With a market cap of $75.4 billion, Cintas Corporation (CTAS) provides corporate identity uniforms and a broad range of related business services across the United States, Canada, and Latin America. The company operates through its Uniform Rental and Facility Services, First Aid and Safety Services, and other segments, serving customers through an extensive distribution network and local delivery routes.

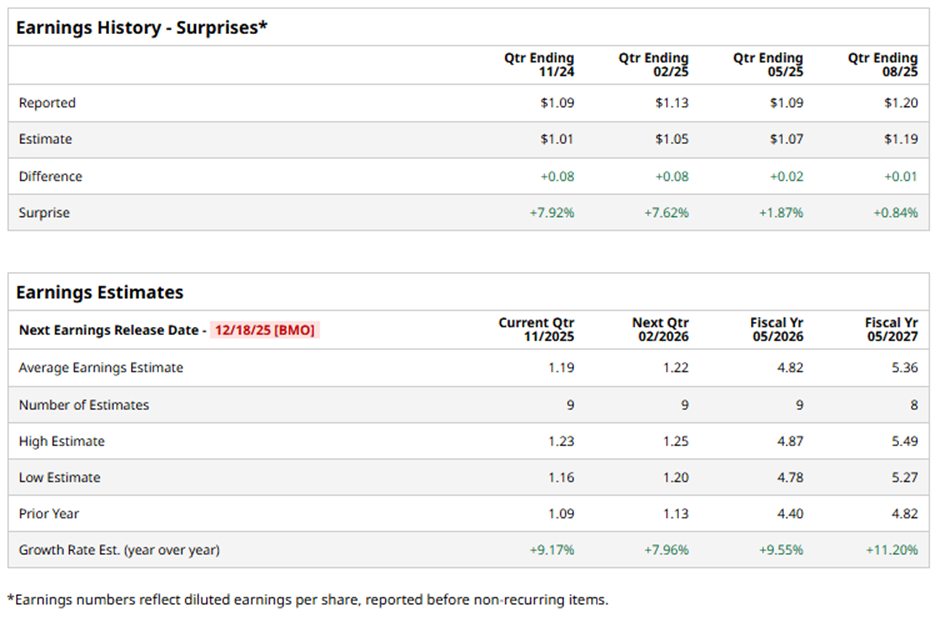

The Cincinnati, Ohio-based company is scheduled to announce its fiscal Q2 2026 results before the market opens on Thursday, Dec. 18. Ahead of this event, analysts expect Cintas to report an EPS of $1.19, up 9.2% from $1.09 in the year-ago quarter. It has surpassed Wall Street's earnings estimates in the last four quarters.

For fiscal 2026, analysts predict the uniform rental company to report an EPS of $4.82, a growth of 9.6% from $4.40 in fiscal 2025. Moreover, EPS is anticipated to increase 11.2% year-over-year to $5.36 in fiscal 2027.

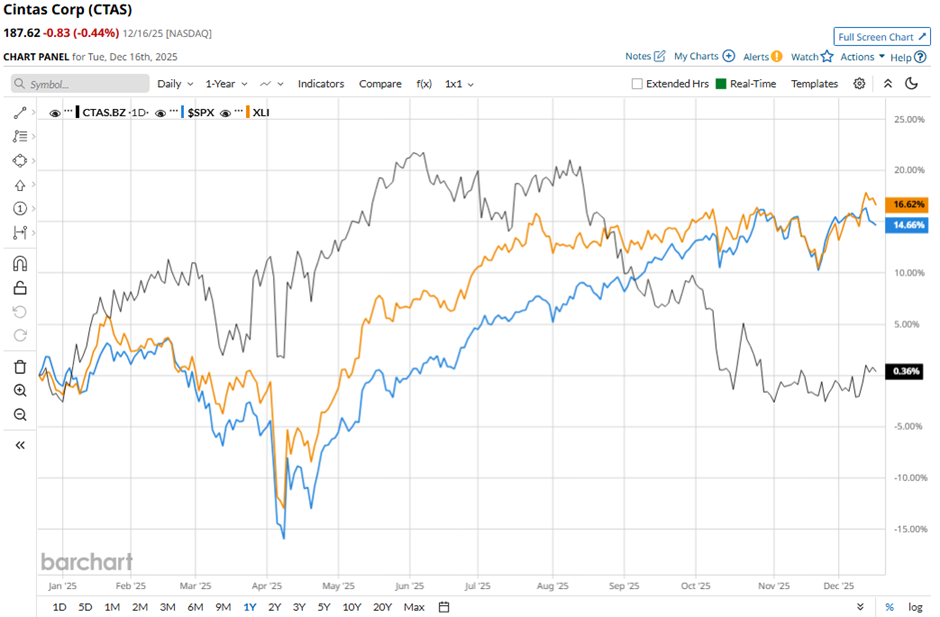

Shares of Cintas have declined 11.4% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) nearly 12% gain and the Industrial Select Sector SPDR Fund's (XLI) 13.5% return over the same period.

Cintas reported strong Q1 2026 results on Sept. 24, including revenue of $2.72 billion, operating income up 10.1% to $617.9 million, and EPS of $1.20. Investor sentiment was further boosted by raised full-year guidance, with revenue now expected at $11.06 billion - $11.18 billion and EPS increased to $4.74 - $4.86. However, the stock fell marginally on that day.

Analysts' consensus view on CTAS stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 21 analysts covering the stock, seven suggest a "Strong Buy," 12 give a "Hold," one recommends a "Moderate Sell," and one "Strong Sell."

The average analyst price target for Cintas is $218.18, indicating a potential upside of 16.3% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Growth Stock With 137% Upside Faces New Challenge: Buy, Hold or Sell?

- How to Buy CSCO for a 2.5% Discount, or Achieve a 19% Annual Return

- S&P Futures Gain as Investors Weigh U.S. Jobs Data, Fed Speak and Micron Earnings in Focus

- This High-Yield Dividend Stock Trades at a Third of Its Record Highs: Is It a Buy for 2026?