With a market cap of $18.5 billion, Packaging Corporation of America (PKG) is a leading North American producer of containerboard and uncoated freesheet paper. The company operates through two segments: Packaging and Paper, offering products ranging from corrugated shipping containers and retail displays to commodity, specialty, and communication papers.

Companies valued at more than $10 billion are generally considered “large-cap” stocks, and Packaging Corporation of America fits this criterion perfectly. Its products are sold through dedicated sales and marketing organizations serving a wide range of industrial and consumer markets.

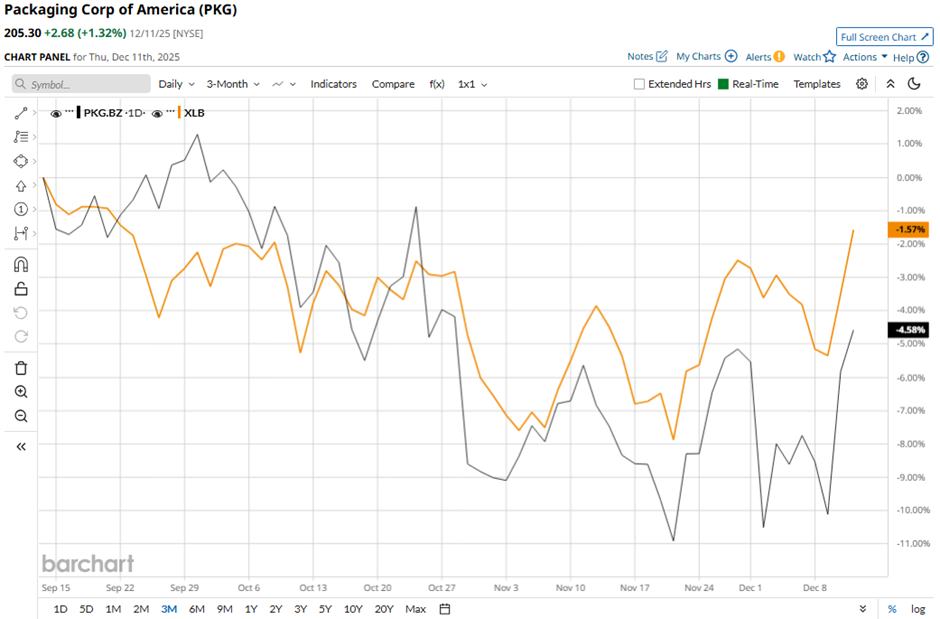

Shares of the Lake Forest, Illinois-based company have declined 15.4% from its 52-week high of $242.68. Over the past three months, its shares have dropped 5.4%, underperforming the Materials Select Sector SPDR Fund's (XLB) 2.6% dip during the same period.

Longer term, PKG stock is down 8.8% on a YTD basis, lagging behind XLB's 7.3% rise. Moreover, shares of the company have decreased nearly 14% over the past 52 weeks, compared to XLB’s marginal drop over the same time frame.

The stock has been trading below its 50-day moving average since mid-October.

Despite reporting weaker-than-expected Q3 2025 adjusted EPS of $2.73 on Oct. 22, shares of PKG rose 2.2% the next day because revenue of $2.31 billion exceeded forecasts and improved from $2.2 billion a year earlier. Investors responded positively to strong operational performance, including $503.4 million in EBITDA excluding special items and solid Packaging segment operating income of $347.9 million.

Additionally, management projected Q4 EPS of $2.40 excluding special items and highlighted expected improvements from the newly acquired Greif containerboard business.

In contrast, rival International Paper Company (IP) has lagged behind PKG stock. IP stock has dropped 27.4% YTD and 28.4% over the past 52 weeks.

Despite the stock’s underperformance relative to the sector, analysts remain moderately optimistic about its prospects. PKG stock has a consensus rating of “Moderate Buy” from 11 analysts in coverage, and the mean price target of $231.90 is a premium of nearly 13% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart