Tilray (TLRY) shares soared about 30% today after President Donald Trump said he’s “strongly” considering an executive order that will reclassify cannabis as a Schedule III drug.

The expected mandate will also authorize a pilot program that will enable seniors to access cannabis products under Medicare coverage, according to media reports on Tuesday.

Following today’s surge, Tilray stock is up more than 100% versus its recent low set on Dec. 4.

What Cannabis Reclassification Means for Tilray Stock

TLRY stock rallied this morning because the aforementioned policy shift could materially improve the company’s business prospects.

Reclassifying cannabis as a Schedule III drug would ease major federal restrictions, including tax burdens and banking limits, and make R&D easier, expanding long-term industry potential.

This may clear the path for Tilray to sustainable profitability.

Meanwhile, offering seniors federally backed access to cannabis products under the Medicare pilot program could unlock a large, stable new customer base, helping attract institutional investments.

In short, the Trump administration’s expected change of stance on cannabis would mean lower risk and increased revenue for the likes of Tilray moving forward.

Where Options Data Suggests TLRY Shares Are Headed Next

Options traders seem to agree that the reclassification of cannabis under the Trump administration could prove transformative for Tilray shares in 2026.

According to Barchart, option contracts expiring on March 20 imply a 50% move in TLRY. The bull case would see shares hit $21.22.

Additionally, key technical indicators suggest continued upward momentum as well.

The cannabis stock is now trading handily above its major moving averages (50-day, 100-day, 200-day), with the long-term relative strength index at 53 reinforcing that the bullish trend is far from over yet.

Note that Tilray has historically (over the past four years) returned an exciting 14.20% on average in January.

Wall Street Sees Significant Further Upside in Tilray

Wall Street analysts also recommend sticking with Tilray stock for the long term.

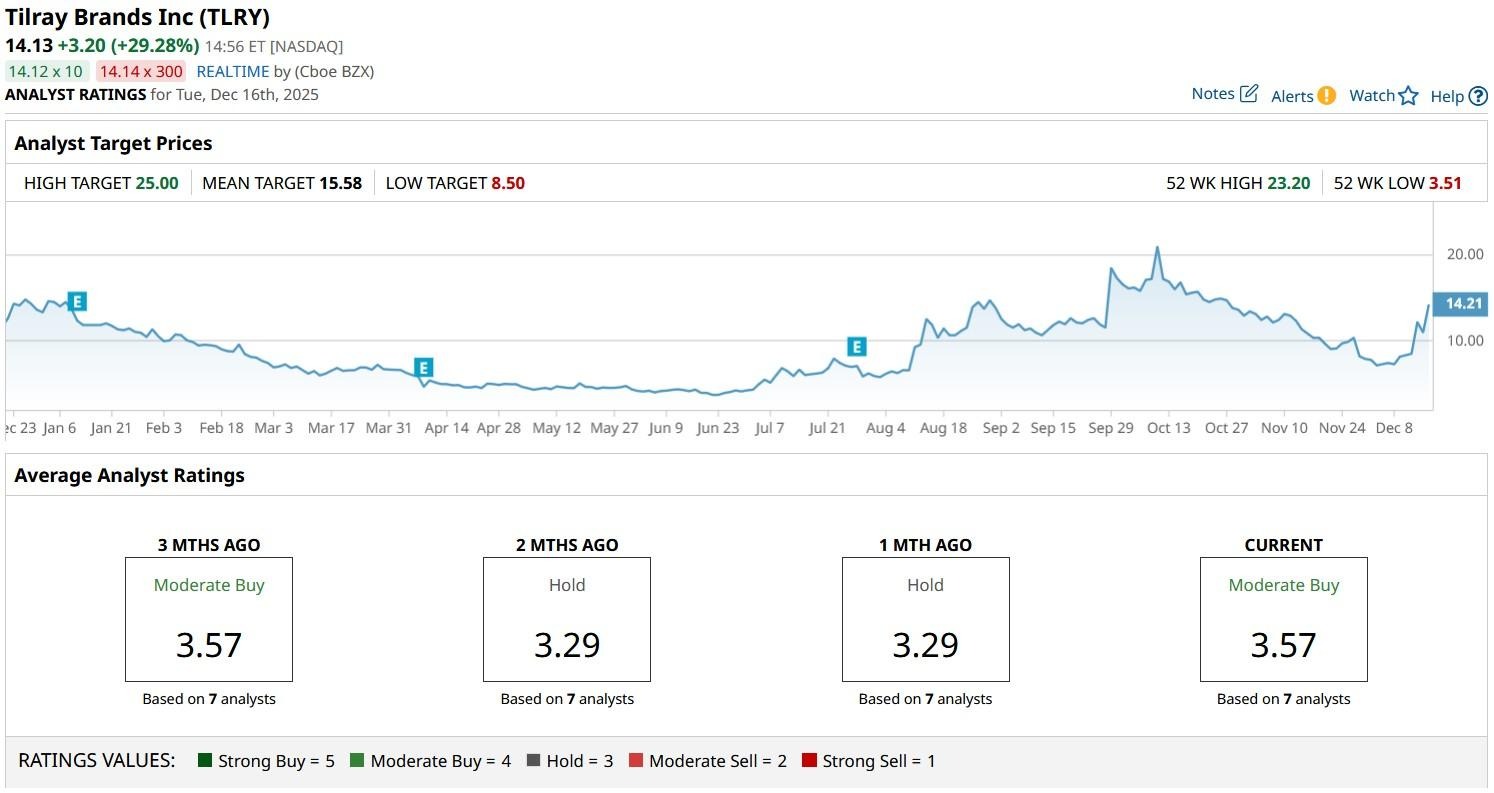

According to Barchart, the consensus rating on TLRY shares remains at “Moderate Buy” with price targets going as high as $25 indicating potential upside of more than 75% from current levels.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Buy the Dip, or Panic Sell? What This Powerful Chart Indicator is Telling Us About the Stock Market Now.

- Option Traders Are Pricing a Nearly 22% Move in Tilray Stock Before the End of 2025. Should You Buy, Sell, or Hold TLRY Here?

- JPMorgan Says to Sell NVDA March $160 Puts. Should You Actually?

- While AI Panic Struck Applied Digital (APLD) Stock, the Smart Money Has a Different View