Cannabis stocks surged on Friday amid reports that President Donald Trump will soon ease federal marijuana restrictions through executive action, with shares jumping as much as 54% across the sector.

While major players Tilray Brands (TLRY) and Canopy Growth (CGC) captured headlines with their double-digit rallies, one company has quietly dominated the 2025 performance charts.

Curaleaf Holdings (CURLF) shares are up 124% year-to-date (YTD), outpacing every other cannabis stock tracked by Barchart and positioning the company as the clear winner of this year's regulatory-fueled rally. The anticipated reclassification of marijuana to Schedule III could mark a turning point for an industry that's struggled since its pre-Covid peak.

Is Curaleaf Stock a Good Buy Right Now?

Valued at a market cap of $2.86 billion, Curaleaf stock is still down almost 70% from all-time highs, despite the ongoing rally. Curaleaf produces and distributes cannabis products in the United States and internationally.

The company offers flowers, pre-rolls, flower pots, hemp-based products, and cannabinoids, such as cannabidiol and cannabigerol. In addition, Curaleaf engages in the cultivation, production, and sale of hemp-derived THC products through wholesale channels.

Curaleaf Holdings posted mixed third-quarter results, with international expansion offsetting price compression in domestic markets. CEO Boris Jordan emphasized that Curaleaf’s year-long restructuring effort is delivering tangible improvements despite ongoing headwinds.

In Q3, Curaleaf reported revenue of $320 million, a decrease of 3% year-over-year (YoY), driven by double-digit price declines across multiple markets. The domestic segment achieved modest gains, while international sales rose 56% YoY. Its adjusted gross margins improved to 50%, up 115 basis points as cultivation efficiencies offset pricing pressures.

Jordan highlighted that average flower potency surpassed 30% for the first time in company history, a direct result of the Dark Heart genetics program and improved growing techniques. Higher yields and better quality are flowing through the supply chain as Curaleaf implements data-driven analytics tools for merchandising and inventory management across its 2.1 million loyalty member database.

The company's Anthem pre-roll brand, launched in April, has gained rapid traction. It is now a top-ten brand in Illinois and has captured nearly 30% of total pre-roll sales after introducing the infused Anthem Bold line in September.

Curaleaf is scaling production to meet growing demand while its ACE aqueous cannabis extraction oil continues gaining adoption in New York and Massachusetts, with Florida launches planned next. International operations delivered another standout quarter despite near-term challenges from regulatory delays on German import permit caps, which were resolved last week.

Curaleaf launched the world's first medically certified liquid inhalation device in the UK and Germany in September and recently gained Australian approval. The QMID vaporizer provides a competitive advantage as the only Class IIa medical device currently available in European markets.

Curaleaf ended the quarter with $107 million in cash after paying $28 million in debt obligations and generated $53 million in operating cash flow with $37 million in free cash flow. The company subsequently paid $30 million to complete its Tryke acquisition obligations and closed a $100 million upsized revolving credit facility with Needham Bank at 7.99% interest.

What Is the CURLF Stock Price Target?

Management expects fourth-quarter revenue to grow low single digits compared to Q3. Analysts tracking the cannabis stock forecast revenue to increase from $1.27 billion in 2025 to $1.70 billion in 2029. In this period, free cash flow is forecast to improve from $77 million to $540 million. If Curaleaf stock trades at 16x forward FCF, which is in line with its 12-month average, it could more than triple from current levels.

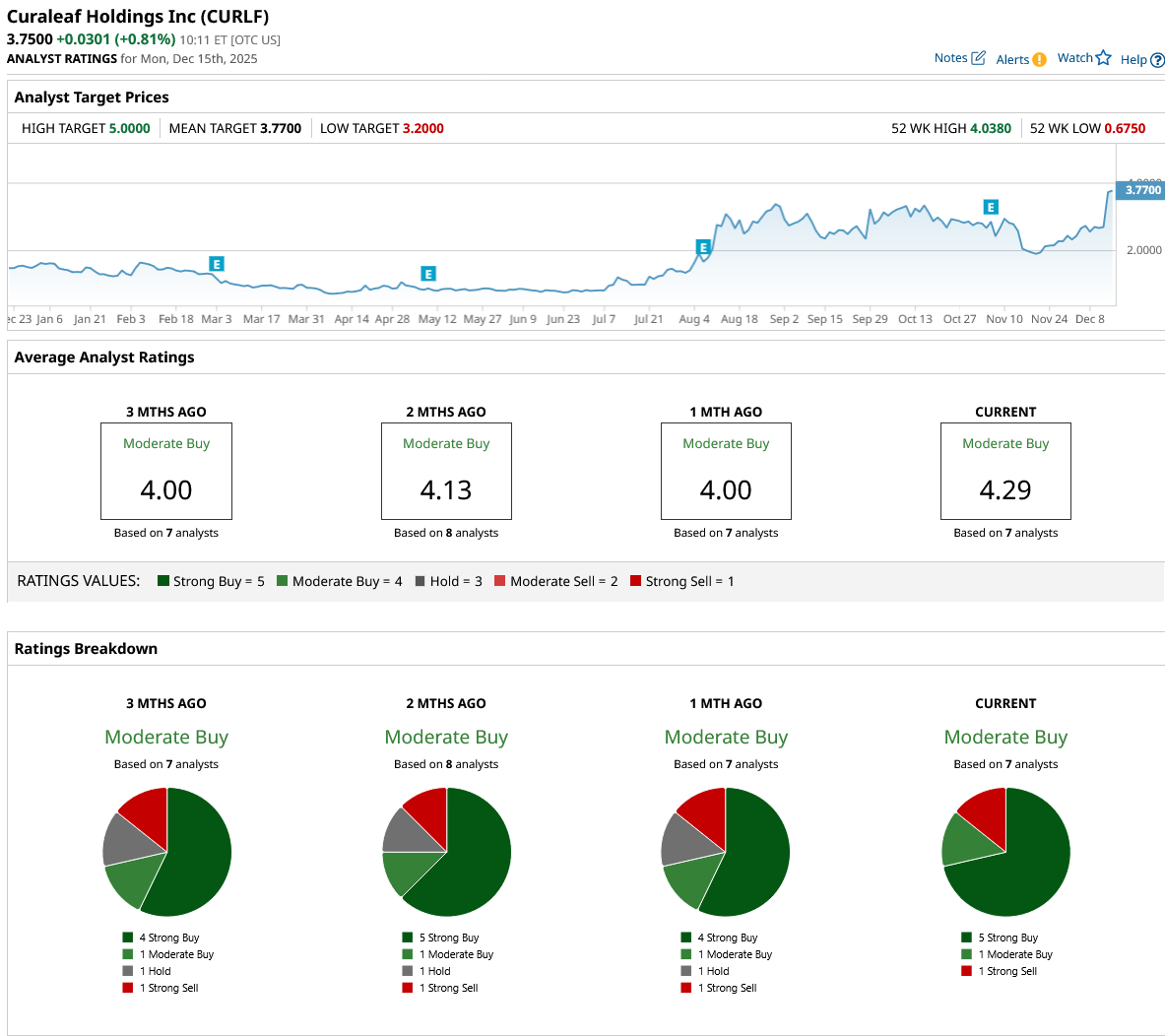

Out of the seven analysts covering CURLF stock, five recommend “Strong Buy,” one recommends “Moderate Buy,” and one recommends “Strong Sell.” The average Curaleaf stock price target is $3.77, which is barely above the current price of $3.75.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart