Unmanned defense systems technology firm AeroVironment (AVAV) was recently awarded a $4.8 million contract from the U.S. Coast Guard to deliver Mission Specialist Defender remotely operated vehicles (ROVs). The contract came in through its VideoRay subsidiary, which the company had acquired this year as part of its acquisition of BlueHalo.

The Mission Specialist Defender ROV is expected to bolster the Coast Guard’s maritime response capabilities through rapid underwater inspections, subsurface surveys, and support for search-and-rescue operations.

In light of this, we look into the company a bit more closely.

About AeroVironment Stock

Headquartered in Arlington, Virginia, AVAV is a premier defense technology firm specializing in unmanned and autonomous platforms. The company engineers and produces compact unmanned aerial systems and analytics tools that bolster surveillance, reconnaissance, and intelligence for defense and government clients. The company has a market capitalization of $11.7 billion.

Operations encompass R&D, manufacturing, evaluation, and system integration for robotics across multiple domains, improving awareness and targeted strikes. Integrating sensors and networks enable real-time tactical decision-making. Deployed worldwide, these solutions support U.S. troops and partners in demanding scenarios, driven by ongoing innovation and strategic acquisitions.

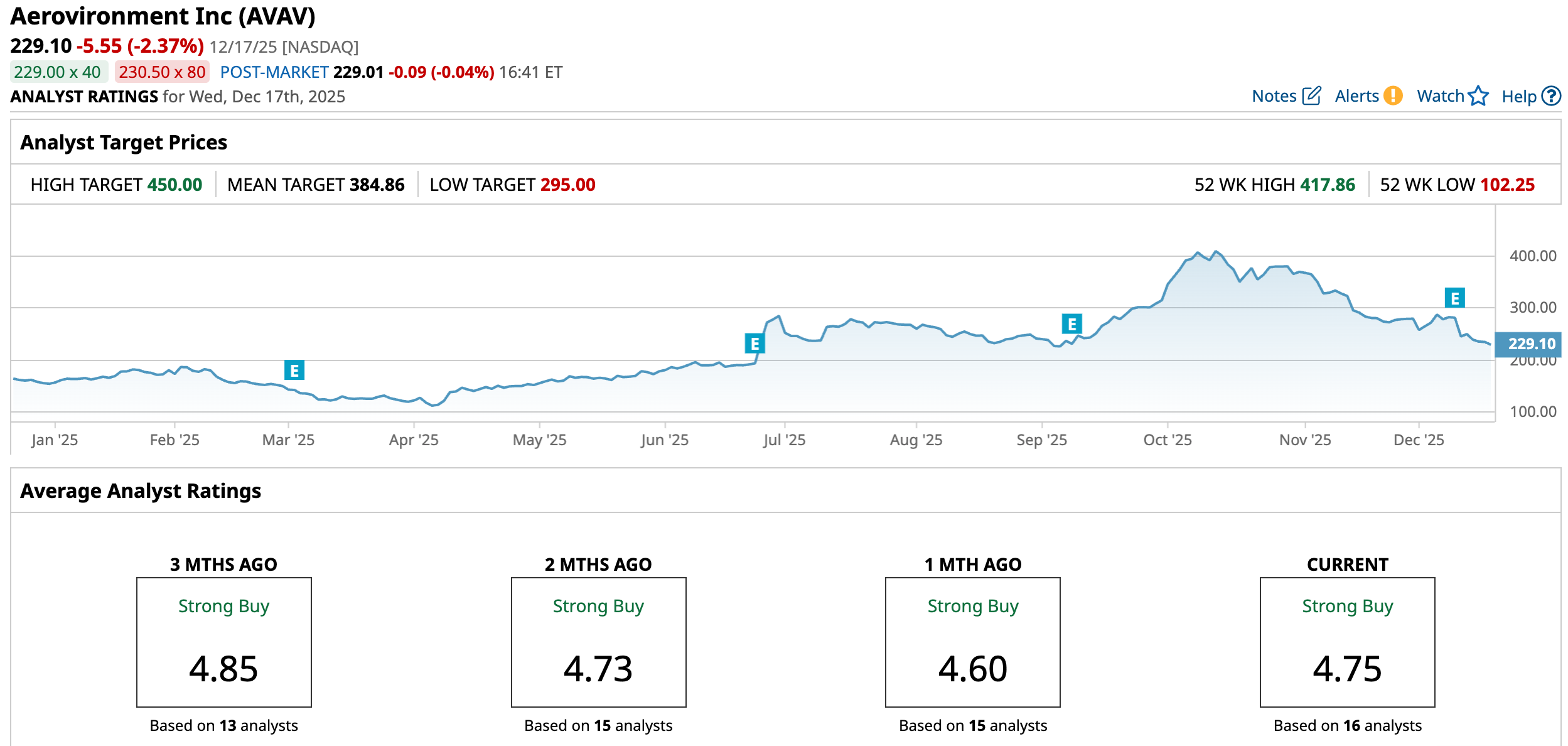

AeroVironment has benefited from tailwinds driven by strong optimism about the stock and broad momentum in the defense sector. Over the past 52 weeks, the company’s stock has gained 40%, and over the past six months, it has risen 21.69%. AeroVironment’s shares had reached a 52-week high of $417.86 in October, but are down 45.2% from that level.

AeroVironment’s stock is trading at a stretched valuation. Its price-to-non-GAAP earnings multiple is 67.64x, considerably higher than the industry average of 21x.

AeroVironment’s Several Contracts

In addition to the $4.8 million contract from the U.S. Coast Guard, AeroVironment has received multiple contracts for its products and services. This month, the company was awarded a five-year Indefinite Delivery, Indefinite Quantity (IDIQ) contract from the U.S. Army Contracting Command that supports foreign military sales (FMS). The contract, worth $874.26 million, includes specific variations of multiple models.

In December, AeroVironment, alongside partner Parry Labs, secured a three-year Other Transaction Agreement with an initial base value of $13.2 million, with options that could increase the total to $42 million. This deal supplies the innovative P550 uncrewed aircraft system (UAS) to the U.S. Army's Long Range Reconnaissance (LRR) program.

In October, the company received multiple contracts from the U.S. AeroVironment was selected to deliver the U.S. Army’s Next-Generation C-UAS Missile (NGCM) and was also awarded a $95.9 million contract for the U.S. Army's Long-Range Kinetic Interceptor (LRKI) program to manufacture and deliver its Freedom Eagle (FE-1) kinetic counter-UAS (C-UAS) missile.

In the same month, AeroVironment announced a collaboration with GrandSKY to develop the Golden Dome for America defense architecture at Grand Forks Air Force Base (AFB) in North Dakota. The company will support the project with its inner-layer distributed C-UAS capabilities.

AeroVironment Reported Mixed Second-Quarter Results

On Dec. 9, AeroVironment reported its second-quarter results for fiscal 2026 (the quarter that ended on Nov. 1). The company’s total revenue increased by a whopping 150.7% year-over-year (YOY) to $472.51 million. However, this missed the $477.4 million figure that Wall Street analysts had expected. This solid top line growth was driven by product sales, which jumped 114.9% from the prior year’s period to $325.04 million.

Despite the solid growth in AeroVironment’s top line, rising costs have taken a bite out of the company’s bottom line. The company’s adjusted EPS was $0.44, down 6.4% YOY. The adjusted EPS figure missed the $0.85 analysts’ estimate by a wide margin. For fiscal 2026, AeroVironment expects revenue in the range of $1.95 billion to $2 billion, while its adjusted EPS is projected to be in the range of $3.40 to $3.55.

Wall Street analysts are considerably optimistic about AeroVironment’s future earnings. They expect the company’s EPS to increase by 150% YOY to $0.75 for the fiscal third quarter. For fiscal 2026, EPS is projected to surge 7.93% annually to $3.54, followed by a 24.86% growth to $4.42 in the next fiscal year.

What Do Analysts Think About AeroVironment’s Stock?

Following the recent quarterly results, Wall Street analysts reiterated their ratings on AeroVironment’s stock. Analysts at Cantor Fitzgerald maintained an “Overweight” rating on the stock but reduced the price target from $335 to $315. While Cantor Fitzgerald analysts were disappointed in parts of the company’s results, they also expect any potential stock underperformance to be “short-lived.”

Canaccord Genuity analysts also maintained a “Buy” rating, while cutting the stock’s price target from $430 to $400. This downward revision was done following the company’s quarterly results, which did not meet Canaccord’s expectations.

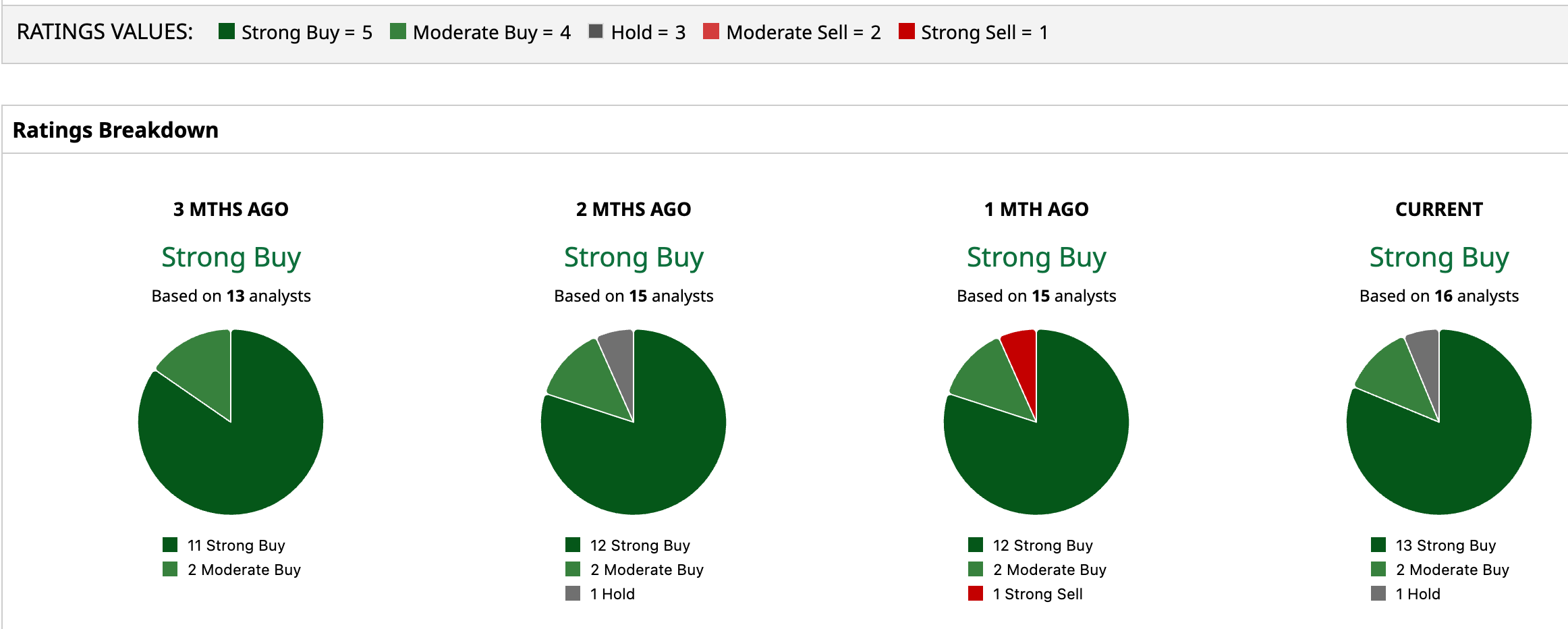

However, AeroVironment is generally gaining praise on Wall Street, with analysts awarding it a consensus “Strong Buy” rating overall. Of the 16 analysts rating the stock, 13 have given it a “Strong Buy,” two a “Moderate Buy,” and one a “Hold.” The consensus price target of $384.86 represents a near 68% upside from current levels. The Street-high price target of $450 indicates a 96.4% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- A $4.8 Million Reason to Buy AeroVironment Stock Today

- This Analyst Says IonQ Stock Can Gain Over 75% from Here. Should You Buy It Now?

- 3 Barchart Stock Screeners to Help You Find Better Call Option Trades

- ‘You Didn’t Want to Be in Jamestown’: Elon Musk Warns Mars Won’t Be A Billionaire Vacation Spot; It Will Be ‘Very Dangerous’ and ‘You Might Die’