Copper (HGH26) has a lot of smart features. But calling it a “doctor” is a bit too much for me. That’s the Wall Street slang for the commodity that is essential in industries such as construction, machinery, and electrical wiring. Copper has historically been highly correlated to the economy. Thus the nickname. It’s like it knows where things are trending.

However, I’m starting to question that.

Today’s markets are so different from the ones that existed when Dr. Copper earned its so-called medical degree. These days, markets can rush to judgement about a single data release from the government, or a hint of more good times ahead. It is more pavlovian than anything else.

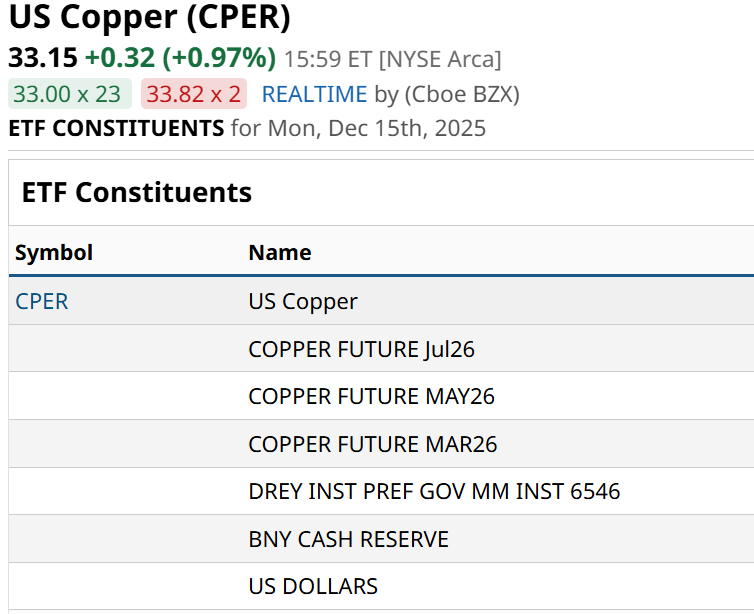

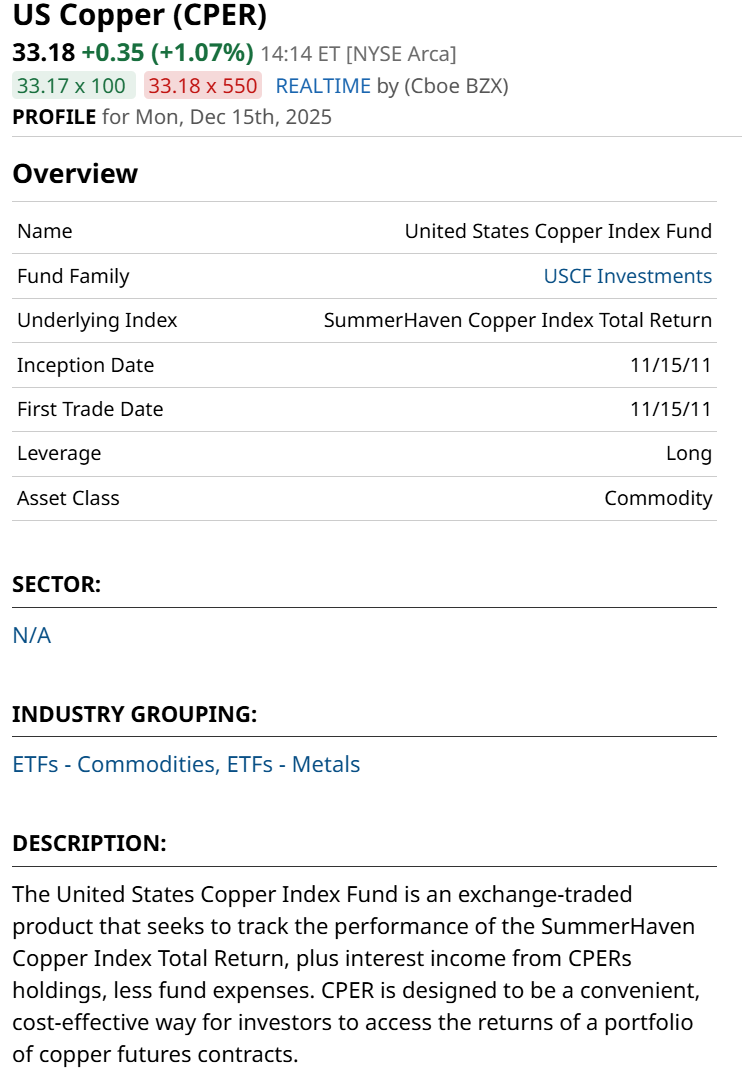

And that means we have to look at surges in prices like the one seen in ETFs like the US Copper ETF (CPER), a 14-year old ETF built using copper futures. With this ETF, it is a good time to see if an option collar is worth considering.

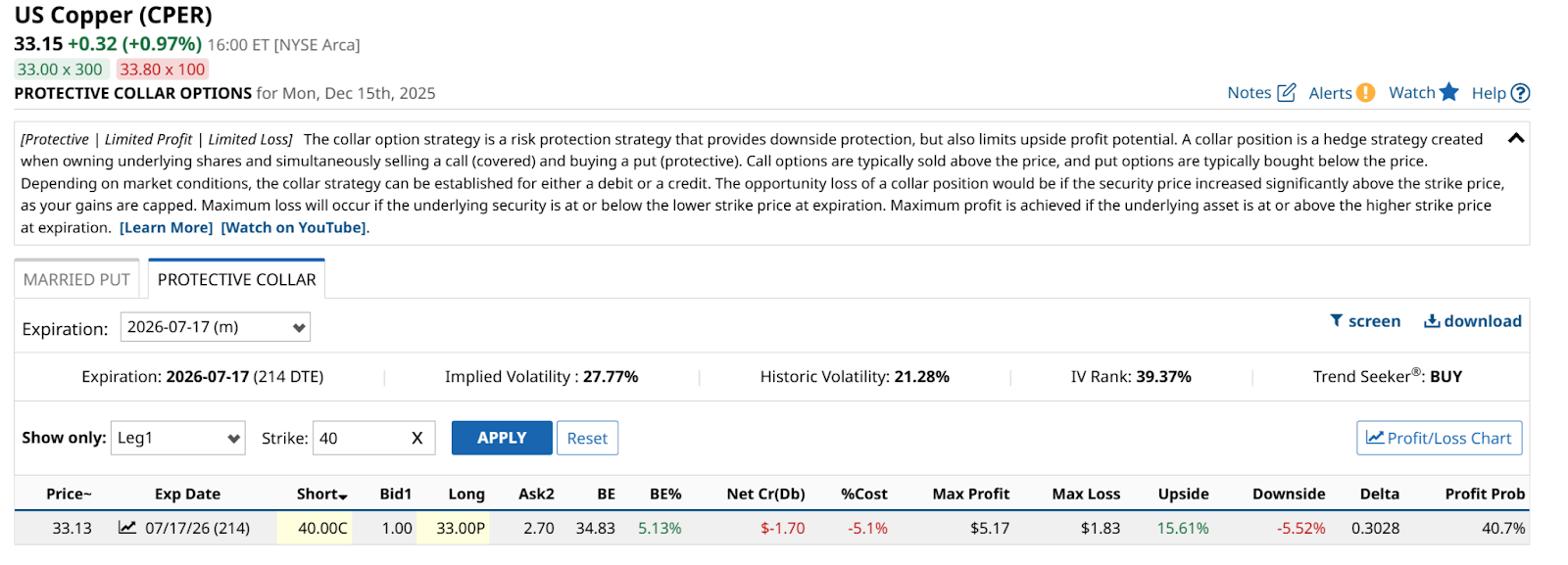

The prerequisite is that to collar an ETF or a stock, you need to own 100 shares of that security per 1 option contract purchased and sold (collars involve selling a call and buying a put). So in this example, let’s assume that’s the case.

Which Is a Better Investment, Gold or Copper?

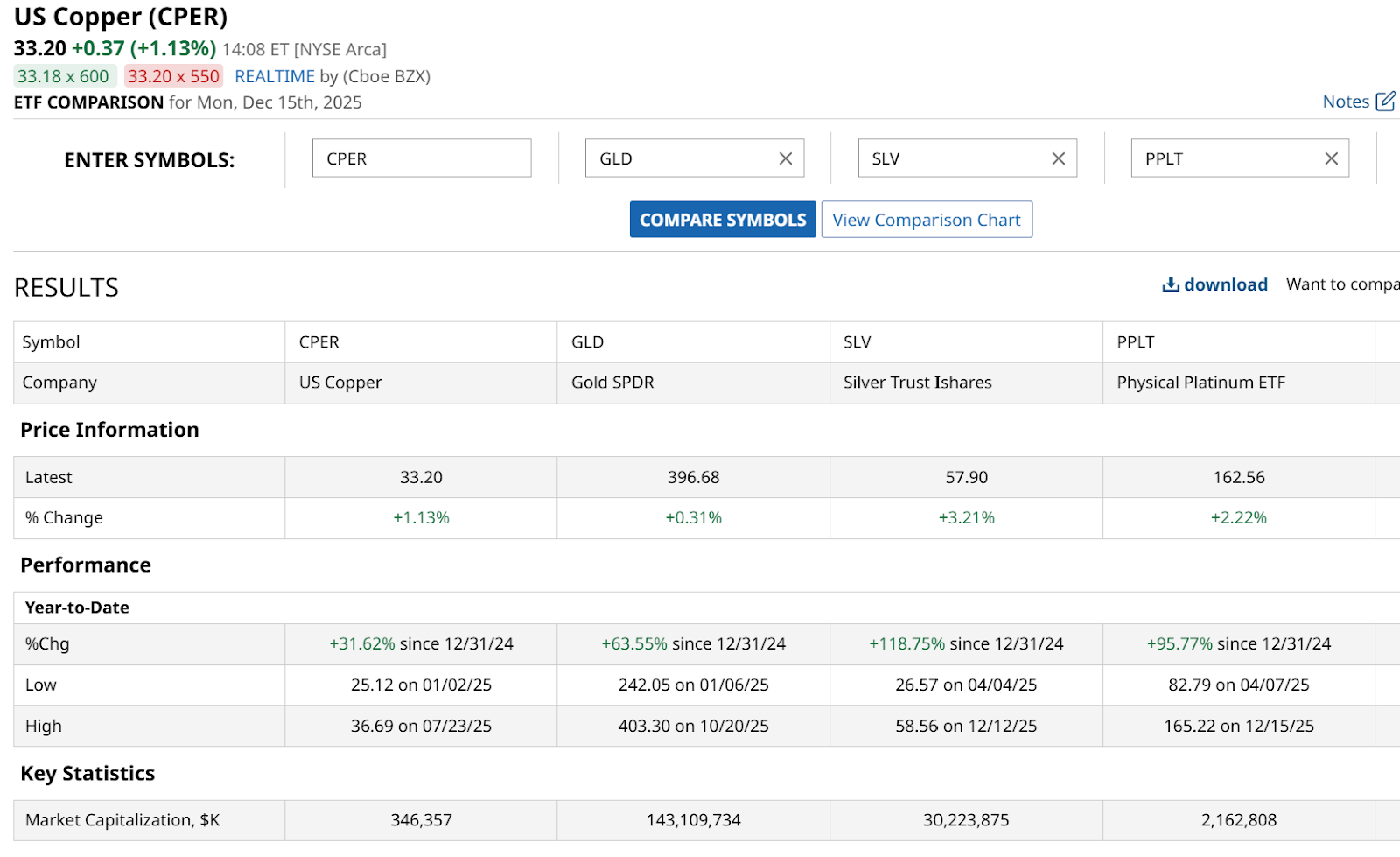

So far this year, it has been neither, if you’re considering silver (SIH26) and platinum (PLF26). Both of those have sped past gold (GCG26) and copper in 2025. However, while copper also trails gold, there’s a good reason for that. It is not thought of the same way.

Copper has very specific properties that make it ideal for certain functions. Unless the function is a party you are going to, where you want to show off jewelry and watches, gold is not very “functional” compared to copper. So we might think of gold as more like a currency or an inflation asset, while copper is, shall we say, a more serious-minded, less speculative commodity than gold.

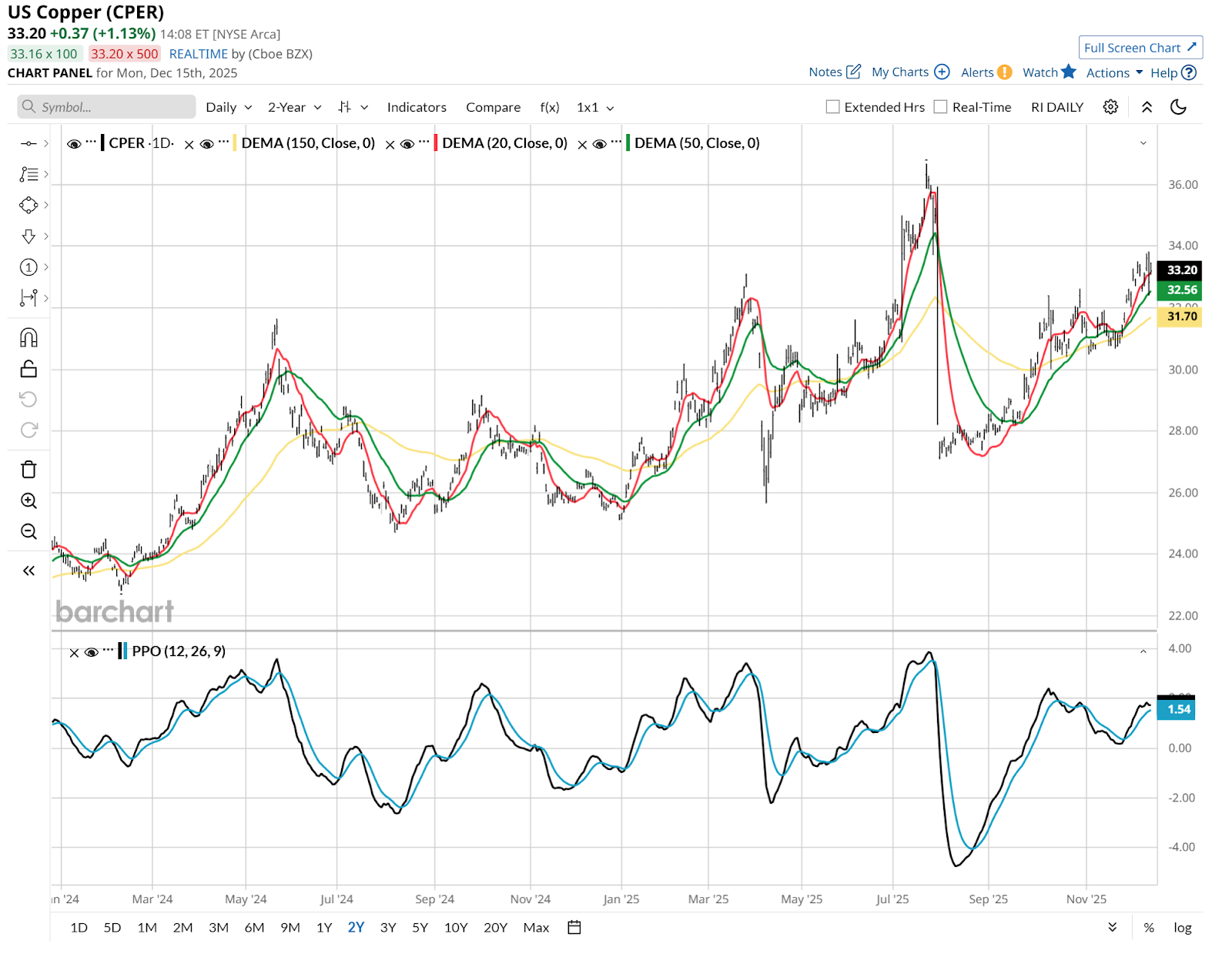

Much of 2025 was spent concerned the economy would be sluggish. For reasons I can’t say I’m on board with, sentiment is improving a bit as we near 2026. Whether for that reason or others, CPER has seen a lot of volatility since July, including an approximately 20% rip higher in that period.

The Doctor Is in… a Collar Trade

Copper is prone to moves like this, which makes it an intriguing collar candidate. To cap how much a trader can give back after a strong up move, while maintaining plenty of profit potential if it continues to rise in price.

The collar above is a decent tradeoff. It caps the gains through that July 17, 2026 expiration date at $40 a share, which is a few dollars above CPER’s all-time high. And the $1.00 I’d get back for the covered call offsets nearly half the cost of the corresponding put protection I would have paid $2.70 a share for.

The up/down tradeoff is 15.6% to 5.5%, so nearly a 3:1 ratio. That’s a solid tradeoff to me. And let’s face it, it is so difficult to get in to see some doctors today, any time you can get access to one in this manner, it is something to consider!

Rob Isbitts, founder of Sungarden Investment Publishing, is a semi-retired chief investment officer, whose current research is found here at Barchart, and at his ETF Yourself subscription service on Substack. To copy-trade Rob’s portfolios, check out the new Pi Trade app.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Doctor Copper Needs a Collar: Why Copper’s Surge Might Not Last, and How to Hedge It

- After a Record-Setting Run, This Signal Says Silver Prices Might Be Peaking. Here’s How to Play It.

- What Does the Latest Rate Cut Mean for Commodity Investments?

- USA Rare Earth Just Revved up Its Commercial Timeline. Should You Buy USAR Stock Here?