With a market cap of $13.7 billion, Kimco Realty Corporation (KIM) is a leading U.S. real estate investment trust specializing in high-quality, open-air, grocery-anchored shopping centers and mixed-use properties concentrated in top metropolitan and high-barrier-to-entry markets. The company brings more than 65 years of expertise in shopping center ownership, management, acquisitions, and redevelopment.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Kimco Realty fits this criterion perfectly. As of September 30, 2025, Kimco owned interests in 564 U.S. properties totaling approximately 100 million square feet, with a strong focus on necessity-based tenants and corporate responsibility.

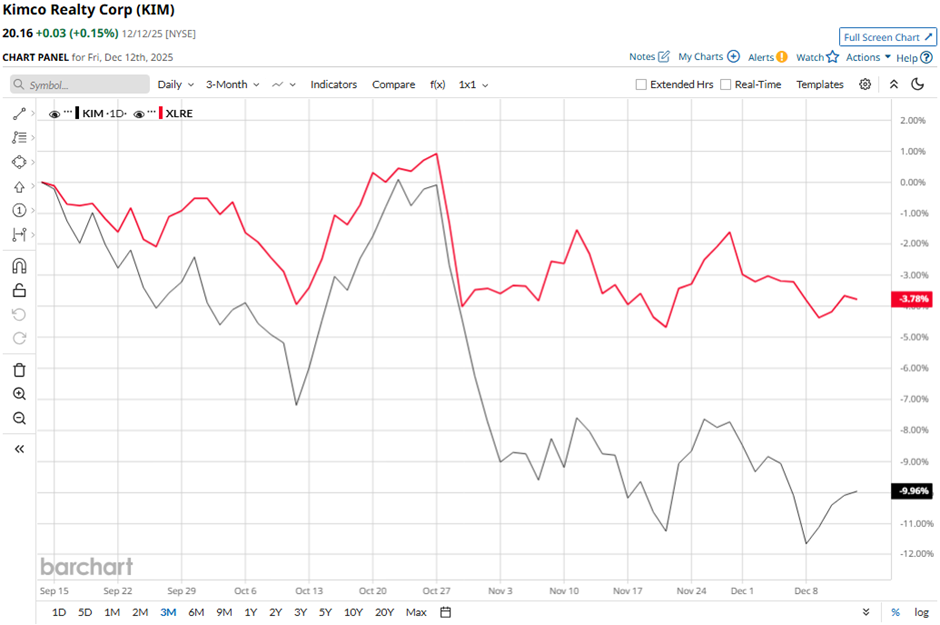

Shares of the Jericho, New York-based company have declined 19.6% from its 52-week high of $25.06. Over the past three months, its shares have fallen nearly 10%, underperforming the Real Estate Select Sector SPDR Fund’s (XLRE) 3.8% dip during the same period.

Longer term, KIM stock is down nearly 14% on a YTD basis, lagging behind XLRE's marginal gain. Moreover, shares of Kimco Realty have decreased 17.7% over the past 52 weeks, compared to XLRE's 5.3% decline over the same time frame.

The stock has fallen below its 50-day and 200-day moving averages since late October.

Despite posting better-than-expected Q3 2025 FFO of $0.44 per share and revenue of $535.9 million, Kimco’s shares fell 1.9% on Oct. 30. The quarter reflected higher costs, including a $13.6 million increase in depreciation and amortization and an $8.0 million rise in interest expense, which partially offset revenue and operating gains.

In comparison, rival Realty Income Corporation (O) has outpaced KIM stock. Shares of Realty Income have risen 8.1% on a YTD basis and 4.7% over the past 52 weeks.

Despite the stock’s weak performance, analysts remain moderately optimistic about its prospects. KIM stock has a consensus rating of “Moderate Buy” from 25 analysts in coverage, and the mean price target of $24.20 is a premium of 20% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart