With a market cap of around $11 billion, FactSet Research Systems Inc. (FDS) is a global financial digital platform and enterprise solutions provider serving the investment community with data, analytics, and workflow solutions across the entire investment lifecycle. The company delivers subscription-based financial data, market intelligence, and technology through desktop, mobile, cloud, and API platforms to investment professionals worldwide.

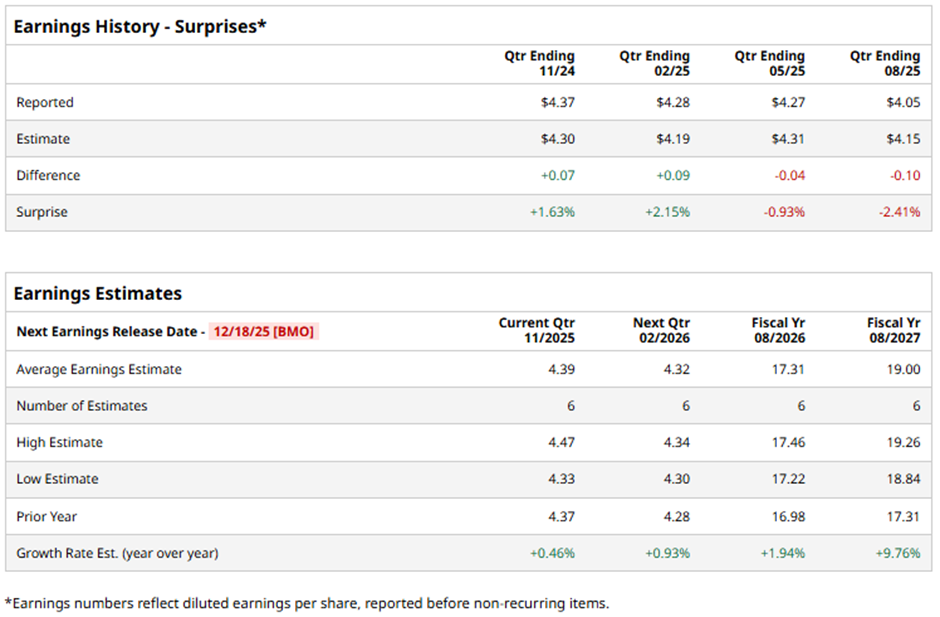

The Norwalk, Connecticut-based company is set to announce its fiscal Q1 2026 results before the market opens on Thursday, Dec. 18. Ahead of this event, analysts forecast FDS to report an adjusted EPS of $4.39, up marginally from $4.37 in the year-ago quarter. The company has surpassed Wall Street's earnings estimates in two of the last four quarters while missing on two other occasions.

For fiscal 2026, analysts expect the financial data firm to report an adjusted EPS of $17.31, up 1.9% from $16.98 in fiscal 2025. Moreover, adjusted EPS is anticipated to grow 9.8% year-over-year to $19 in fiscal 2027.

Shares of FactSet Research have decreased 39.9% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) nearly 12% rise and the Financial Select Sector SPDR Fund's (XLF) 10.5% return over the same period.

Despite reporting better-than-expected Q4 2025 revenue of $596.9 million, FactSet shares tumbled 10.4% on Sept. 18 as adjusted EPS of $4.05 missed estimates. Investors were also concerned about margin pressure, as Q4 adjusted operating margin declined to 33.8% and fiscal 2025 adjusted operating margin fell 150 bps to 36.3%, reflecting higher compensation and technology costs.

Analysts' consensus view on FDS stock is cautious, with a "Hold" rating overall. Among 19 analysts covering the stock, two recommend "Strong Buy," 11 have a "Hold," and six suggest "Strong Sell." The average analyst price target for FactSet Research is $322.07, suggesting a potential upside of 9.9% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is SoundHound Stock a Buy for 2026? This Analyst Thinks So.

- Netflix Says the Warner Bros’ Deal Is All About ‘Growth.’ Will NFLX Stock Keep Growing in 2026?

- Southwest Airlines and TJX Hit New 52-Week Highs: Which Is More Likely to Fly Higher in 2026 and beyond?

- This Under-the-Radar Stock Is Crushing the Market in 2025 and Is Joining the Nasdaq-100 Next Week. Should You Buy Shares Now?