Valued at a market cap of $12.3 billion, Franklin Resources, Inc. (BEN) is an investment management firm based in San Mateo, California. It provides asset management services to retail and institutional clients, offering a diversified range of investment products across equities, fixed income, multi-asset, alternatives, and ETFs.

Companies worth $10 billion or more are typically classified as “large-cap stocks,” and BEN fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the asset management industry. With a strong international presence and a multi-manager investment platform, the company focuses on active management, global distribution, and long-term capital appreciation, positioning it as a leading player in the industry.

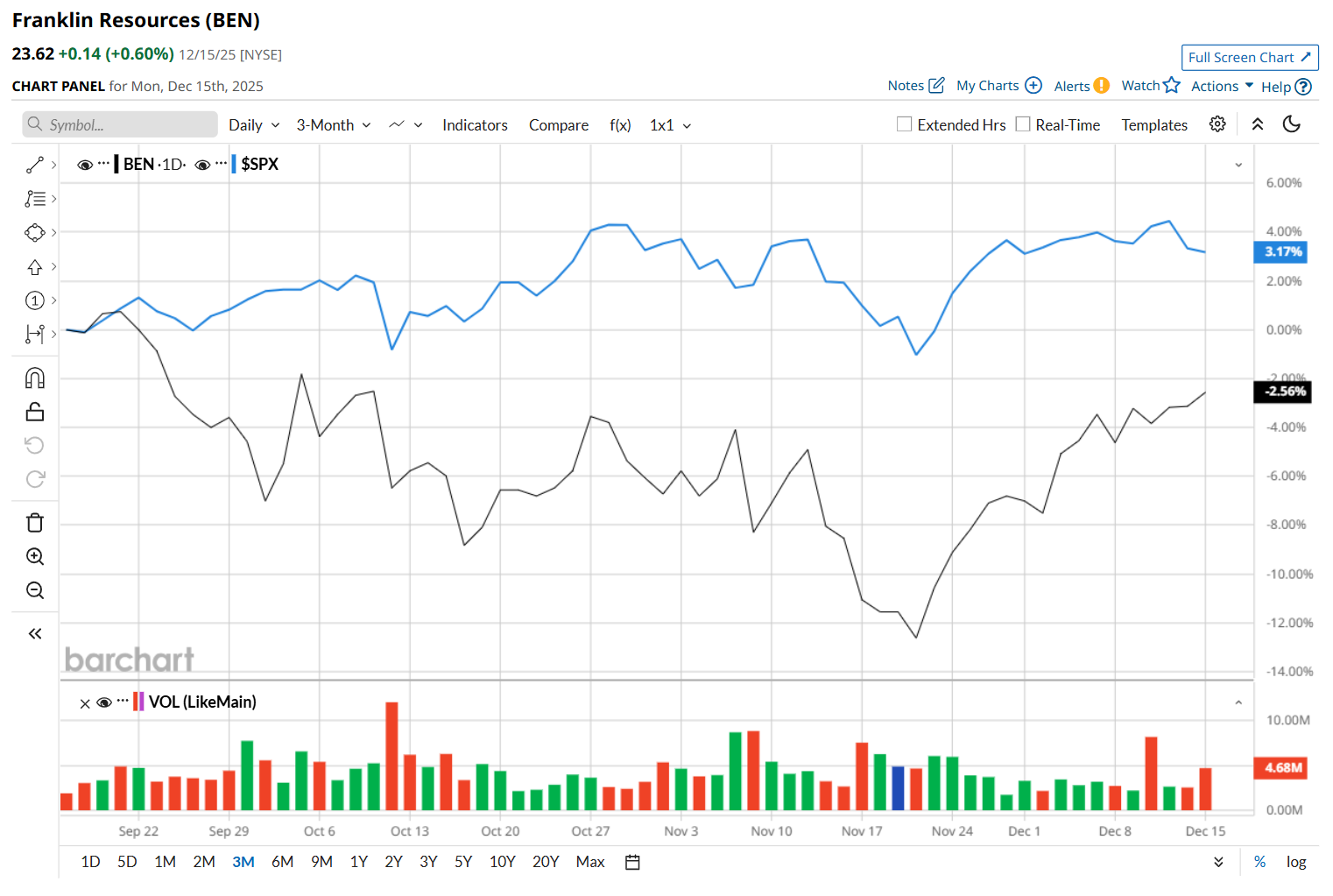

This financial company has slipped 9.4% from its 52-week high of $26.08, reached on Aug. 13. Shares of BEN have declined 3% over the past three months, underperforming the S&P 500 Index’s ($SPX) 3% rise during the same time frame.

Moreover, in the longer term, BEN has gained 7.5% over the past 52 weeks, lagging behind SPX’s 12.7% uptick over the same time frame. Nonetheless, on a YTD basis, shares of BEN are up 16.4%, outpacing SPX’s 15.9% return.

To confirm its bullish trend, BEN has been trading above its 200-day moving average since early May, with slight fluctuations, and has remained above its 50-day moving average since early December.

On Nov. 7, shares of BEN plunged 4.4% after its Q4 earnings release. The company’s operating revenue increased 6% year-over-year to $2.3 billion, while its adjusted EPS of $0.67 climbed 13.6% from the year-ago quarter, surpassing consensus estimates by a notable margin of 17.5%. However, its adjusted operating margin fell by 30 basis-points, and its ending and average Assets Under Management (AUM) declined from the same period last year, weighing on investor sentiment.

BEN has outpaced its rival, BlackRock, Inc. (BLK), which gained 1.3% over the past 52 weeks and 5.2% on a YTD basis.

Looking at BEN’s recent underperformance, analysts remain cautious about its prospects. The stock has a consensus rating of "Hold” from the 12 analysts covering it, and the mean price target of $24.36, suggests a 2.8% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart