Visa (V) is making a bold push into blockchain-based payments, launching a USDC stablecoin settlement for U.S. banks and fintechs. This move could reshape how money moves through the global financial system.

The credit card giant announced that issuer and acquirer partners can now settle obligations in Circle's (CRCL) dollar-pegged USDC. It is the first time a major payment network has brought stablecoin settlement to the U.S. at scale.

Visa's stablecoin settlement program has already hit a $3.5 billion annualized run rate as of November, with early U.S. participants including Cross River Bank and Lead Bank settling transactions over the Solana (SOLUSD) blockchain.

The company plans a broader rollout through 2026 while deepening its partnership with Circle by helping design Arc, a new Layer 1 blockchain purpose-built for high-volume commercial activity.

For Visa, the stakes are clear: financial institutions want faster, programmable settlement options that operate seven days a week rather than the traditional five-business-day window.

Stablecoins offer near-instant transfer of funds and enhanced treasury efficiency without changing the consumer card experience. The stablecoin launch suggests that Visa expects blockchain rails to gain traction as infrastructure for modern finance is poised for disruption.

It will be interesting to see whether Visa’s blockchain bet gives it a first-mover advantage and a competitive moat.

The Bull Case of Investing in Visa Stock

Visa's core business continues to perform well amid a challenging macro environment. The payments giant grew its payment volumes by 8% in the U.S., while cross-border volumes rose by 11% in fiscal Q4.

Visa explained that consumer spending remains resilient across discretionary and nondiscretionary categories, while cross-border travel and e-commerce volumes show no signs of slowing.

The company recently settled longstanding merchant litigation that will reduce average U.S. credit interchange rates by 10 basis points for five years and give merchants more flexibility around surcharging and card acceptance. Visa's management believes merchants will continue to prioritize the network's reliability, security, and customer experience over pure cost considerations.

Notably, Visa’s value-added services now account for 27% of total sales, up 23% year-over-year (YoY). This segment includes issuing solutions, acceptance solutions, risk management, and advisory services.

The business addresses a critical pain point for financial institutions struggling to keep pace with payments innovation. Rather than building capabilities themselves, banks increasingly turn to Visa for everything from fraud prevention to tokenization to marketing services. These are sticky, high-margin offerings that deepen client relationships and reduce churn.

Visa's tokenization strategy has helped reduce fraud by 35% and improve approval rates by five percentage points. It monetizes tokens through growth in transaction volume and value-added services such as lifecycle management and account updates.

The company's commercial money movement business is also gaining traction, with volumes accelerating to 10% growth as new client wins ramp up and cross-border activity strengthens. Management sees a massive runway in the $200 trillion commercial payments opportunity where Visa currently holds a minimal share.

Visa's global scale remains unmatched. The network's ability to enable seamless cross-border commerce across 200 countries with different currencies, regulations, and banking systems took decades to build and would be extremely difficult for competitors to replicate through partnerships alone. With stable consumer trends, expanding value-added services, and structural advantages in cross-border payments, Visa appears well-positioned for sustained growth.

Is V Stock Still Undervalued?

Analysts tracking V stock forecast revenue to increase from $40 billion in fiscal 2025 (ended in September) to $59.5 billion in 2029. In this period, adjusted earnings are forecast to expand from $11.47 per share to $18.48 per share.

If Visa stock is priced at 27x forward earnings, which is in line with its 10-year average, it could gain 45% within the next three years. If we adjust for dividends, cumulative returns could be closer to 50%.

