Headquartered in Providence, Rhode Island, Citizens Financial Group, Inc. (CFG) is a full-service bank serving individuals, small businesses, middle-market firms, and large corporations with a wide range of retail and commercial banking products and services. With a market capitalization of approximately $25.1 billion, the company is firmly classified as a “large-cap” stock, well above the $10 billion threshold.

Its Consumer Banking segment provides a seamless digital and in-branch experience through mobile and online platforms, a customer contact center, and nearly 1,000 branches and 3,100 ATMs across 14 states and Washington, D.C., covering banking, lending, savings, wealth management, and small-business services. In Commercial Banking, Citizens provides comprehensive offerings including lending and leasing, treasury and deposit services, foreign exchange and risk management, as well as corporate finance, M&A, and debt and equity capital markets solutions.

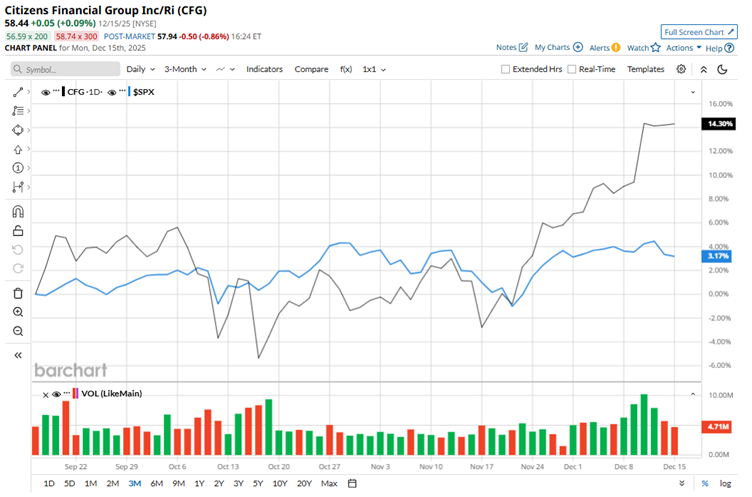

Citizens Financial ranks among the nation’s oldest and largest financial institutions, with total assets of about $222.7 billion as of September 30, 2025. The financial firm is performing quite well on Wall Street, with shares up almost 13.8% over the past three months, easily outpacing the broader S&P 500 Index’s ($SPX) roughly 3% gain over the same period. In fact, the stock reached a new 52-week high of $59.31 on Dec. 11 and is only down 1.5% from that level.

The stock’s longer-term performance is just as compelling. Shares have surged an impressive 27.9% over the past year and are up 33.6% so far in 2025, comfortably outpacing the broader market. By comparison, the benchmark index has gained 12.7% over the past 52 weeks and 15.9% in 2025.

From a technical standpoint, the stock has shown notable strength, consistently trading above its 200-day moving average since June, a key sign of a sustained uptrend. Despite some short-term fluctuations along the way, it has also managed to stay above its 50-day moving average throughout this period, reinforcing the stock’s strong underlying momentum and positive trend.

Citizens Financial has delivered a strong performance in 2025, driven by meaningful expansion in its net interest margin, which is lifting both revenue and profitability. At the same time, the bank’s strategic investments in its private banking franchise and its “Reimagining the Bank” technology initiative are boosting efficiency and sharpening execution.

The company delivered a modest but encouraging beat in its third-quarter earnings, surpassing both Wall Street’s top and bottom-line expectations, keeping investors' attention intact. Revenue rose to $2.12 billion, marking an 11% year-over-year increase, while earnings per share surged 36% from a year ago to $1.05, reflecting strong operating momentum.

Amid intense competition in the financial sector, CFG is clearly outperforming. The stock has pulled well ahead of peer Fifth Third Bancorp (FITB), which has risen about 5% over the past year and 13.1% so far in 2025, underscoring CFG’s stronger relative gains.

Given the stock’s solid price action, Wall Street appears bullish about CFG. Among the 23 analysts covering the stock, the consensus rating sits at a “Strong Buy.” And the average price target of $62.16 implies almost 6.3% upside from the current levels.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart