Zebra Technologies Corporation (ZBRA) is a technology company that specializes in enterprise asset intelligence and automatic identification and data capture solutions. The company designs, manufactures, and sells a broad portfolio of products and software, including barcode scanners, RFID readers, mobile computers, and specialty printers for labels, receipts, and cards. The company is headquartered in Lincolnshire, Illinois and has a market cap of around $13.6 billion.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Zebra Technologies fits right into that category. The company provides cutting-edge enterprise asset intelligence solutions that help organizations track and manage assets and workflows across industries such as retail, transportation, logistics, healthcare, and manufacturing.

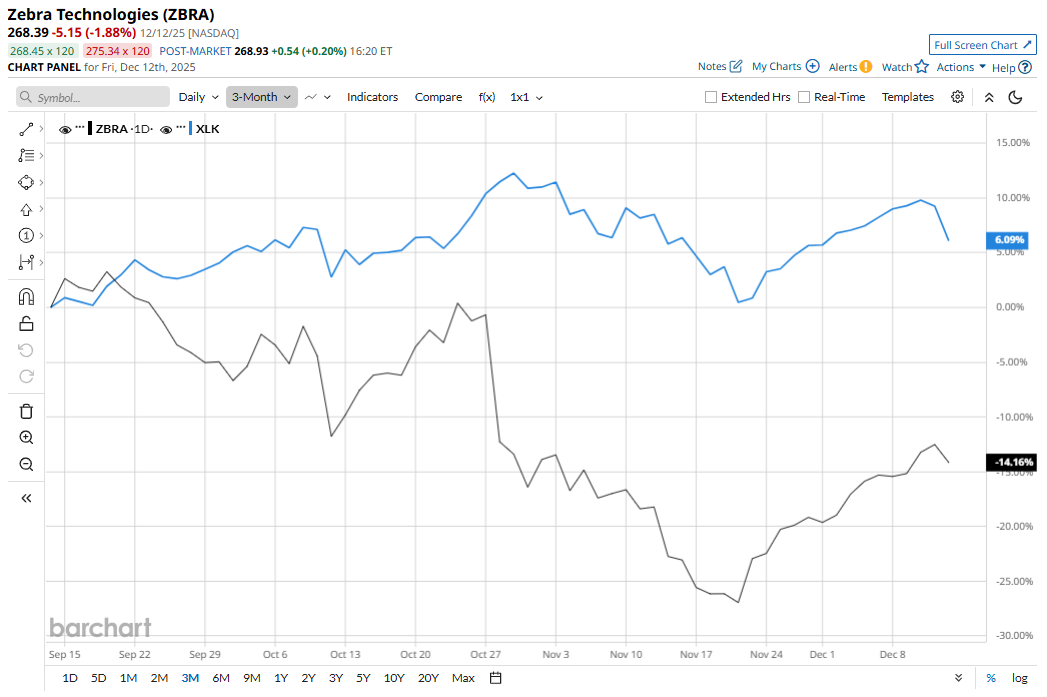

ZBRA is trading 37.3% below its 52-week high of $427.76, which it hit on Jan. 22. The stock has declined 14.2% over the past three months, underperforming the broader Technology Select Sector SPDR Fund’s (XLK) 6.1% return over the same time frame.

In the longer term, ZBRA is down 30.5% on a YTD basis and 34.2% over the past 52 weeks. In comparison, the XLK has gained 23.6% in 2025 and 20.7% over the past year.

The stock has been trading below the 200-day moving average since mid-August and below the 50-day moving average since early September, except for some fluctuations.

In 2025, Zebra Technologies’ stock has declined even amid generally stable quarterly results because of macro-economic headwinds, including the impact of U.S. import tariffs, potential supply chain disruptions in a complex geopolitical landscape and broader market volatility that have dampened sentiment.

Also, markets have reacted negatively to uneven geographic performance and uncertain growth in some regions. Notably, weakness in the European, Middle East, and Africa (EMEA) market, and a softer manufacturing environment, offset strong performance in North America and Asia-Pacific.

ZBRA has underperformed its rival, Trimble Inc. (TRMB), which gained 13.6% on a YTD basis and 7.2% over the past year.

However, the stock has a consensus rating of “Moderate Buy” from 17 analysts in coverage. The mean price target of $360.50 indicates a potential 34.3% upside ahead.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart