London, U.K.-based Pentair plc (PNR) is a water treatment company, providing various water solutions, operating through the Flow, Water Solutions, and Pool segments. With a market cap of $17.3 billion, Pentair delivers a range of smart and sustainable water solutions to homes, businesses, and industries, enabling its customers to access clean water, reduce water consumption, as well as recover and reuse it.

Companies worth $10 billion or more are generally described as "large-cap stocks." Pentair fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the water treatment space.

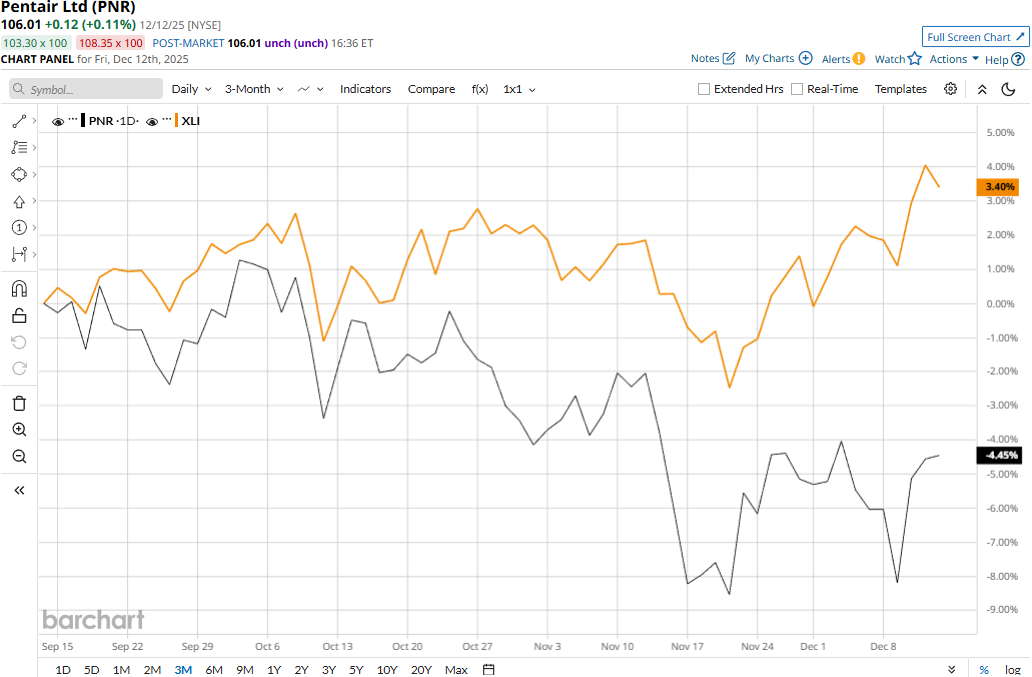

PNR touched its all-time high of $113.95 on Oct. 3 and is currently trading 7% below that peak. Meanwhile, PNR stock prices have declined 4.5% over the past three months, notably outperforming the Industrial Select Sector SPDR Fund’s (XLI) 3.4% gains during the same time frame.

Pentair’s performance has remained grim over the longer term as well. PNR stock prices have gained 5.3% on a YTD basis and dipped 2.1% over the past 52 weeks, underperforming XLI’s 19% surge in 2025 and 13.8% gains over the past year.

PNR stock has traded consistently above its 200-day moving average since May and dropped below its 50-day moving average since late October, underscoring its previous bullish trend and recent downturn.

Pentair’s stock prices observed a marginal dip in the trading session following the release of its Q3 results on Oct. 21. The company’s core revenues after adjusting for the impact of currency translation, acquisitions, and divestitures increased 3% compared to the year-ago quarter. Overall, its topline came in at $1 billion, up 2.9% year-over-year and 1.7% above Street expectations. Meanwhile, its adjusted EPS increased 13.8% year-over-year to $1.24, beating the consensus estimates by 5.1%. Following the initial dip, Pentair stock prices maintained a positive momentum for two subsequent trading sessions.

When compared to its peer, PNR has slightly lagged behind American Water Works Company, Inc.’s (AWK) 5.7% uptick in 2025 and marginal 77 bps gains over the past 52 weeks.

Among the 21 analysts covering the PNR stock, the consensus rating is a “Moderate Buy.” As of writing, its mean price target of $123.31 suggests a 16.3% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart