The cannabis sector as a whole is seeing strong upside today, with investors in a broad range of stocks hitting the bid. That's because a very critical piece of news came across the tape last week: that President Trump is reportedly looking to reclassify marijuana.

Doing so would allow for greater medical research and expand the use cases currently provided for by law. With many marijuana experts cheering this news, as it would be a first step toward legalization (as other major developed countries have done), opening up the medical cannabis sector for business could have big impacts on companies that are already operating in this space. It would also allow new entrants to join the party, with IRS rules tied to business deductions and various loan products leading to a surge of activity in this sector that's simmered down of late.

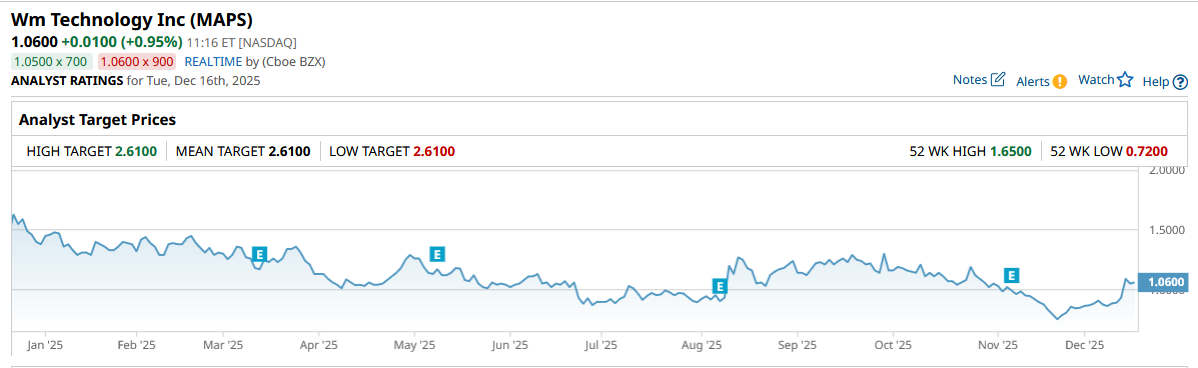

One of the biggest movers in the cannabis sector riding this news is WM Technology (MAPS). Looking at the stock chart above and Friday's impressive 17% move higher, this news is clearly being cheered by investors in this particular stock (in contrast to the rather steep downturn this stock has seen in recent quarters).

Here's why.

Technology Meets the Cannabis Sector

I've long thought WM Technology is among the more intriguing companies in the cannabis sector. That's because, unlike multi-state operators and other companies in the distribution or retail business, WM Technology operates an online cannabis marketplace with a number of key offerings. Providing users with e-commerce capabilities to purchase cannabis in states where it is legal, WM Technology has a very scalable business model that could take off if marijuana is eventually decriminalized or legalized at the federal level (we're not there yet).

The company's offerings also include a Weedmaps marketplace, which allows cannabis consumers to peruse the available retailers and brands in their area. This one-stop shopping and educational experience could be a key driver of growth in this sector moving forward, leading to higher multiples over time.

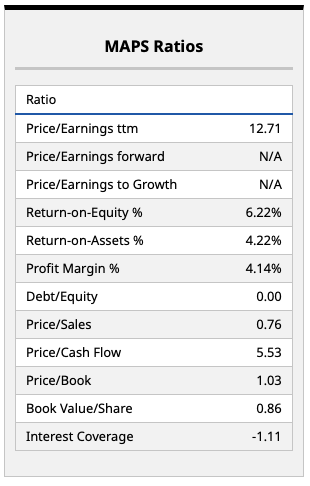

Looking at WM Technology's fundamentals above, it does appear that there's something to like about this company's underlying strength. With positive earnings over the past year (though negative earnings are expected over the next year) driven by a slim profit margin, at least investors have some multiples to work with. Many other companies in the cannabis sector are unprofitable, and that's one of the key reasons why many investors have looked to other sectors for growth.

That said, if this reclassification of marijuana really is indeed the first step in a longer decriminalization or legalization effort by Congress, perhaps WM Technology is a stock that provides investors with excellent value at its current levels. Trading right around book value currently, I do think there's probably something to this thesis.

What Do Analysts Think?

With only one analyst currently covering MAPS stock, it's difficult to make any real determinations around how viable this rating really is, depending on when it was handed down.

The consensus price target of $2.61 put on WM Technology implies upside of nearly 150% from here. And that's inclusive of Friday's rally.

I do think this relative lack of analyst coverage could be a good thing for those willing to do their research and find top-tier cannabis stocks worth buying in this environment. MAPS stock could be one such opportunity.

I'd like to see a few more quarters of positive earnings growth before coming to a bullish opinion on this name. For now, I'm going to watch how WM Technology performs from here.

But suffice it to say, Friday's price action in MAPS stock is compelling, and I will keep this name on my watch list for some time to come.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart