Valued at a market cap of $14.4 billion, Solventum Corporation (SOLV) is a Minnesota-based healthcare company, focused on delivering medical and health technology solutions. The company operates in medical-surgical products, dental solutions, health information systems, and purification and filtration technologies, serving hospitals, dental practices, and healthcare providers globally.

Companies worth $10 billion or more are typically classified as “large-cap stocks,” and SOLV fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the medical instruments & supplies industry. Solventum aims to leverage its strong legacy brands, innovation capabilities, and global distribution network to improve patient outcomes and operational efficiency in healthcare settings.

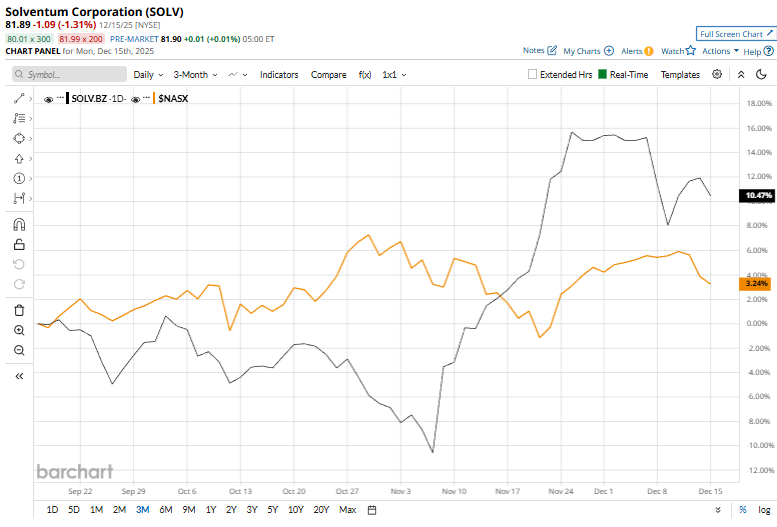

This healthcare company has dipped 7.2% from its 52-week high of $88.20, recorded recently on Dec. 2. Shares of SOLV have gained 11.9% over the past three months, outperforming the Nasdaq Composite’s ($NASX) 3.2% rise during the same time frame.

In the longer term, SOLV has gained 17.7% over the past 52 weeks, outpacing NASX's 15.7% uptick over the same time period. Moreover, on a YTD basis, shares of SOLV are up 24%, compared to NASX’s 19.4% rise.

To confirm its bullish trend, SOLV has been trading above its 50-day and 200-day moving averages since early November.

Solventum shares climbed 2.9% on Nov. 20, after the company announced a definitive agreement to acquire Acera Surgical for $725 million in cash, with up to $125 million in additional contingent payments tied to future milestones. Acera, founded in 2013, specializes in synthetic regenerative wound care solutions and is best known for its Restrata® products used to treat complex, hard-to-heal wounds in acute care settings.

The acquisition is expected to strengthen Solventum’s advanced wound care portfolio, accelerate adoption of Acera’s products, and create synergies through Solventum’s global footprint, specialized sales force, and leadership in negative pressure wound therapy.

SOLV has outpaced its rival, Becton, Dickinson and Company (BDX), which declined 11.3% over the past 52 weeks and 11.8% on a YTD basis.

Analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 14 analysts covering it, and the mean price target of $86.09 suggests a 5.1% premium to its current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart