Headquartered in Eden Prairie, Minnesota, C.H. Robinson Worldwide, Inc. (CHRW) delivers freight transportation and supply chain solutions. By linking shippers and carriers across road, rail, ocean, and air, the company leverages technology and data to streamline operations and enhance efficiency across global logistics networks.

With a market capitalization of approximately $18.6 billion, C.H. Robinson firmly exceeds the $10 billion “large-cap” threshold. This scale allows it to manage millions of shipments annually and serve customers across diverse industries worldwide.

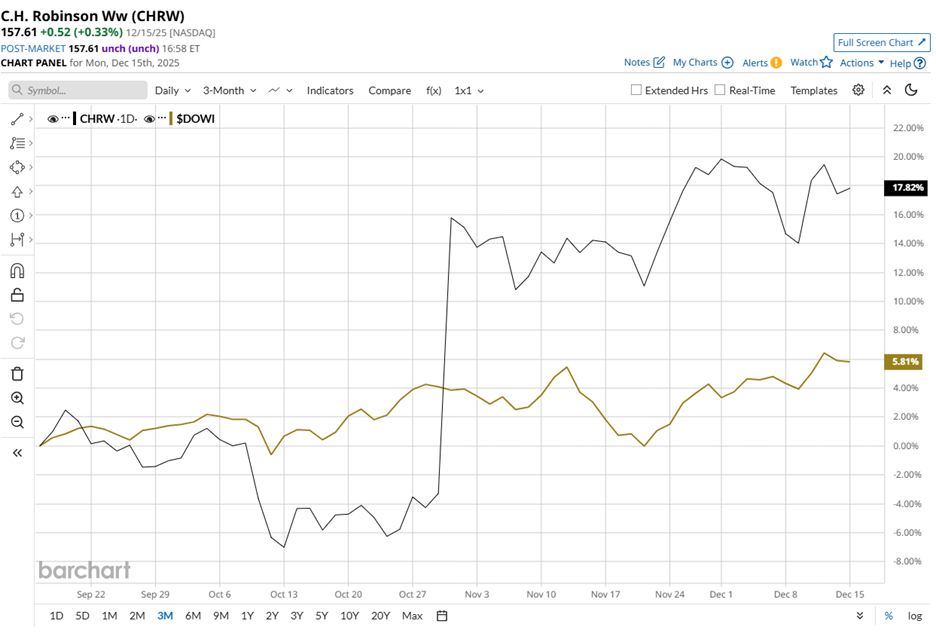

CHRW shares currently trade 3.2% below their December high of $162.79, yet the stock has surged 18.3% over the past three months. The gain decisively outpaces the Dow Jones Industrial Average’s ($DOWI) 5.5% gain, signaling confidence in the company’s execution.

Extending the horizon, CHRW stock has climbed 41.5% over the past 52 weeks and risen 52.6% year-to-date (YTD). Over the same periods, the Dow advanced only 10.5% and 13.8%, respectively, underscoring sustained relative strength.

Since Aug, the stock has traded above its 50-day moving average of $145.11, briefly dipping below the level in Oct before quickly reclaiming it. At the same time, CHRW stock has stayed above its 200-day moving average of $115.35 since Aug, reinforcing the broader uptrend.

Momentum accelerated on Oct 30, when the stock jumped nearly 19.7%, a day after the company reported Q3 2025 results. Although revenue declined 10.9% year over year to $4.14 billion, falling short of the $4.29 billion analyst estimate, adjusted EPS rose 9.4% to $1.40 and surpassed the $1.29 estimate, redirecting investor attention toward improved profitability.

Moreover, management strengthened that narrative by raising its 2026 operating income target by $50 million to $965 million–$1.04 billion, despite freight headwinds. This builds on a prior $350–$450 million uplift from 2023’s $553 million adjusted figure, driven by Lean AI productivity, margin expansion, and market share gains.

To put CHRW's outperformance in context, its rival Expeditors International of Washington, Inc. (EXPD) has gained 27.9% over the past 52 weeks and climbed another 36.8% YTD. Even against that solid showing, C.H. Robinson’s stronger run keeps it a step ahead, signaling superior momentum.

Wall Street remains broadly supportive of CHRW stock. Based on coverage from 26 analysts, the stock carries an overall rating of “Moderate Buy,” and already trades above the average price target of $150.36.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart