Micron Technology (MU) will release its first-quarter fiscal 2026 earnings on Wednesday, Dec. 17. Market expectations remain high heading into the earnings. Management set an optimistic tone during the previous quarter’s conference call, indicating that the company could deliver record revenue and earnings for the first quarter.

Micron is benefitting from the rapid expansion of artificial intelligence (AI)-led data centers. These facilities require faster, higher-capacity, and more energy-efficient memory and storage solutions, driving demand for Micron’s products. Demand for both DRAM and NAND chips has been strengthening, and the company is also experiencing improved pricing conditions. Higher average selling prices, combined with rising volumes, position Micron for margin expansion and stronger earnings per share (EPS).

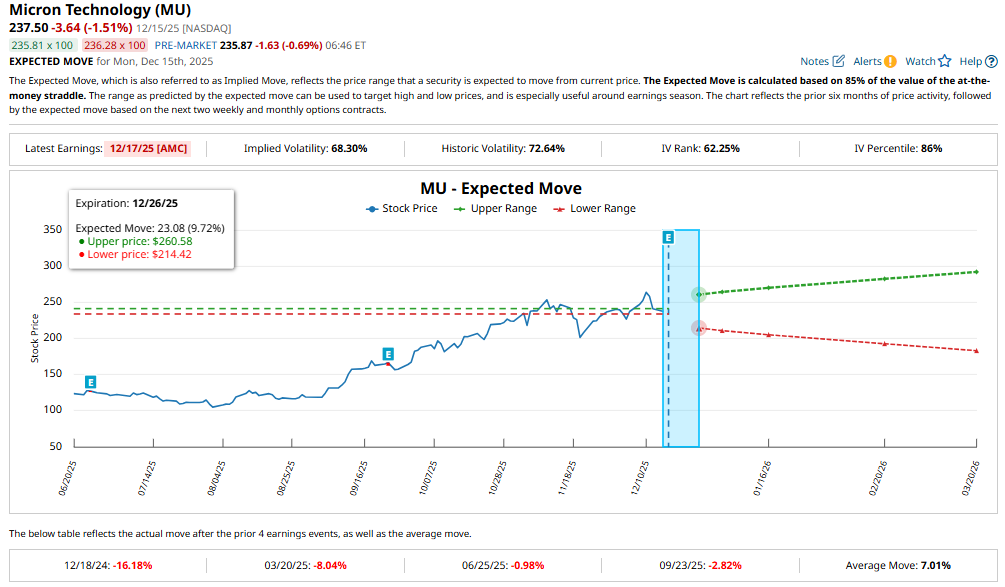

Despite these favorable fundamentals, recent history suggests caution is warranted. Micron’s shares have declined following each of the past four earnings announcements, even as operating performance has been solid. This pattern reflects that Micron stock has been highly sensitive to expectations and near-term guidance.

Further, the options market suggests traders expect a notable move in MU stock after the earnings release. Based on current contracts expiring Dec. 26, traders are implying a post-earnings move of about 9.7% in either direction. This is higher than Micron’s average post-earnings move of approximately 7% over the past four quarters.

Micron Q1: What Investors Should Expect

Micron’s upcoming first-quarter results are likely to reflect the strong tailwinds from AI workloads and improving pricing dynamics. Demand from data centers remains the key growth catalyst, as the rapid expansion of AI servers and a rebound in traditional server deployments, are driving strong consumption of DRAM products. Moreover, the data center market will drive higher demand for its high-value memory solutions, supporting its top and bottom lines.

Micron’s High Bandwidth Memory (HBM) business is seeing strong growth. The HBM revenue had an annualized run rate of approximately $8 billion. This performance reflects the ramp of Micron’s HBM3E products, which are seeing broad adoption across leading AI platforms. Micron has expanded its HBM customer base, and the majority of its HBM3E supply is already priced and committed through 2026, providing revenue visibility in the coming quarters.

Market conditions are also working in Micron’s favor. Tightening supply across the memory industry has translated into higher pricing, creating an additional lever for revenue and margin expansion. Management expects first-quarter revenue of $12.5 billion, representing roughly 44% year-over-year growth.

Gross margin is projected to reach 51.5% at the midpoint of management’s guidance, a substantial improvement from 39.5% in the same quarter last year. Earnings are set to reflect that margin expansion, with management forecasting earnings per share of $3.75 at the midpoint, more than doubling from the prior year. Wall Street’s consensus is slightly lower at $3.67 per share, but still implies year-over-year growth of 126.5%.

Adding to the positives is Micron’s strong recent quarterly performances. The company has exceeded earnings expectations in each of the past four quarters, including a solid beat in the most recent report. As Micron enters the quarter with strong demand, favorable pricing, and improving margins, expectations are high for another robust performance.

Is Micron Stock a Buy Now?

Micron stock has gained significantly, rising 182.2% year-to-date. This rally reflects the solid demand for its products. Despite this rally, the ongoing investment in AI infrastructure, strong pricing, and a compelling valuation make Micron a buy.

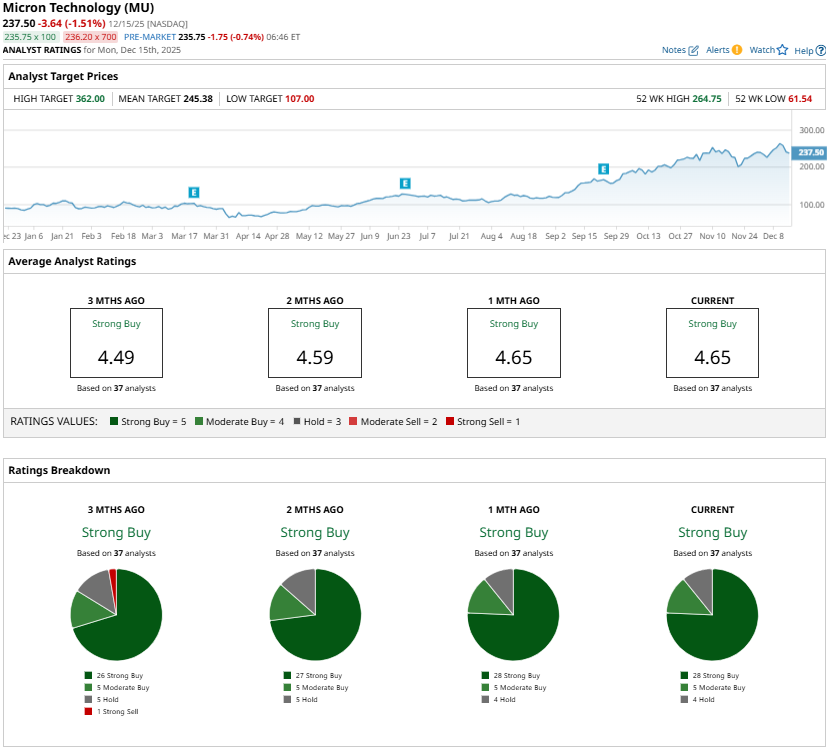

Micron stock trades at roughly 14 times forward earnings, which looks reasonable given its solid growth trajectory. Analysts project Micron’s EPS to grow by 131.8% in fiscal 2026, implying further upside potential. At the same time, analysts maintain a “Strong Buy” consensus rating on Micron stock.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart