Expedia Group, Inc. (EXPE) is a major travel technology company and one of the world’s largest online travel platforms. Headquartered in Seattle, Washington, it operates a broad portfolio of travel brands and digital services that enable consumers and partners to research, plan, book, and manage travel across flights, hotels, vacation rentals, car rentals, cruises, and activities

With a market cap of $34.7 billion, the company is firmly positioned in the large-cap segment. It generates revenue from transaction fees, commissions, merchant-model bookings, advertising, and technology services provided to partners. Its global reach spans dozens of countries, connecting millions of travelers with a large inventory of travel options.

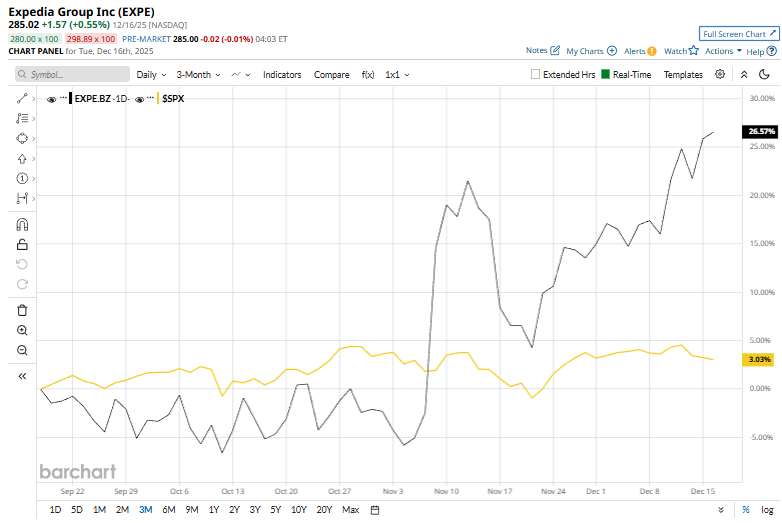

Expedia recorded its 52-week high of $289.98 in the last trading session, underscoring strong upward momentum. The stock has climbed 26.7% over the past three months, significantly outperforming the S&P 500 Index ($SPX) 2.9% surge during the same period.

This strength extends over longer horizons as well. EXPE is up 56.1% over the past 52 weeks and has surged 73.2% in the last six months, far ahead of the S&P 500’s 12% and 12.7% advances, respectively.

From a technical standpoint, despite intermittent volatility, the stock has traded largely above both its 50-day and 200-day moving averages since early May, reinforcing its bullish trend.

On Nov. 6, Expedia Group delivered a strong third quarter in 2025, with key metrics beating expectations and driving investor optimism. As a result, its shares popped 17.6% in the next trading session. Revenue increased about 9% year-over-year to $4.4 billion, while gross bookings grew roughly 12% to $30.7 billion, supported by broad strength across both consumer and B2B segments. Adjusted EPS climbed 23% to $7.57, significantly exceeding forecasts, reflecting higher demand and operational leverage. Room nights climbed 11% as travel demand strengthened, particularly in the U.S., and adjusted EBITDA and operating income expanded, demonstrating margin improvement.

In comparison, rival Tripadvisor, Inc. (TRIP) has lagged behind EXPE stock. EXPE stock has gained 8.7% over the past 52 weeks and 11.7% over the past six months.

The stock has a consensus rating of “Moderate Buy” from the 36 analysts covering it, and the stock currently trades above the mean price target of $265.85.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Growth Stock With 137% Upside Faces New Challenge: Buy, Hold or Sell?

- How to Buy CSCO for a 2.5% Discount, or Achieve a 19% Annual Return

- S&P Futures Gain as Investors Weigh U.S. Jobs Data, Fed Speak and Micron Earnings in Focus

- This High-Yield Dividend Stock Trades at a Third of Its Record Highs: Is It a Buy for 2026?