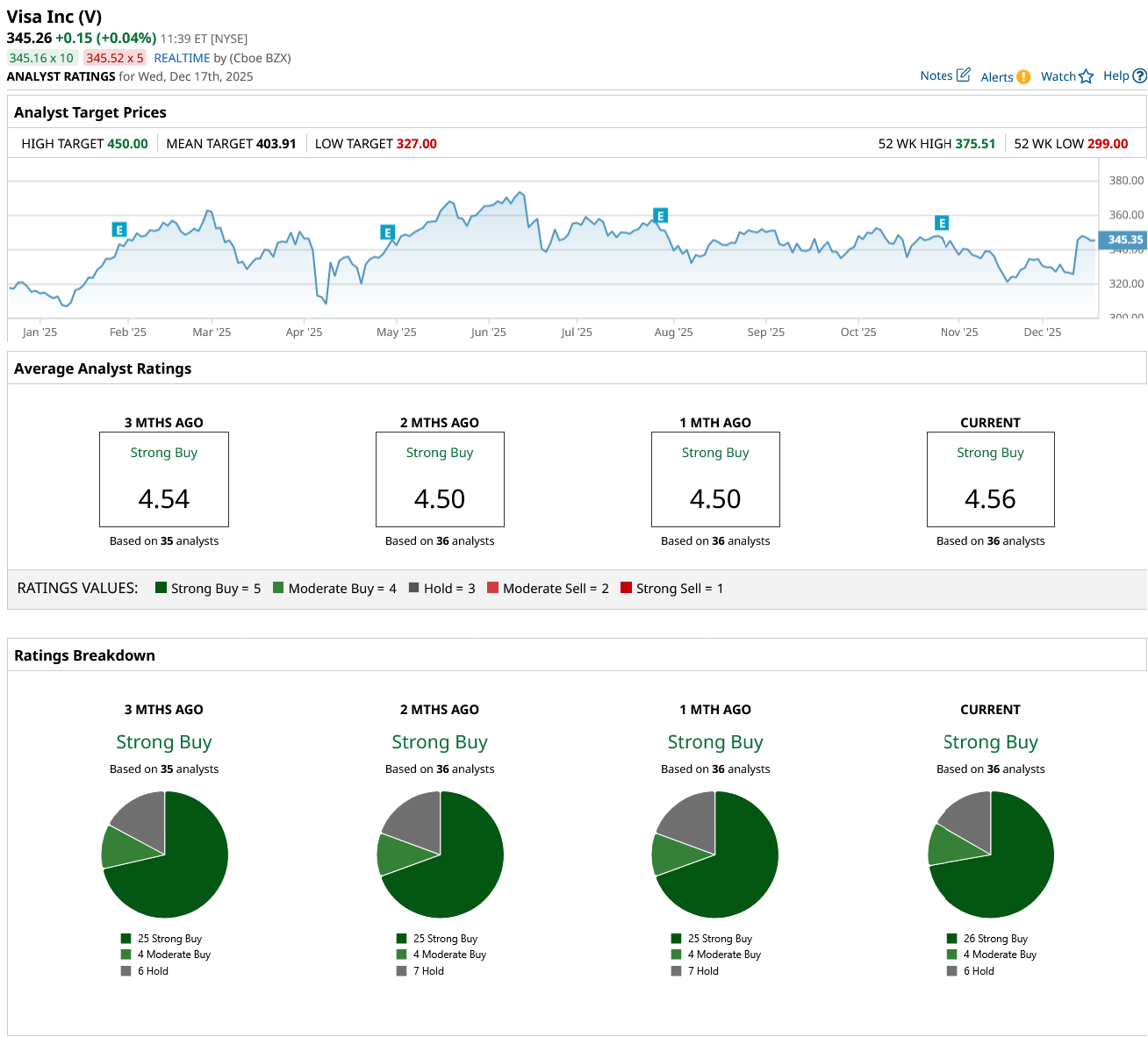

Out of the 36 analysts covering V stock, 26 recommend “Strong Buy,” four recommend “Moderate Buy,” and six recommend “Hold.” The average Visa stock price target is $404, above the current price of $345.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Warren Buffett Warns That During Bubbles, Stock Prices and Earnings Will ‘Diverge,’ But They Can’t ‘Continuously Overperform Their Businesses’

- As Visa Rolls Out Stablecoin Settlement, Should You Buy, Sell, or Hold the Blue-Chip Stock?

- Cathie Wood Keeps Buying the Dip in CoreWeave Stock. Should You?

- JPMorgan Says the Dip in Broadcom Stock Is a Screaming Buy. Are You Loading Up on Shares Now?