Valued at a market cap of $10.2 billion, MGM Resorts International (MGM) is a hospitality, gaming, and entertainment company headquartered in Las Vegas, Nevada. It owns and operates a portfolio of iconic integrated resort properties that combine luxury hotels, casino gaming, convention space, live entertainment, dining, nightlife, and retail experiences.

Companies worth $10 billion or more are typically classified as “large-cap stocks,” and MGM fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the resorts & casinos industry. The company has a growing digital footprint through sports betting and online gaming platforms, positioning it to benefit from both destination travel demand and the expansion of legalized gaming and digital wagering.

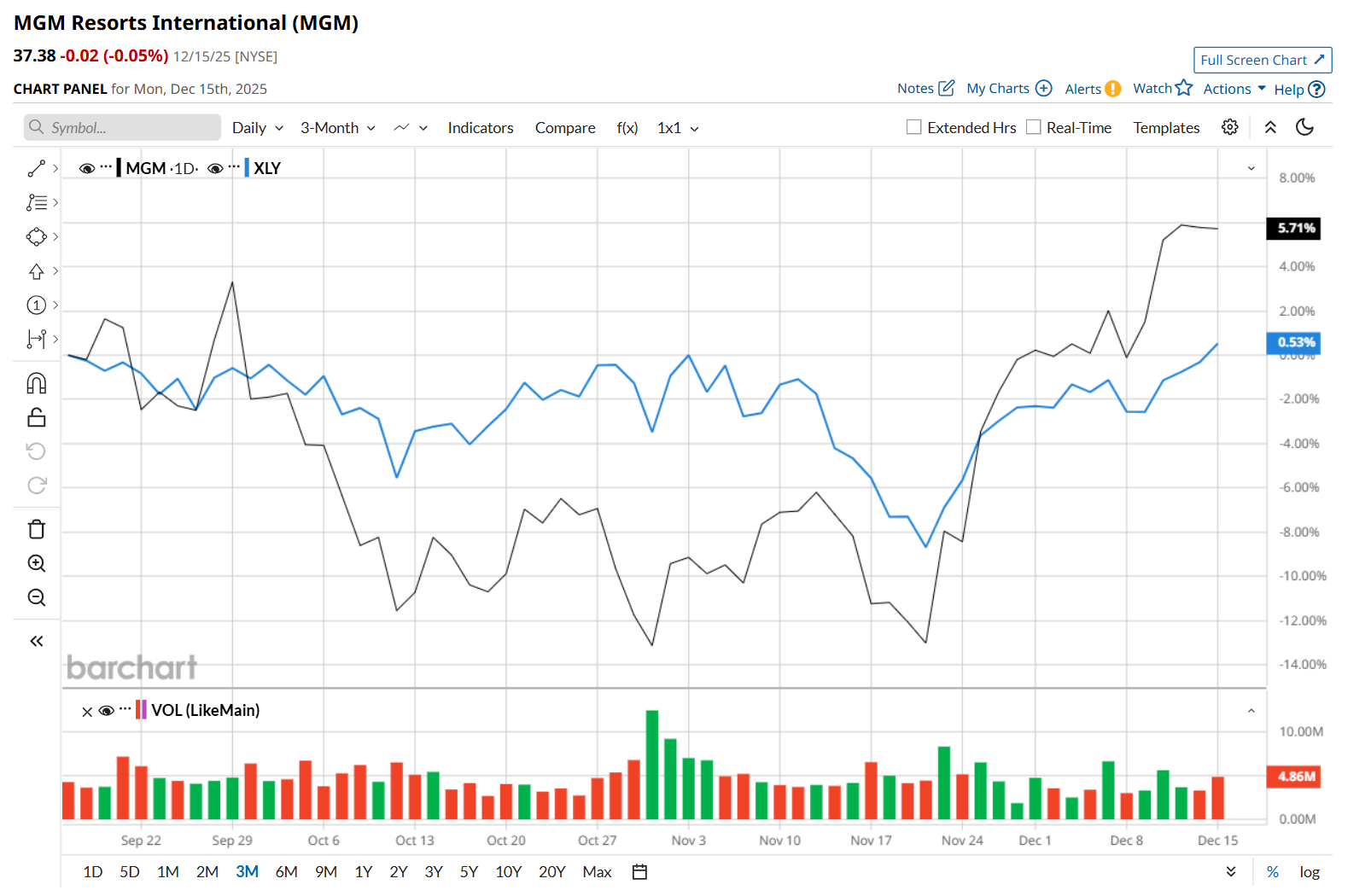

This resort and casino company is currently trading 9.5% below its 52-week high of $41.32, reached on Feb. 14. Shares of MGM have gained 4.9% over the past three months, outperforming the State Street Consumer Discretionary Select Sector SPDR ETF’s (XLY) 1.2% rise during the same time frame.

However, in the longer term, MGM has gained 3.1% over the past 52 weeks, slightly trailing behind XLY’s 3.4% uptick over the same time frame. Moreover, on a YTD basis, shares of MGM are up 7.9%, compared to XLY’s 8.5% return.

To confirm its recent bullish trend, MGM has been trading above its 200-day and 50-day moving averages since late November.

On Oct. 29, MGM’s shares plunged 2.3% after reporting mixed Q3 results. Primarily due to an increase in net revenues at MGM China, the company’s total revenue improved 2% year-over-year to $4.3 billion, surpassing consensus estimates by a slight margin. However, its adjusted EPS of $0.24 declined by a notable 55.6% from the year-ago quarter and fell short of Wall Street expectations of $0.37.

MGM has lagged behind its rival, Las Vegas Sands Corp. (LVS), which soared 24.4% over the past 52 weeks 30.4% on a YTD basis.

Looking at MGM’s recent outperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 20 analysts covering it, and the mean price target of $42, suggests a 12.4% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart