysts see Google’s AI spending as a big growth driver for Lumentum.

Lumentum Beats Q3 Earnings Estimate

Lumentum just delivered a huge quarter. Revenue jumped to $533.8 million, up more than 58% from last year, landing at the top end of management’s guidance. The company said revenue, margins, and earnings all beat expectations.

Its business is now split into Components and Systems. Components, which include laser chips and key parts, surged to about $379 million, while Systems reached roughly $155 million. More than 60% of total sales now come from AI and cloud customers.

Profitability also flipped sharply higher. Lumentum posted a GAAP profit and delivered a big jump in adjusted earnings. Cash climbed to over $1.1 billion.

Looking ahead, management expects another strong quarter with revenue moving into the mid-$600 million range. Wall Street sees a blockbuster year driven by AI demand.

What Analysts Are Saying About LITE Stock

Analysts’ views on Lumentum have turned mostly bullish, though some caution remains. Needham reiterated a “Buy” rating and raised its target to around $290, calling Lumentum a leader amid strong laser demand.

Mizuho also kept an “Outperform” rating and increased its target to $325, highlighting Google’s TPU expansions as a key growth driver.

Morgan Stanley, however, maintained an “Equal-Weight” rating with a $190 target, noting that Lumentum’s recent quarterly performance was largely in line with expectations and that supply is finally starting to catch up with demand, which may lead to moderate growth.

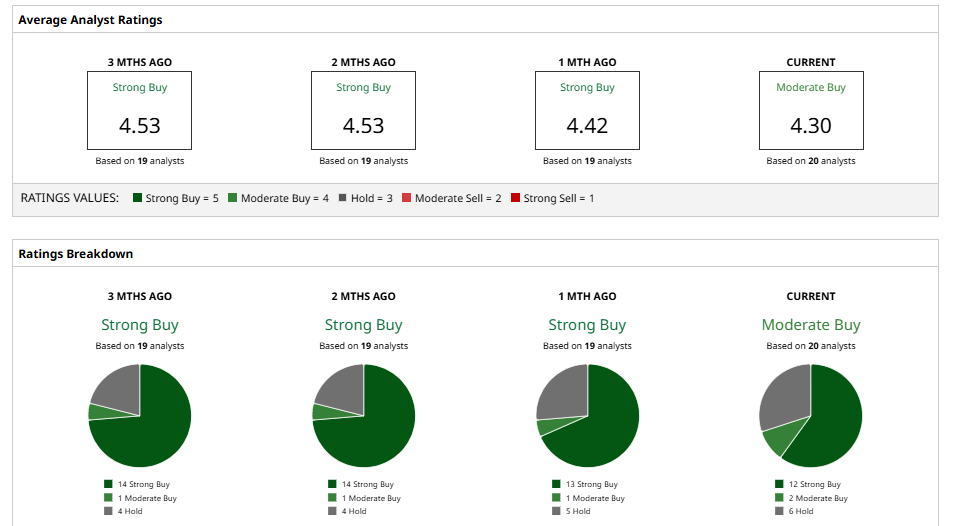

If we look at the overall consensus, LITE stock has a “Moderate Buy” rating from all 20 analysts covering the stock, with no “Sell” ratings. However, the stock has already surpassed its mean price target of $225.44 and is currently trading near its street-high level of $325, which suggests it could face a future correction.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Analysts Say Even the Bear Case for Oracle Stock Is Bullish. Should You Back Up the Truck on ORCL?

- With Apple Poised to Best Samsung in Smartphone Shipments, Should You Buy, Sell, or Hold AAPL Stock?

- Wedbush Says This 1 Tech Giant Is the Best AI Hyperscaler Stock to Own as 2025 Ends

- IonQ Just Locked In Another Defense Deal. Should You Buy the Quantum Computing Stock Here?