Domino's Pizza (DPZ) stock remains over 14% below our target price of $498 as shown in my Oct. 17 Barchart article. Moreover, selling short out-of-the-money (OTM) put options is one profitable way to play it.

I discussed this income-producing play in a follow-up Nov. 18 article, suggesting selling short the $390 strike price put expiring Dec. 19 for a one-month 1.667% yield (i.e., $6.50/$390.00).

Today, DPZ stock is well over that strike price at $435.31 with 5 days left until expiry. So, this short-put play has worked well, as the put premium has fallen to just 18 cents at the midpoint.

That implies that investors can roll this trade over and do a new short-put one-month out play. But first, let's review DPZ's price targets to provide confidence that this is a good play.

DPZ Price Targets

In my Oct. 17 Barchart article, I discussed Domino's strong Q3 performance. That included its 14.56% fQ3 free cash flow (FCF) margin compared to 11.5% a year ago.

As a result, using analysts' revenue estimates, I projected that Domino's would generate $755 million in FCF over the next 12 months (NTM).

And, using a 4.50% FCF yield metric, that works out to a projected market value of $16.777 billion (i.e., $755/0.045).

Today, according to Yahoo! Finance, DPZ has a market cap of just $14.786 billion. That implies the value of DPZ could rise by +13.47% (i.e., $16.777b/$14.786b).

In other words, DPZ could be worth $493.92 per share (i.e., 1.13465 x $435.31).

Other analysts agree. For example, Yahoo! Finance reports that 34 analysts have an average price target (PT) of $496.65. And Barchart's mean survey PT is $500.53.

Similarly, AnaChart.com, which tracks recent analyst write-ups, shows that 22 analysts have an average PT of $493.53.

The bottom line, then, is that DPZ looks cheap here. That makes it ideal for short-sellers of out-of-the-money (OTM) puts.

Shorting DPZ Put Options

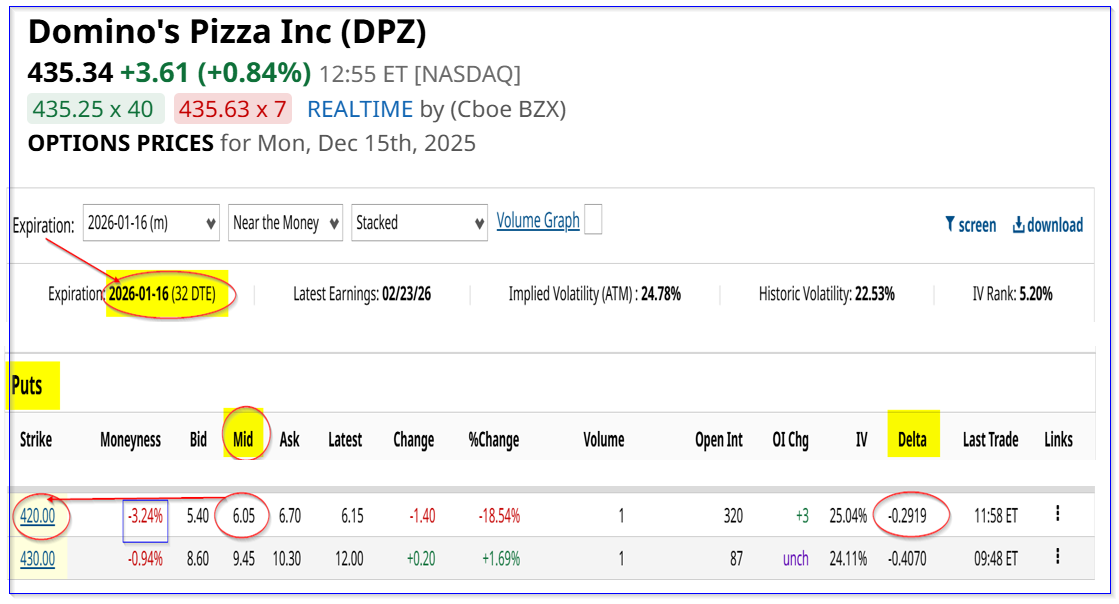

For example, the Jan. 16, 2026, expiry period, 32 days from today, shows that the $420.00 strike price put option contract has a midpoint premium of $6.05.

That strike price is over 3% below today's price and provides a potentially lower buy-in point. Moreover, the short-seller of this contract makes an immediate yield of 1.44% (i.e., $6.05/$420.00).

This means that an investor who secures $42,000 in cash or buying power with their brokerage firm can enter an order to “Sell to Open” 1 put contract at $420.00.

The account will then immediately receive $605.00. Hence, the 1.44% yield (i.e., $605/$42,000).

Moreover, it provides a potentially lower breakeven point, if DPZ falls to $420 over the next month:

$420 - $6.05 income received = $413.95 breakeven

That is $21.39 below today's price - i.e., 4.9% lower. That provides good downside protection and an attractive potential buy-in price.

Expected Returns (ER)

For example, if DPZ eventually rises to $493.92, the upside is:

$493.92/$413.95 = 1.193 = +19.3% upside

That is an attractive potential expected return (ER). Moreover, investors get to keep each month's short-put income. For example, over the last 3 articles (the past 3 months) that I've highlighted shorting DPZ puts, an investor could have made $18.60, or $1,860 per put contract shorted:

$6.05 +6.50 + 6.05 = $18.60

The average investment was $403.00 (i.e., ($400+390+420)/3), or $40,300. That means the ROI has been over 4.6% in 3 months:

$1,860/$40,300 = 0.04615 = 4.615%

That is also the same as buying in at $418.48 from my first article on Oct. 17 and seeing the stock rise to $437.79 (i.e., $418.48 x 1.04615). That is slightly higher than today's stock price.

In other words, the short-put play income for the last 3 months is more than the stock price gain over the same period. The average investment was lower than the price paid for DPZ shares.

The bottom line is that shorting out-of-the-money (OTM) puts is an attractive way to DPZ stock.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart