Shares of enterprise software and cloud computing major Oracle (ORCL) had a tough trading session Thursday. Nosediving by more than 15% intraday, the stock closed 11% lower to have its worst day on the exchanges since 2001, as its Q2 revenues missed estimates. Moreover, its five-year CDS spread widened sharply to reach its highest levels since 2009. This makes the cost of raising debt more expensive for the Larry Ellison-led company.

Oracle already has a debt pile of more than a hundred billion dollars, and it appears that they may require more fundraising, with the company increasing its capex forecast to about $50 billion in fiscal year 2026 from $35 billion earlier. A small cloud player earlier, Oracle's rise to become a serious contender in the cloud space, thanks to its $300 billion deal with OpenAI, was fueled by debt.

Although this propelled Ellison to become the world's richest person, his aversion to equity dilution may come back to haunt him in the future, as a slight deviation from market expectations will result in sentiments souring and the stock getting whiplashed, as was evident yesterday.

However, did the ORCL stock really deserve to have its worst day in almost a quarter of a century just for missing revenue estimates? Or, after going up by almost 12% on a YTD basis, even after this sharp correction, are the company's fundamentals intact for a sustained upmove in the future? Let's find out.

Demand Definitely There, But Debt Levels Scary

In its fiscal Q2 2026, Oracle's numbers proved that the demand is there. Total revenue, the protagonist for yesterday's battering of the stock, was $16.1 billion. Not only was this up 14% from the previous year, but its largest revenue segment, Cloud, reported revenues of about $8 billion in the quarter. This marked a YoY growth of 34%. Estimates for total revenue for the quarter were $16.21 billion.

Earnings for the quarter came in at $2.26 per share, up an impressive 54% from the prior year. Not only that, but the figure also came in higher than the consensus estimate of $1.64 per share. The past eight quarters have seen an even distribution of hits and misses from Oracle in terms of earnings estimates.

Remaining performance obligations, or RPOs, surged by a whopping 438% on a YoY basis to come in at $523 billion. This may have been the brightest spot in the earnings print, as a significant growth in this metric reflects a strong commitment, visibility into future revenue, and long-term customer stickiness.

In terms of cash flows, net cash from operating activities for the first six months of fiscal 2026, ended Nov. 30, was $10.2 billion, up from $8.7 billion in the year-ago period. However, the negative turn of the free cash flow to $394 million from $11.3 billion at the start of the year. A negative free cash flow figure for a company with more than $100 billion of debt is certainly alarming.

Overall, Oracle closed the quarter with a cash balance of $19.2 billion, much higher than its short-term debt levels of $8.1 billion. This is comforting as it denotes that the company is not expected to face any kind of short-term liquidity concerns.

Oracle: Things To Keep In Mind Now

As an investment option, Oracle remains in an interesting position. While doubters have grown louder due to its recent revenue miss, high debt levels, and heavy dependence on OpenAI to drive future growth, believers are seeing Oracle as a vital fourth player in the cloud race (the others being AWS, Azure, and Google Cloud) and as a potential key cog in the AI infrastructure space.

The truth lies somewhere in between.

Firstly, the increased capex is not really a headwind for a company having RPOs to the tune of $523 billion. In fact, it is a step in the right direction to service this huge demand, with Oracle driving its demand somewhat. Moreover, Oracle already has a strong position in the enterprise software market, which the company can leverage to its advantage. Further, Oracle remains highly profitable and is delivering strong earnings growth, largely fueled by the company’s aggressive push into AI and cloud services. Its bold approach in these areas is a key driver of its current financial performance.

Moreover, the Oracle Cloud Infrastructure (OCI) offers some differentiated offerings that make it a serious choice for the hyperscalers. Notably, OCI’s Generation 2 architecture differs materially from legacy cloud designs. Oracle built a flat, non-oversubscribed, high-bandwidth network with RDMA (Remote Direct Memory Access) at hyperscale. OCI’s design allows significantly higher throughput and lower jitter, enabling faster model convergence times.

Further, Oracle has signaled and executed a willingness to co-engineer custom AI data centers for partners. Unlike AWS/Azure (which rely on standardized cloud primitives), Oracle customizes cluster topology, tunes interconnect, provides bare-metal GPU nodes at massive scale, and designs dedicated regions for single-customer use. All this is attractive to AI labs that require specialized supercomputing configurations.

However, challenges persist, and they are not just related to free cash flow and the company's high debt. For instance, Oracle still depends heavily on its slower legacy businesses such as license support revenues, on-premise databases, and hardware/engineered systems. These are either flat or declining segments. Even though cloud/AI growth is strong, the legacy base dilutes overall growth rates.

Additionally, Oracle remains an insignificant player in the hot market of enterprise AI. AWS, Azure, and Google dominate PaaS, SaaS, and multi-cloud enterprise workloads. Oracle Cloud is still perceived as narrowly specialized, not broadly adopted. This perception gap reduces pipeline conversion rates and raises customer acquisition costs.

Analyst Opinion on ORCL Stock

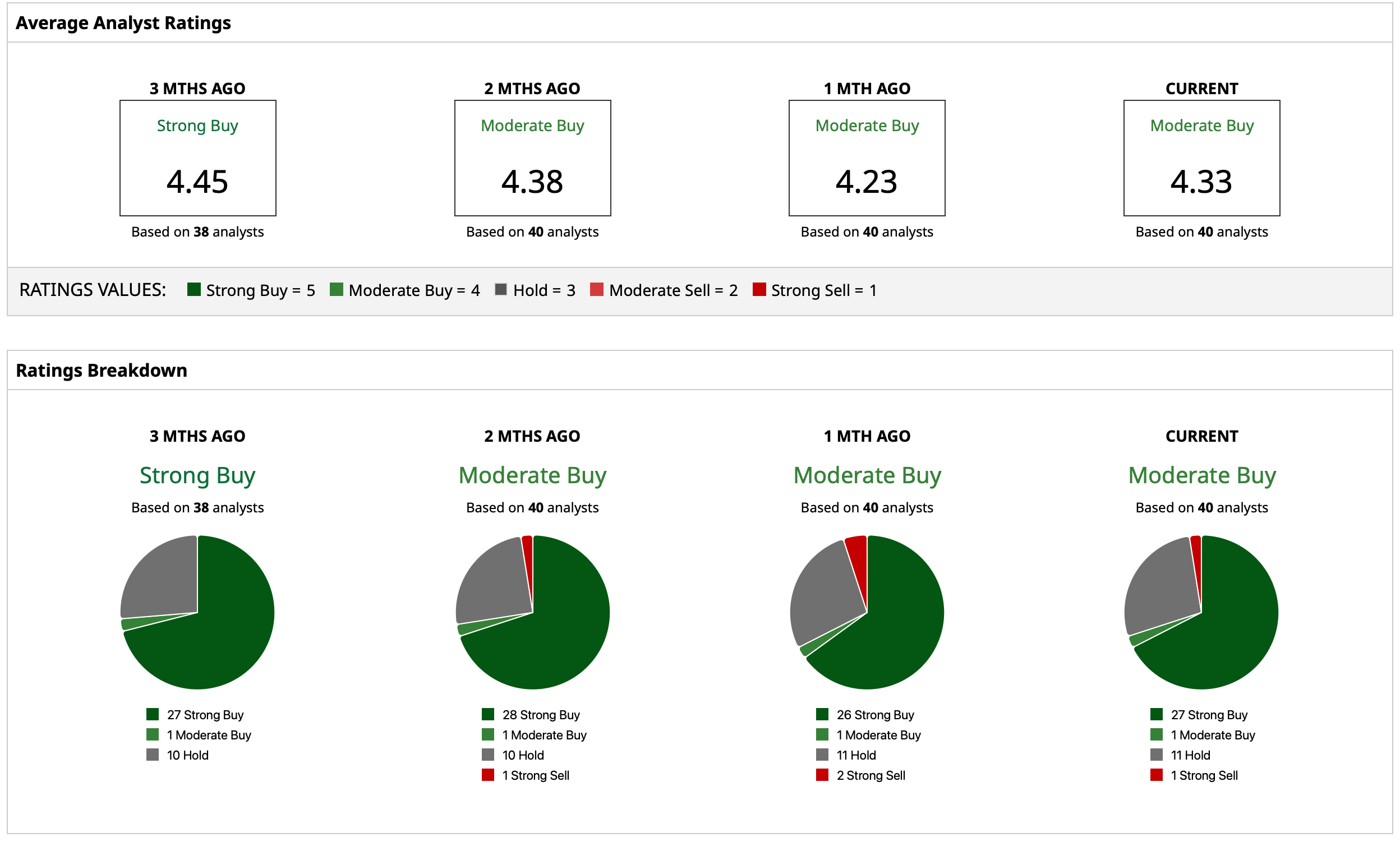

Overall, analysts have deemed ORCL stock a “Moderate Buy,” with a mean target price of $307.86. This indicates an upside potential of about 66% from current levels. Out of 40 analysts covering the stock, 27 have a “Strong Buy” rating, one has a “Moderate Buy” rating, 11 have a “Hold” rating, and one has a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart